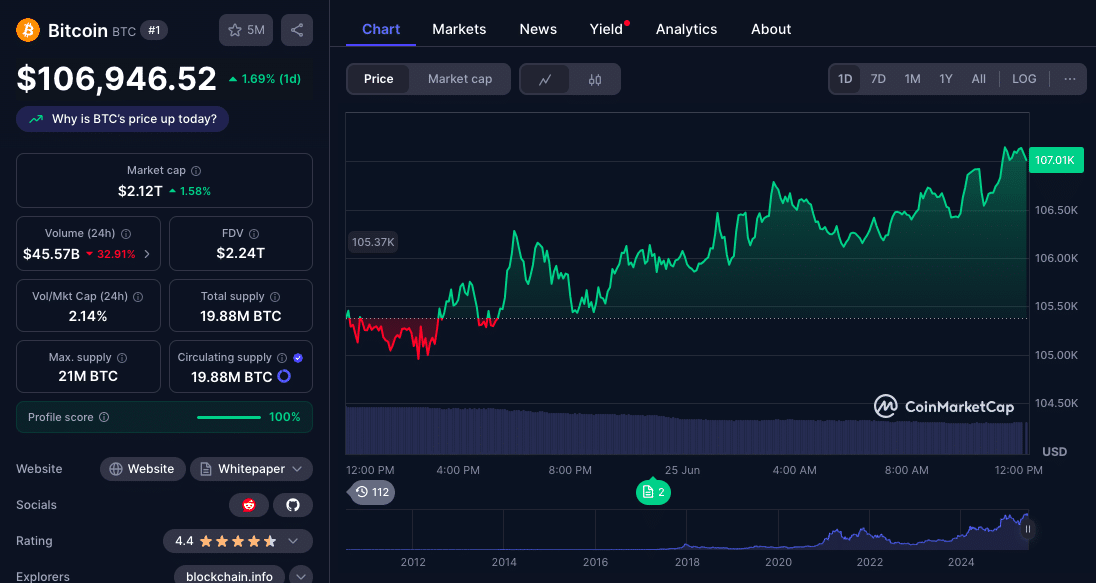

Bitcoin has clawed back lost ground, rising above $106,000 after briefly dropping below the five-figure threshold earlier in the week. This rebound aligns with a broader recovery in global risk assets as markets respond positively to reports that a Middle East ceasefire between Israel and Iran is holding. The renewed stability is improving investor confidence in digital assets, especially Bitcoin, which has seen renewed debate about its role as a safe-haven asset during geopolitical crises.

According to Bitget Research’s Chief Analyst Ryan Lee, the recovery is partially supported by sustained ETF inflows, which now exceed $46 billion. However, he cautioned that while the price bounce is encouraging,

“Bitcoin’s potential as a safe-haven shines through, but tempered risk appetite delays recovery.”

Still, Lee forecasts Bitcoin hitting $110,000 to $115,000 in Q3, with the possibility of reaching $130,000 to $160,000 by the end of the year.

Ether and Altcoins See Modest Gains Amid Rebound

Bitcoin’s recovery has pulled other cryptocurrencies into positive territory. Ether is hovering around $2,400, with analysts eyeing resistance near $2,450. Lee projects a near-term target of $2,600 to $2,800 for ETH and a longer-term view of $5,500. Solana’s SOL is trading at $146, while Cardano’s ADA trades around $0.58 after earlier testing the $0.60 level. Dogecoin saw marginal gains, trading around $0.166.

Though the movements in altcoins were modest compared to Bitcoin, analysts believe institutional inflows and macroeconomic support could fuel broader gains in the months ahead; especially if the Federal Reserve signals a dovish stance or if additional ETF approvals emerge.

Fed Outlook, Institutional Demand, and the New BTC Narrative

Bitcoin’s sharp recovery over the weekend; rebounding over $7,000 in under 48 hours; has reignited the discussion about its evolving role in financial markets. While traditionally considered volatile, some analysts argue that its behavior during recent geopolitical disruptions reflects increasing maturity.

Gadi Chait, Head of Investment at Xapo Bank, noted that Bitcoin’s swift bounce back above $105,000 shows signs of deepening liquidity and growing institutional adoption.

“Bitcoin’s status as a safe-haven asset is still taking shape,” he said. “But its V-shaped recovery back above $105K shows its growing liquidity and integration into mainstream portfolios.”

Contributing to this resilience are expectations that the U.S. Federal Reserve may ease its monetary stance. Fed Chair Jerome Powell’s statement this week that “many paths are possible” on policy direction has reinforced speculation around upcoming rate cuts, further supporting risk assets like Bitcoin.

Near-Term Outlook: Key Levels to Watch

As Bitcoin steadies above $106,000, the $110K–$115K zone is emerging as the next technical target. Breaking through could push toward the $130K–$160K range Lee projected by year-end. Ether faces its own test at the $2,450 level. A confirmed breakout could trigger bullish momentum toward $2,600 and beyond.

Still, caution remains necessary. As Ryan Lee points out, macroeconomic factors, ETF flows, and continued geopolitical developments will dictate whether Bitcoin’s momentum is sustained or interrupted by volatility.

Conclusion

The return of market calm following the Middle East ceasefire has revived optimism in the crypto sector, with Bitcoin leading the way. Institutional inflows, hopes of a dovish Fed, and growing narratives around BTC’s role as a safe-haven asset are pushing prices higher.

Analysts now see a path for Bitcoin to reach $160,000 before the end of 2025 provided macro conditions remain favorable and ETF momentum continues. While risks persist, the market’s recovery shows resilience, especially when paired with increased mainstream participation.

Summary

Bitcoin has rebounded to over $106,000 following a week of geopolitical-driven volatility. Analysts, including Bitget Research’s Ryan Lee, forecast a price target of $160,000 by year-end. Ether and other altcoins followed with modest gains, while renewed debate has emerged over Bitcoin’s role as a safe-haven asset.

FAQs

Why did Bitcoin rebound this week?

Bitcoin surged after reports of a Middle East ceasefire between Israel and Iran stabilized global markets. ETF inflows and dovish Fed signals also supported the recovery.

What is the Bitcoin price forecast for 2025?

Bitget Research’s Ryan Lee expects Bitcoin to reach $130,000–$160,000 by the end of 2025, assuming favorable market conditions and continued ETF support.

Is Bitcoin now considered a safe-haven asset?

Not fully, but analysts say its recent performance, especially rapid rebounds, suggest it’s gaining attributes of a safe-haven, particularly due to institutional backing.

What are the next key resistance levels for Ether and Bitcoin?

Bitcoin faces resistance around $110,000–$115,000. Ether is testing $2,450, with upside targets between $2,600 and $2,800.

How much has been invested into Bitcoin ETFs?

Total inflows have exceeded $46 billion, with daily flows suggesting robust demand from both retail and institutional investors.

Glossary

ETF Inflows: The amount of capital moving into exchange-traded funds, indicating investor confidence and interest in an asset.

Safe-Haven Asset: An investment expected to retain or grow in value during periods of market stress or uncertainty.

Macro Tailwinds: Broader economic conditions that positively influence asset prices, such as interest rate cuts or geopolitical stability.

Resistance Level: A price at which an asset encounters selling pressure, potentially halting its upward movement.

V-Shaped Recovery: A sharp and rapid market rebound following a steep decline.

Source