According to Bitcoin Treasuries and Strategy’s latest financial update on March 21, 2025, Michael Saylor, the co-founder and executive chairman of Strategy, has announced its plan to make a big decision in its bitcoin holding. He added that the company is scheduling to raise $711 million through a stock offering to purchase more bitcoins.

Michael Saylor Strategy Plans to Reach 500,000 BTC

The company will sell Series A Perpetual Preferred Stock, to increase its current Bitcoin holding and will boost its financial position. As of March 19, Strategy holds around 499,226 BTC and is planning to increase that number to 500,000 BTC. This would make up around 2.3% of the total Bitcoin supply.

Due to strong investor demand, the offering, which was originally set at 5 million shares, has been increased to 8.5 million shares. Big institutions like Morgan Stanley and Barclays back the sale, with each share price at $85. This action is part of Michael Saylor’s larger plan, the “21/21 plan.” This method aims to raise $42 billion in the next three years by purchasing Bitcoin.

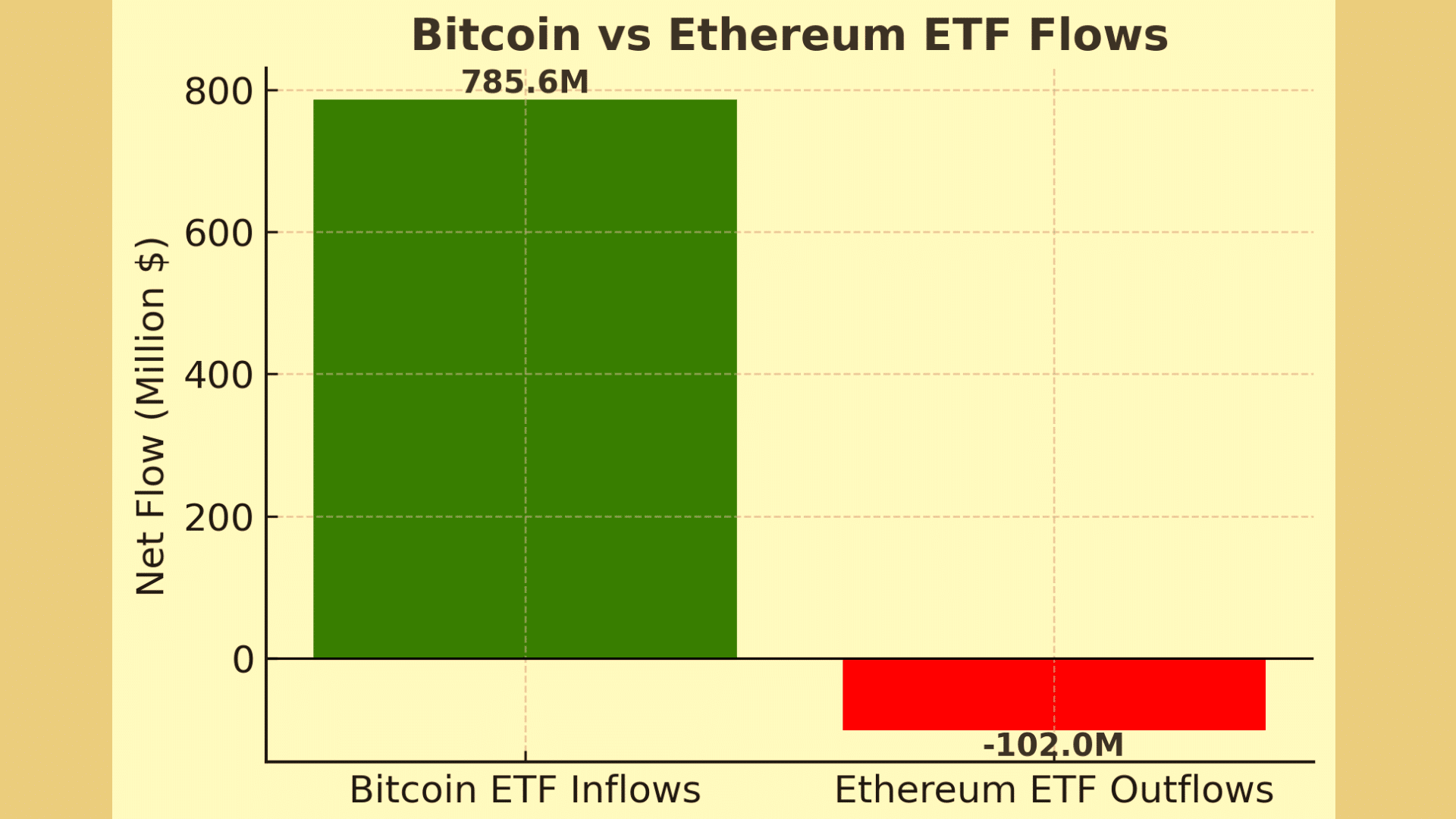

Bitcoin ETFs Surge In Inflows, Ethereum Fronts Capital Rotation

Besides Michael Saylor move, Bitcoin ETFs are also seeing an increase in demand. In the last week, ETFs drew around $ 785.6 million in total inflow. BlackRock’s iShares Bitcoin Trust (IBIT) is at the lead by adding around 6342 BTC, which is worth $535.5 worth of million. Other big companies like Fidelity and VanEck also contributed to increasing institutional investment in Bitcoin.

At the same time, Ethereum funds are experiencing significant outflows. Ethereum ETFs saw a decline of $102 million, which shows that investors are shifting their focus toward Bitcoin. In addition to this flow, Bitcoin’s transaction of 2.999 BTC, which is worth over $250 million, was successfully completed, giving rise to speculation about Bitcoin’s price in the future.

A new chapter for Bitcoin? Technicals suggest so

