Michael Saylor’s Strategy is not letting up its BTC purchase despite a temporary setback after the House of Representatives voted to reject the Montana Bitcoin reserve bill.

According to a post on social media platform X by Bitcoin Laws, Montana’s House of Representatives rejected a bill that would have seen BTC become part of the state’s reserve assets. The report states that lawmakers were especially concerned about the risks associated with Bitcoin’s speculative nature, which could put taxpayers’ funds at risk.

Create Value for Shareholders

Despite the setback to the Montana Bitcoin reserve Bill, Michael Saylor’s Strategy has signaled intentions to go on with its Bitcoin buying spree. The company’s co-founder recently posted a chart suggesting the firm was intent on making another purchase soon after the February 10 acquisition where Strategy bought 7,633 BTC at over $743 million. The last purchase brought the total number of the firm’s Bitcoin holdings to 478,740.

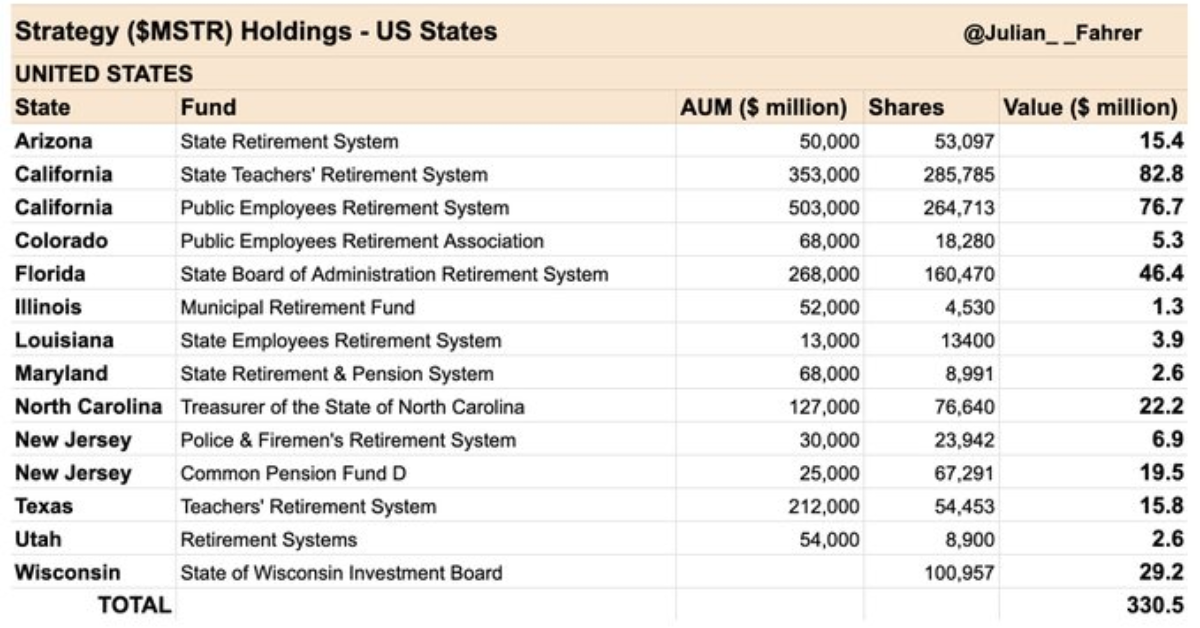

Data from SaylorTracker shows that the value of the Bitcoin stash owned by Strategy stood at least $46 billion, meaning the company had earned an impressive 47.7% return on investment. Michael Saylor has previously stated that the company intends to use intelligent leverage in 2025 to buy more BTC, especially during the first quarter. According to the CEO, the aim is to create value for shareholders and strengthen the firm’s position as the leading corporate holder of Bitcoin. Several other institutions have since joined the Bitcoin buying spree and added digital assets to their holdings.

Fear over Taxpayers’ Money

The Montana Bitcoin reserve bill, also known as House Bill 429, failed to sail through in a 41-59 vote during the second reading following apprehensions that it could allow the state’s treasury the green light to invest in stablecoins, precious metals, and Bitcoin. The Bill had placed a cap on the eligibility of crypto assets to the average market capitalization of over $750 billion over the last year, meaning that only Bitcoin could have met the criteria.

Speaking during the debate, State representative Steven Kelly alluded to the risks associated with digital assets, with Representative Bill Mercer stating he didn’t like the idea of allowing the Montana Bitcoin reserve bill to facilitate crypto investment by the state. Kelly said:

“It’s still taxpayer money, and we’re responsible for it, and we need to protect it […] I did not come here to do that […] this smacks of speculation to me.”

A Good Return on Investment

Despite the strong opposition against the Montana Bitcoin reserve bill, a number of lawmakers supported the flagship cryptocurrency, citing the potential to maximize returns on investment. According to Representative Lee Demming, the state should have aimed for the highest possible return or given back the funds to the taxpayer.

Representative Curtis Schomer, who sponsored the Bill, had warned of the dangers of rejecting the Montana Bitcoin reserve bill, arguing that it wasn’t wise to rely solely on traditional assets like bonds. According to Representative Steve Fitzpatrick, the state could have utilized the large amounts of idle funds to invest in cryptocurrencies and precious metals to provide fiscal relief by reducing taxes.

Conclusion

The rejection of the Montana Bitcoin reserve bill comes at a time when at least 24 states, including Arizona, Illinois, Kentucky, Maryland, New Hampshire, New Mexico, North Dakota, Ohio, Oklahoma, Pennsylvania, South Dakota, and Texas, have introduced similar bills. While 20 of those bills remain active and Utah is reportedly making notable progress, North Dakota, Wyoming, and Pennsylvania have allegedly halted their proposals. Bitcoin was trading at $95,572 at the time of writing, according to CoinMarketCap data.

Frequently Asked Questions (FAQs)

Why are the US States interested in Bitcoin reserve bills?

Some leaders who believe in the future of cryptocurrencies are hopping onto the train because they think Bitcoin is a potential hedge against inflation.

What are the benefits involved?

Diversification is the most significant benefit, as people are averse to putting all their eggs in one basket.

Are there any potential downsides?

Bitcoin volatility lacks intrinsic value, and the fact that the regulatory landscape is still murky means the states will be treading on uncharted waters as they navigate existing laws that don’t yet accommodate digital assets.

What challenges can they expect ahead?

The lack of a regulatory policy, security and volatility are among the challenges lawmakers will have to address if the plans are going to succeed.

Appendix: Glossary of Key Terms

Bill: A proposed law that can introduce new legislation, change existing laws, or repeal laws.

Bitcoin: A cryptocurrency designed to act as money and a form of payment outside the control of any one person, group, or entity.

Strategic Reserve: A stockpile of a vital resource that can be used during a crisis or supply shortage.

Volatility: A tendency to change quickly and unpredictably.

References