The once-dominant Bitcoin exchange Mt. Gox has extended its repayment deadline until October 31, 2025, following court approval. This move aims to ensure that creditors receive compensation without rushing the repayment process. The extension has calmed fears of a sudden sell-off in the market, leading to increased optimism among investors.

Mt. Gox Sets Final Deadline for Bitcoin Payouts

Mt. Gox, a Tokyo-based Bitcoin exchange founded in July 2010, suffered a major attack in 2014, losing a significant amount of BTC, which eventually led to its bankruptcy. As previously reported by The Bit Journal, the exchange has begun compensating creditors. In its latest announcement, Mt. Gox revealed it would extend the repayment process for another year.

The exchange also noted that while many creditors have completed the basic, interim, and early payment processes, some have yet to complete the necessary procedures or faced issues during repayment. Regarding the situation, Mt. Gox stated:

“Many rehabilitation creditors have not yet received their repayments because they have not completed the required procedures. Additionally, a significant number of creditors have faced various issues during the repayment process and have not received their funds.”

Is This Good News for Investors?

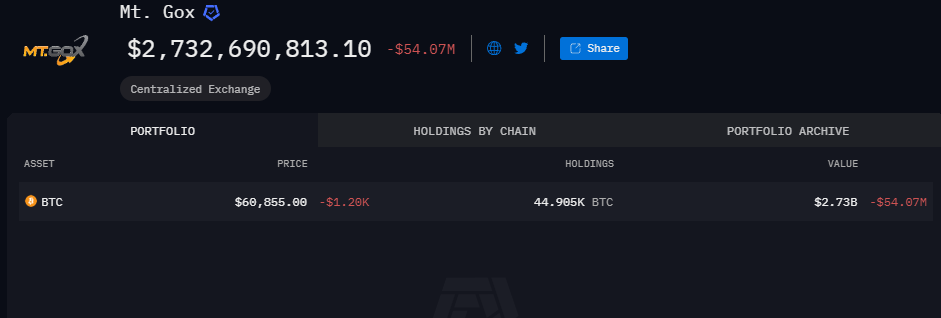

As a result, the final date to receive repayments has been extended from October 31, 2024, to October 31, 2025. According to Arkham, Mt. Gox’s wallet currently holds 44,905 Bitcoin, valued at over $2.7 billion.

Throughout the year, the crypto community has feared a massive sell-off following the Mt. Gox repayments. However, this extension may have relieved some concerns. One X user commented, “The $4 billion sell pressure is now delayed until 2025.” That said, Mt. Gox has already made some significant transfers, including moving 13,265 BTC worth $782 million to an unknown wallet and 1,265 BTC to an internal wallet in August. Many believe these transactions were in preparation for creditor repayments.

Rising Volatility and the U.S. Presidential Election

With the U.S. presidential election approaching, traders are bracing for increased Bitcoin price volatility. The options market reflects these expectations, with implied volatility rising as traders speculate on potential price hikes or hedge against downside risks following the election on November 5.

According to a market analyst, much of the activity is concentrated at the end of the quarter, particularly around call options expiring on December 27. Presto Research analyst Rick Maeda noted a sharp rise in bullish bets on long-term Bitcoin options expiring at the end of the year. Maeda shared his thoughts, saying:

“Trump’s implied election odds on Polymarket reached their highest levels since early August. There has been a notable increase in long out-of-the-money (OTM) call flows, with 64.53% targeting December 27, 2024, expiration and 79.79% targeting March 28, 2024. This suggests a strong bullish outlook moving forward.”

For more updates on the crypto market and insights into how these developments may affect Bitcoin, stay tuned to The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!