Nasdaq has formally requested the SEC to list the 21Shares Dogecoin ETF. By filing this application, traditional stock exchanges continue to expand their pursuit of crypto ETF products. Through financial institutional access, this proposed ETF offers investors direct investment in Dogecoin.

The filing surfaced just weeks after 21Shares submitted its proposal to launch a spot Dogecoin ETF. The SEC now handles two applications from companies Bitwise and Grayscale, which were submitted during the preceding month. The recent Nasdaq decision validates that investors are assuming greater interest in acquiring authorized digital asset investment products.

Dogecoin ETF Signals Rising Institutional Interest

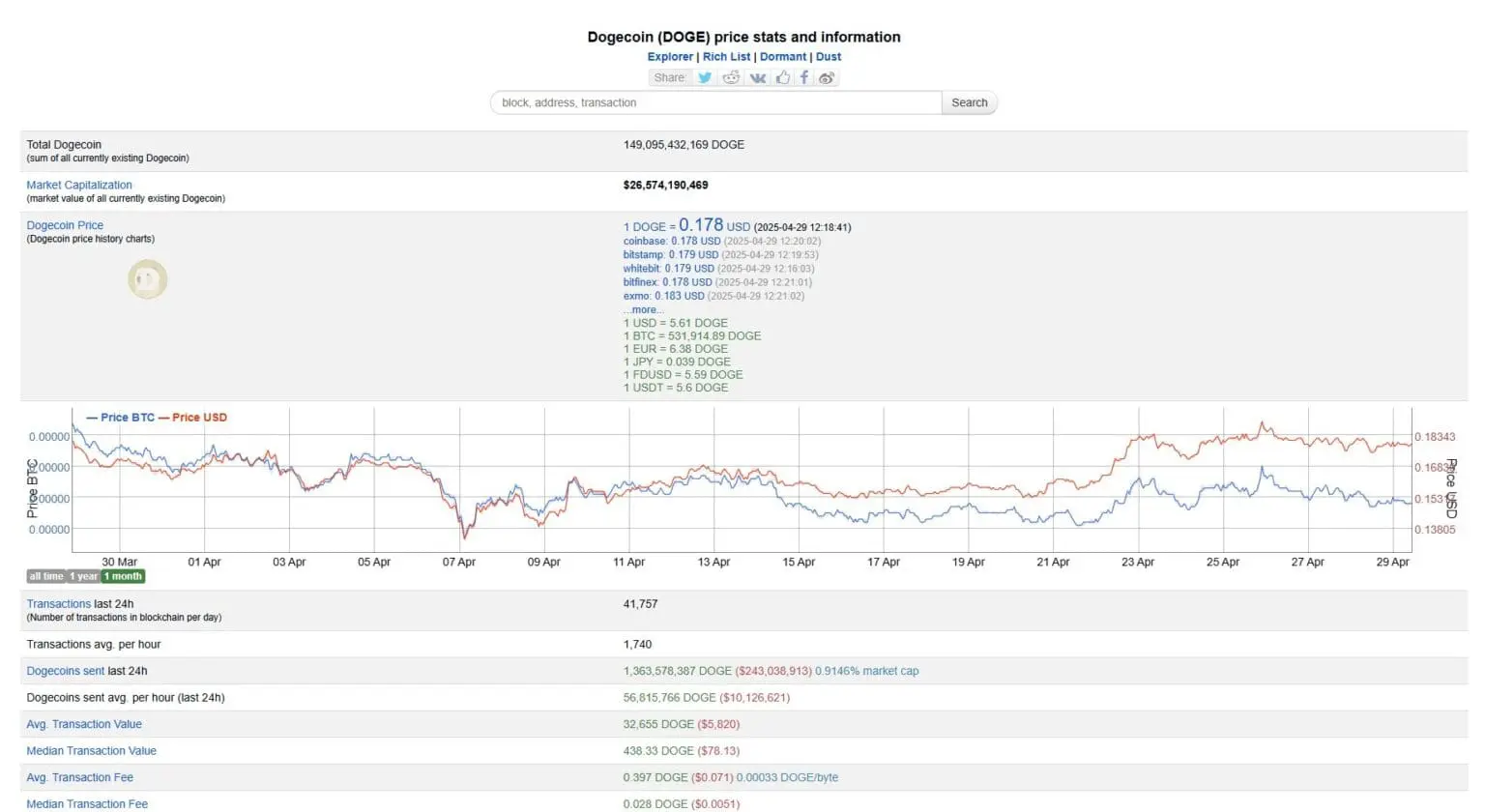

Dogecoin is an attractive investment opportunity for institutional investors because its market capitalization has reached $26 billion, and an upcoming ETF listing demonstrates potential draw. A Dogecoin ETF would work as an asset-based mechanism that tracks Dogecoin market movements. The approval status would enable investors to exchange DOGE using brokerage accounts, thus bringing more investors into the market.

