MicroStrategy has made headlines once again by acquiring 2,530 Bitcoin, valued at approximately $243 million, in January. This marks the company’s second large-scale purchase this month. However, compared to its aggressive acquisitions in Q4 2024, the scale of this buy remains modest.

Michael Saylor’s Bitcoin Vision and Declining Purchase Volumes

Under the leadership of Michael Saylor, MicroStrategy has become one of the largest institutional holders of Bitcoin globally. Saylor reiterated the company’s commitment to accumulating Bitcoin in a recent social media update:

“MicroStrategy purchased 2,530 Bitcoin at an average price of $95,972, totaling $243 million. As of January 12, 2025, we hold 450,000 Bitcoin at an average cost of $62,691 per coin, with a total investment of approximately $28.2 billion.”

Despite this statement, the January acquisition reflects a more cautious approach. The Bitcoin bull market in November saw the company doubling its purchases, while December recorded $6 billion in acquisitions. In contrast, January’s total purchases have so far remained at a modest $344 million.

A Glimmer of Recovery Amid Uncertainty

This recent purchase signals some recovery in MicroStrategy’s buying momentum, even as acquisition volumes have declined. The move aligns with Saylor’s earlier announcement of plans for a $2 billion stock offering to fund future purchases, though SEC filings suggest this initiative has not yet materialized.

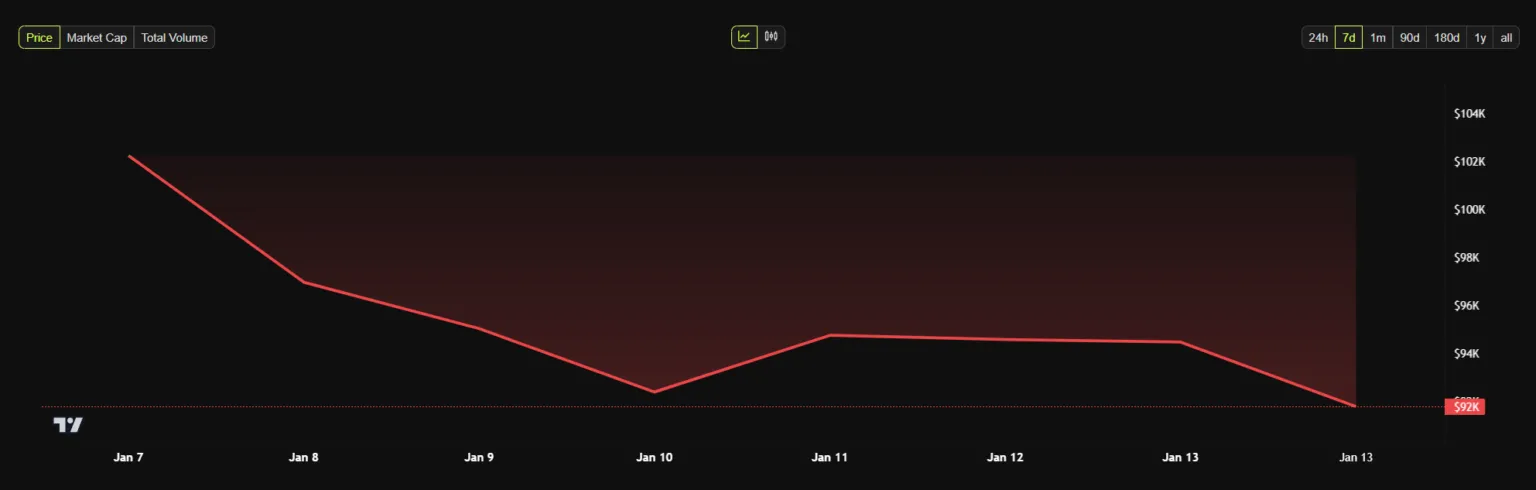

Market analysts speculate that macroeconomic conditions and Bitcoin’s price volatility could be influencing MicroStrategy’s cautious stance. Bitcoin’s value experienced a sharp drop of over 10% last week, adding to market uncertainty. In such conditions, the company may be adopting a more measured approach to its investments.

MSTR Shares Reflect Investor Caution

MicroStrategy’s stock (MSTR) has seen a nearly 20% decline this month, reflecting growing concerns among investors about the company’s strategy. However, MSTR remains a standout performer, having recorded a remarkable 550% growth in 2024. This resilience may help maintain investor confidence despite short-term setbacks.

What Lies Ahead for MicroStrategy and Bitcoin?

MicroStrategy’s strategic decisions will undoubtedly shape its future in the cryptocurrency space. The January purchase highlights the company’s continued commitment to large-scale Bitcoin investments, while also raising questions about how market dynamics and internal strategies may evolve. Under Saylor’s leadership, the company remains a pivotal player in institutional Bitcoin adoption, with potential to drive further interest in the cryptocurrency.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!