At the moment Bitcoin is trading around $84,660, which is just below the key resistance level of $85,800. The Cryptocurrency could lead to a breakout as it is consolidating within a symmetrical triangle pattern. If Bitcoin Rises above the value of $85,800, it could trigger a rally and the value will go up to $87,400 and even $89,000. On the other hand, if Bitcoin fails to pass this key level, it might have to face selling pressure.

On the downside, Bitcoin is supported by key levels, which are at $83,000,$81,5,00, and $78,400. Along with the 50-period EMA on the 4-hour chart, it is sitting slightly above $ 84,090. The market is still low, even with the support of these technical indicators. Traders are waiting for a major shift in the market.

Conclusion

Michael Saylor’s strategy to buy additional Bitcoin, supported by top institutions like Morgan Stanley and Barclays, results in great confidence for the future value of Bitcoin. The series raised around $711 million. A STRF offering will allow the strategy to continue its rise towards 500,000 BTC by further reducing the available supply of Bitcoin. The Cryptocurrency’s price might experience significant upward momentum as the interest of institutions grows and bitcoin comes at a potential breakout.

Though analysts are divided on Bitcoin’s short-term outlook, one thing is clear: Michael Saylor’s continued Bitcoin acquisition and growing ETF inflow suggest that Bitcoin’s next big movement might be near.

Stay updated with the most recent Bitcoin Price on the Bit Journal

FAQs

1. What is Michael Saylor planning?

He plans to buy $711M worth of Bitcoin by funding through a stock offering.

2. How will Strategy Increase its Bitcoin holding?

The strategy aims to sell its Series A Perpetual Preferred Stock to fund Bitcoin purchase

3. How much BTC does Strategy hold?

As of March 19, it holds 499,226 BTC.

4. What is the ‘21/21 Plan’?

It’s a plan made to raise $42B in 3 years to buy Bitcoin

5. What is happening with ETFs?

Bitcoin ETFs surged by $785.6M, while Ethereum ETFs dropped $102M.

Glossary

Series A Perpetual Preferred Stock- A stock with fixed dividend but no maturity

Bitcoin ETF- A fund that tracks Bitcoin’s price

21/21 Plan – Michael Saylor’s strategy to raise $42 billion over three years

Stock Offering- A company selling shares to raise money

Capital Rotation- Investors, when changing their investment from one asset to another