The Dogecoin system distinguishes itself because its operational blockchain enables quick and economical transactions. The blockchain network processed more than 40,000 daily transmissions according to its April 29 figures, indicating full operational readiness. User data points presented in these metrics prove that its user base remains active, unlike the typical memecoin landscape.

The operational blockchain of Dogecoin operates independently without any dependence on external third-party infrastructure. By design, this structure increases stability and long-lasting usability characteristics. Transaction times remain consistent, while fees remain low when the network experiences increased activity.

QED Protocol and Nexus proposed a layer-2 solution to Dogecoin in 2024, which enabled smart contract capabilities on the platform. The recent developments on Dogecoin do not relate to the ETF initiative but demonstrate continuous networking improvements. Implementing new features would raise Dogecoin’s position within the digital asset sector.

Spot ETFs for Solana and XRP Under Review

On April 21, the SEC had more than 70 pending applications for cryptocurrency ETFs. Dual blockchain major tokens, as well as new emerging memecoins, make up these applications. A rising number of fund managers want to access the regulated crypto investment space, which is reflected in the current review process.

The SEC plans to review spot ETFs for Solana, XRP, and Polkadot. The present market prices of layer-1 blockchain tokens indicate robust investor involvement. Accomplishment of the approvals has the potential to extend traditional market possibilities for high-cap digital assets.

The regulatory framework now includes BONK and Official Trump among its list of memecoin products. Active market interest supports the creation of various new ETF proposals. Most of the reviewed applications currently do not have a determined final deadline date according to the SEC.

Nasdaq Pushes for Clear Crypto Regulations

Nasdaq issued a formal April 25 letter requesting the SEC implement existing securities regulations for digital assets. The exchange maintained that assets that operate like stocks should be governed by corresponding compliance rules. According to the exchange, this regulatory conformity would ensure investor protection and market transparency.

The proposed regulation establishes standards that support the industry-wide search for predictable regulations regarding digital asset exchange-traded funds. Fund managers and exchanges desire a standardized method for handling digital tokens when they qualify as financial instruments. Nasdaq’s stance on exchange-traded funds makes it influential in the SEC decision-making process for future applications.

The ETF review process accelerated following President Trump’s January 2025 executive directive about financial instruments. This order officially instructed regulators to enhance their acceptance of financial products related to crypto. More fund issuers started presenting ETF applications after the approval criteria for digital asset product concepts opened.

FAQs

What is the 21Shares Dogecoin ETF?

It is an investment fund proposed by 21Shares to offer direct exposure to Dogecoin’s price through a traditional stock exchange.

Who applied to list this ETF?

Nasdaq filed the application to the SEC in late April, requesting permission to list and trade the ETF shares.

What makes Dogecoin different from other memecoins?

Dogecoin operates its own blockchain and supports fast, low-fee transactions, unlike most memecoins hosted on other networks.

When will the SEC make a decision?

The SEC has not announced a timeline, but ongoing reviews of similar applications may influence the outcome.

Glossary of Key Terms

- ETF (Exchange-Traded Fund): A marketable security that tracks an asset or group of assets and is traded on stock exchanges.

- SEC (Securities and Exchange Commission): U.S. regulatory agency overseeing securities markets and protecting investors.

- Spot ETF: An ETF that holds the underlying asset itself rather than derivatives or futures contracts.

- Layer-1 Blockchain: A base-level blockchain protocol, such as Bitcoin, Ethereum, or Dogecoin.

- Layer-2 Solution: A secondary framework built on top of a blockchain to increase its functionality and scalability.

- Memecoin: A cryptocurrency created primarily for entertainment or community interest, often with viral origins.