In a swift market downturn, the crypto market faced a significant liquidation event on Monday, with over $90 million in positions wiped out within an hour. This rapid sell-off led to a drop in Bitcoin by over 1%, while Ethereum slipped nearly 2% as investors took profits. Other major altcoins like Solana (SOL), BNB, XRP, and Cardano (ADA) saw declines of 2-3% following substantial 24-hour price gains. Meanwhile, meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) fell 6% within the same hour. Although optimism remains high, especially with Bitcoin-supporter Donald Trump’s projected election win, some indicators suggest potential for further downward pressure.

Will Bitcoin and Altcoins Continue to Fall?

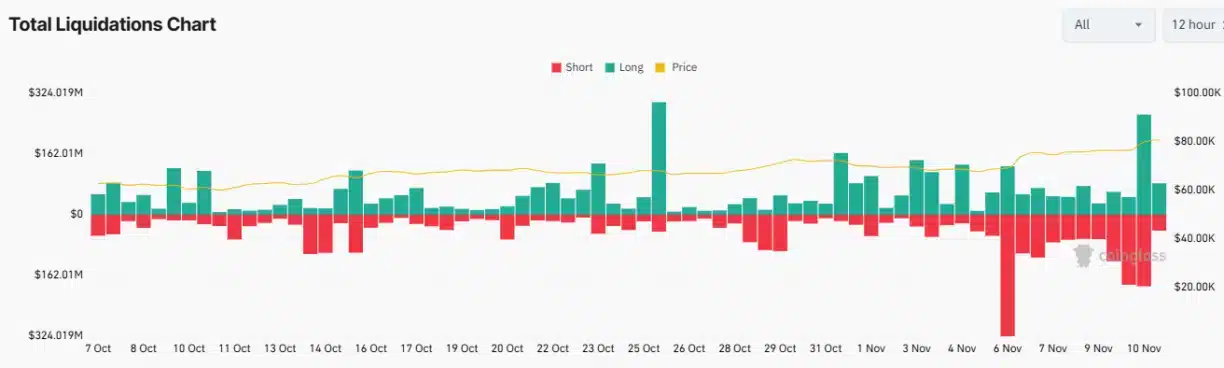

According to data from Coinglass, over $90 million was liquidated within four hours, and a total of $650 million was wiped out over the last 24 hours. This included $75 million in long positions and $15 million in shorts, creating a selling wave that affected more than 217,000 traders. The largest individual liquidation order was worth $15.56 million on OKX’s BTC-USDT swap.

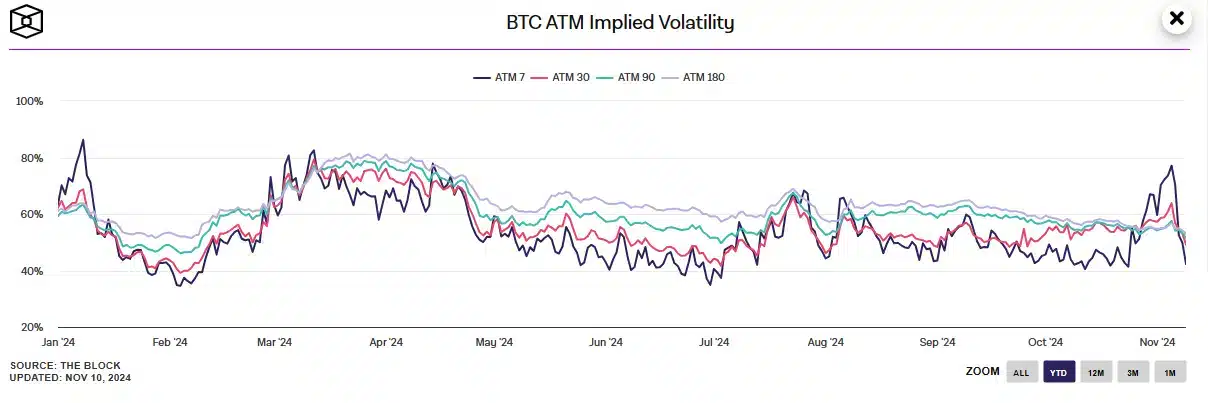

Despite recent turbulence, Bernstein analysts have set a year-end price target of $90,000 for Bitcoin, with BTC already reaching a new all-time high at $81,858. However, derivative market data reveals potential for a larger sell-off. Bitcoin’s implied volatility (IV) is falling across all terms, especially in the ATM-7 IV measure, which gauges market expectations of BTC price movements. This decline in implied volatility suggests that options traders may not expect further upward movement soon, impacting prices for major cryptos like Ethereum, Solana, XRP, and Dogecoin.

The Mt. Gox Move and Market Reactions

In another notable event, Arkham data indicates that Mt. Gox transferred 30,371 BTC—approximately $2.44 billion—across two wallets on Monday, raising concerns among investors about a potential sale. Additionally, China’s recent 10 trillion-yuan stimulus package failed to inspire confidence, impacting sentiment. Amid expected policy changes under the Trump administration, markets are bracing for initial volatility.

Economic Data to Watch

Several key economic indicators in the U.S., including CPI and PPI inflation reports, unemployment claims, and remarks from Fed Chair Jerome Powell, are likely to influence the crypto market this week. Economists anticipate high inflation readings, which, combined with U.S. political shifts, could add pressure to markets. Still, some analysts remain long-term optimistic on Bitcoin, with renowned trader Peter Brandt forecasting BTC could reach $125,000 by year-end and potentially $300,000 long-term based on an inverse head-and-shoulders pattern. While this model faces skepticism, notable analysts like Richard W. Schabacker and John Magee support its potential validity.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!