Based on available reports, Meteora co-founder Ben Chow has stepped down from his leadership position in a bombshell that is rocking the Solana DeFi space. As allegations fly and questions about insider trading emerge, insiders are left to wonder about the integrity of key players in the decentralized finance space. What are the circumstances around Chow’s resignation, the claims and counterclaims made by the involved parties and what it means for the Meteora platform and the Solana ecosystem?

Background: The Libra Scandal and Meteora’s Involvement

The Libra memecoin scandal reportedly started last Friday when Argentina’s President Javier Milei endorsed the token to boost his country’s economy. Libra price went up to crazy levels before Milei retracted his support. During this volatile period, the Libra team allegedly created liquidity pools on Meteora, the Solana-based DeFi platform co-founded by Ben Chow.

The controversy escalated when Hayden Davis, CEO of Kelsier Ventures and self-proclaimed “facilitator” for Libra, claimed in a video interview with Coffeezilla that the project’s team “sniped their own token” at launch – a practice Davis said is common in big memecoin launches. This has put Meteora under intense scrutiny especially since they are tied to other high profile projects like MELANIA token.

Ben Chow’s Resignation

Under pressure, Meteora co-founder Ben Chow announced his resignation. In a statement on social media, Chow denied any involvement in insider trading related to the Libra launch. He said:

“For $LIBRA, although we were told about it a few weeks ago by Hayden, we had no involvement in the project at all beyond providing IT support. Neither I nor the Meteora team leaked $LIBRA information, nor did we buy, receive or manage any tokens.”

But the community was still on edge. Meow, the pseudonymous founder of Solana DEX Jupiter and Meteora co-founder, commented on the situation on X (formerly Twitter) on Monday:

“I am 100% sure about Ben’s character but as a project lead he has also shown lack of judgement and care for some of the core aspects of the project.”

Meow confirmed that Chow has resigned and Meteora will start looking for new leadership immediately.

Allegations and Insider Trading Claims

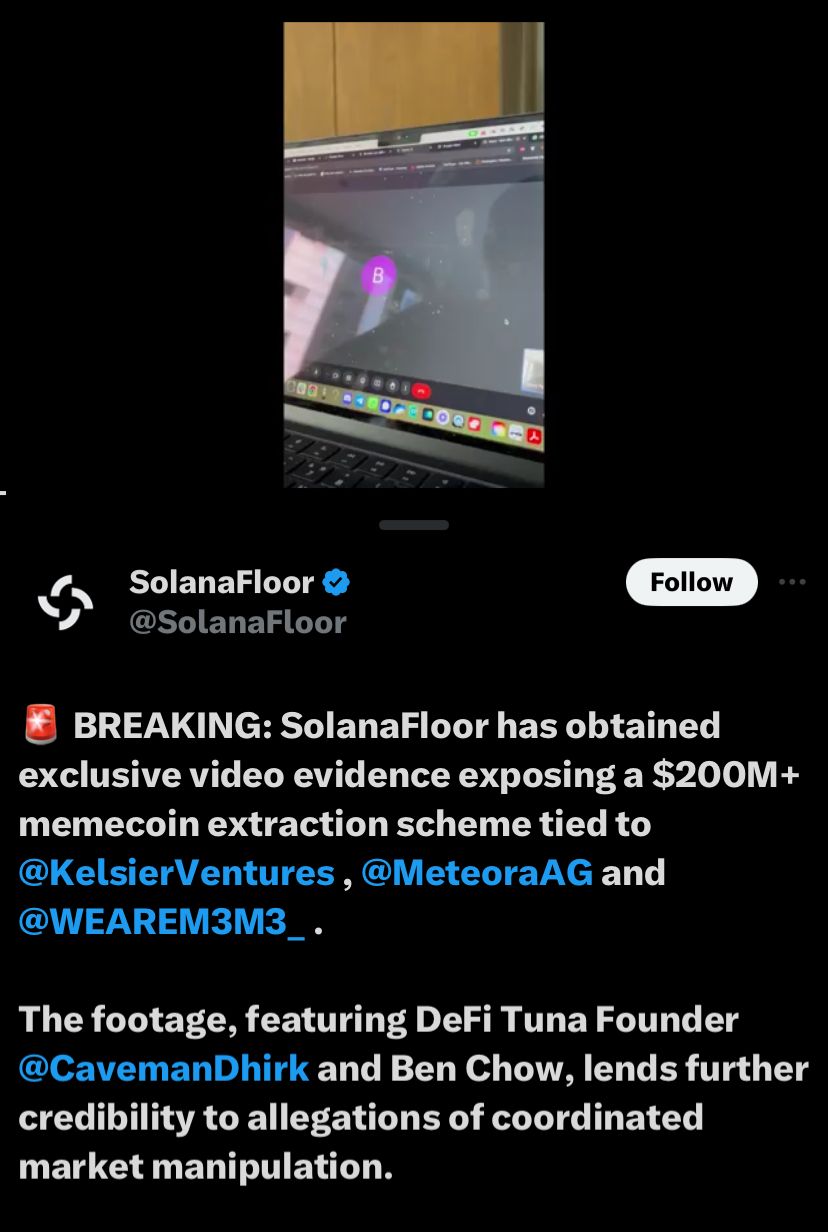

The scandal got worse with the circulation of a video—posted on X by SolanaFloor—allegedly showing a online conversation between DefiTuna founder Dhirk and Ben Chow. In the video, Dhirk accuses Kelsier Ventures members of insider trading during a memecoin launch, recounting an event in Barcelona, allegedly by invitation of Kelsier President Dr. Tom Davis.

