Metaplanet, an investment firm based in Japan that has been in the news for its unconventional fund management strategies, is back in the news. The company intends to garner $62 million from the 12th series of Stock Acquisition Rights (SARs). This strategy will seek to increase Metaplanet’s holdings for Bitcoin as the yen value weakens and the value of Bitcoin continues to appreciate.

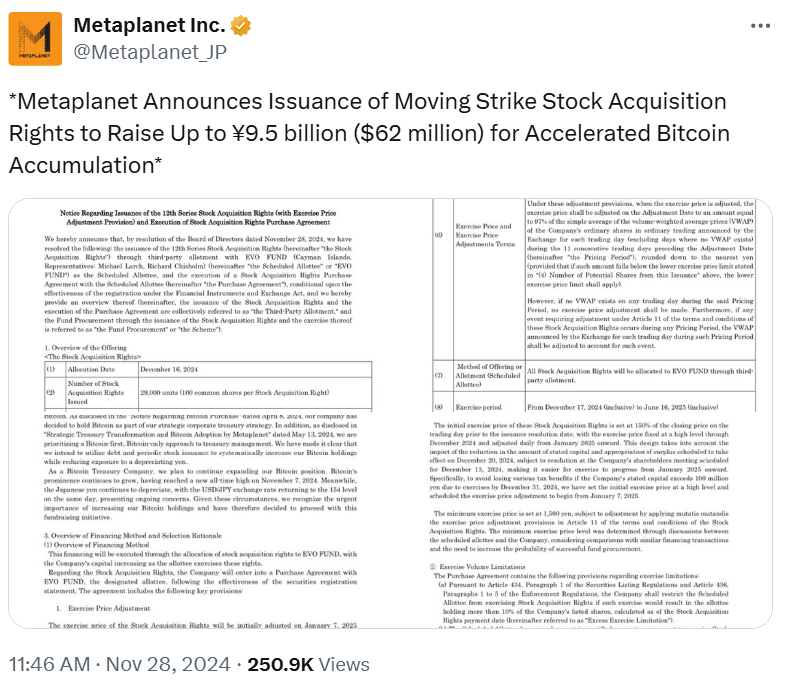

The firm will sell 29,000 SAR units to EVO FUND, a Cayman Islands based investment entity. To that end, each SAR unit allows EVO FUND to purchase 100 shares for 614 yen per right. If EVO FUND decides to exercise all the rights by December 16, 2024, Metaplanet will get 9.5 billion yen or $62 million. But this deal is subject to approval under Japan’s Financial Instruments and Exchange Act, which governs the financial transactions.

Metaplanet’s Bitcoin-Focused Treasury

This is not the first time Metaplanet has used SARs in its cryptocurrency business plan. In October, the company concluded its 11th series of SARs which fetched 10 billion yen or $66 million to bolster the firms Bitcoin reserves. Bitcoins have become, therefore, the core of the company’s financial operations – its treasury is now fully Bitcoin-based. Metaplanet has expanded its Bitcoin position thanks to both debt and equity offerings.

The platfrom has integrated Bitcoin into its financial planning for the future. The firm treats it as a ‘ Funding Currency’ which provides a hedge against further depreciation of the yen and as a new ‘ Core Asset’ in the new economic order that is emerging. As Bitcoin has just crossed $99,000, Metaplanet is stepping up its efforts to buy more bitcoins and taking advantage of the potential gains from the cryptocurrency’s price.

The performance of Metaplanet’s stock has been on the rise in 2024. The company’s shares have risen by 1,300% since May, mainly because it adopted Bitcoin as part of its treasury. Its stock has done so well that it is now trading more than some of Japan’s biggest companies such as Nintendo and Honda. In the last week, company’s trading volume hit $174 million putting it among the best in the Japanese market.

Metaplanet’s Growing Bitcoin Reserves

Beside the focus on Bitcoin, Metaplanet is listed as one of the fund companies in the Amplify Transformational Data Sharing ETF (BLOK), which is an ETF that has its focus on the blockchain and digital assets. This is a major achievement for the firm as it moves closer to its position as Japan’s leading Bitcoin treasury company. BLOK now owns 4.4% of Metaplanet’s shares; this solidifies the company in the worldwide crypto currency market.

The company’s willingness to invest in Bitcoin is in line with the general institutional investors’ approach toward Bitcoin as a safe-haven asset. At the moment, the company controls 1,142 BTC worth of approximately $109.16 million, making it one of the biggest institutional investors in the crypto. Its strategy has been likened to MicroStrategy, a US technology company that has invested heavily in bitcoins. Similarly to MicroStrategy, Metaplanet applies options trading for increasing the company’s Bitcoins and revenue.

Promoting Bitcoin in Japan

The firm is also in the process of promoting the use of Bitcoin in Japan and its surrounding regions. This week, firm closed a licensing agreement for Bitcoin Magazine in Japan. The magazine, a reputable world-wide source of information about Bitcoin, will now provide content specific to the Japanese audience. Metaplanet has been pushing for Bitcoin in Japan and this is another step towards that direction.

Metaplanet is now among the growing list of companies, including Tesla and Block, Inc., that uses Bitcoin as a reserve and an instrument to protect against economic risks. Thus, as the firm is increasing its Bitcoin holdings and impact, it is rapidly carving out for itself a place among major players in the cryptocurrencies market. Platform has continued to issue SARs in its aggressive plan to cement its position in the Web3 ecosystem’s market.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!