Throughout the interview Chow is seen denying any wrongdoing by him or the Meteora team. He says:

“I feel so sick”’ because I gave him Melania. I fucked up because I enabled the guy that should not have been enabled … I’m going to have to step down, I’m going to have to quit.”

This raw unfiltered admission in an online video call shows the internal turmoil and conflicting narratives surrounding the Libra incident.

Hayden Davis’s role in the scandal also comes under fire. Davis claims he was a facilitator and provided pre-launch insights to several projects including Meteora’s memecoin AMM platform launched in December 2024. According to Chow, he referred Davis to multiple projects as a token deployer, including Melania Trump’s MELANIA token, based on the fact that Davis and Kelsier Ventures were supposed to be trustworthy partners. Chow says:

“Like with any other unaffiliated token that lives on Meteora, we did not purchase, receive or manage any tokens on the side related to $MELANIA.”

These statements are meant to distance both Chow and Meteora from any allegations of insider trading even as conflicting accounts from other participants in the Libra launch cast doubt on the project’s governance.

Community and Market Reactions

The fallout has been met with mixed reactions in the Solana DeFi community. Meow has publicly defended Chow, saying “no financial impropriety” happened in his dealings. However, many in the community are skeptical of Meteora’s management and oversight. The resignation has raised questions about the platform’s internal controls, especially since it facilitates high-profile meme coin launches.

Industry analysts say these type of controversies often have a ripple effect and can erode investor confidence in decentralized finance platforms. News sources have reported the increasing scrutiny of insider practices in the crypto space and how regulatory bodies may soon look into how these projects manage sensitive information.

Meteora and Solana Ecosystem Implications

A co-founder resigning is a big deal for any startup and with Meteora being a major player in the Solana DeFi space it could be a tumultuous time. New leadership is needed ASAP and now everyone is wondering how the platform will address internal governance issues and regain trust with users and partners.

The Libra scandal also has implications for the Solana ecosystem. As more and more platforms like Meteora get involved in memecoin launches and other high risk projects oversight and transparency becomes more important. This scandal could be the catalyst for wider reforms across decentralized finance platforms and a reevaluation of best practices in token deployment and insider info management.

Ben Chow’s resignation is a setback for Meteora but also an opportunity for a fresh start. New leadership can impose tighter internal controls and rebuild the platform’s reputation. In a fast paced DeFi industry, accountability and transparency is key to long term success. The current scandal may be a short term damage but could ultimately drive innovation and better governance across the sector.

Meteora’s future will depend on how it navigates these choppy waters and rebuilds trust with its community. Industry experts say if it can learn from this and takes a more serious approach to oversight, it may emerge stronger and better equipped to handle the complexities of DeFi.

Conclusion

Ben Chow’s resignation from Meteora co-founder amid the Libra memecoin scandal is a big deal for the Solana DeFi platform. Chow denies any involvement in insider trading, but the conflicting accounts and internal video recordings have cast a long shadow over the project.

As co-founder Meow and other stakeholders try to calm the community, the broader implications for Meteora and the Solana ecosystem is unknown. With new leadership on the horizon, the path forward will require a focus on transparency, accountability and tighter internal controls.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQ

1. Why did Ben Chow resign from Meteora?

Ben Chow resigned from Meteora due to the Libra memecoin scandal. Despite denying insider trading, the conflicting accounts and internal allegations forced his hand.

2. What was Ben Chow’s role in the Libra project?

Chow said for $LIBRA, he and the Meteora team only provided IT support and had no involvement in leaking information or managing tokens. He also said he referred Hayden Davis to various projects as a token deployer.

3. How is the community reacting?

Opinions are divided. Co-founder Meow defended Chow but many in the community are concerned about internal governance and wanting better oversight at Meteora.

4. What are the implications for the Solana ecosystem?

It raises questions about insider practices and transparency in DeFi. It may lead to wider reforms and tighter internal controls across the Solana ecosystem to regain investor trust.

5. What’s next for Meteora?

Meteora is looking for new leadership. Their future depends on them implementing better governance and rebuilding trust with the community.

Glossary

Meteora: A Solana-based DeFi platform for meme coin launches and token liquidity pools.

Libra: A memecoin that went boom and then bust after being endorsed and then pulled support.

Insider Trading: Trading based on non public information.

DeFi: Decentralized Finance, finance on the blockchain without intermediaries.

Liquidity Pools: Reserves of tokens locked in a smart contract to trade on decentralized exchanges.