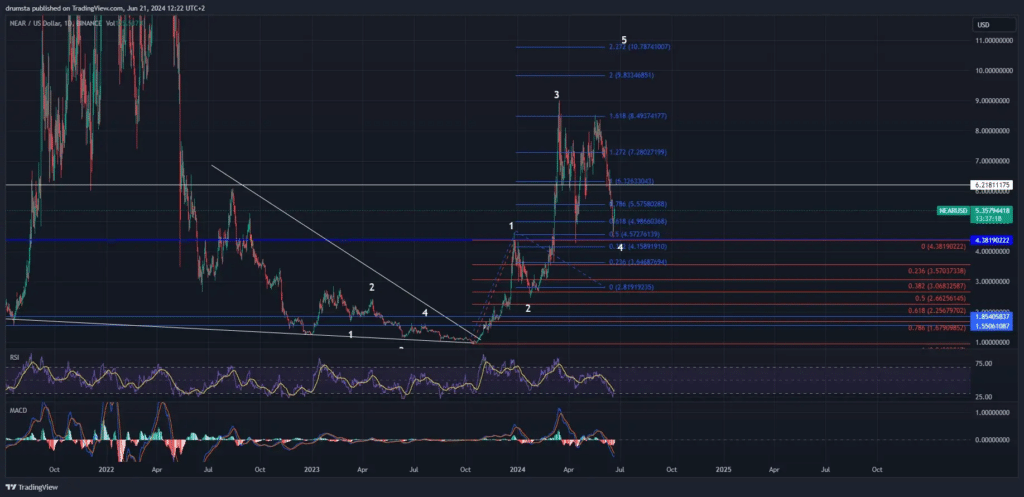

The crypto market has seen massive surges in the price of different blockchain assets. Recently, the NEAR Protocol has experienced a massive price surge that has drawn the attention of analysts and market experts. Over the past week, the NEAR price rise has hit an impressive 37.86%, according to available data. This significant increase brings NEAR closer to reclaiming the 23.6% Fibonacci retracement line as a support level. According to sources, the sharp spike in the Chaikin Money Flow (CMF) indicates a sudden NEAR price rise in inflows, indicating an increase in the demand for NEAR. Experts believe that this trend reflects a growing investor interest and confidence in the NEAR protocol.

The recent NEAR price rise is significant for the token and the general broader market dynamics. The surge has the potential to influence Bitcoin (BTC) and Ethereum (ETH) prices. Based on available data, combining bullish investors and whale activities creates a complicated picture of the current market environment surrounding NEAR. As the NEAR price approaches a critical resistance level, the interplay between retail investors and whales and also institutional investors will play a pivotal role in understanding what the future holds for NEAR’s price. Experts suggest that if the token crosses the resistance mark, it may have a stable place in the market.

Market Dynamics and Rising Demand

Analysts suggest that the NEAR price rise can be attached to certain key factors, namely, a combination of market dynamics and positive bullish sentiment. The CMF’s sharp spike indicates a surge in inflows, which means that investors and traders demand the NEAR Protocol in high volumes. The increase in demand is positive as it shows that more investors are buying into the asset, which in turn could lead to further surges in NEAR’s value. As NEAR surges in value, the broader implication may affect the entire crypto industry, potentially leading to the mass adoption of assets like Bitcoin (BTC), Ethereum (ETH) and other cryptocurrencies.

Impact of Short Liquidations and NEAR Price Rise

Apart from the recent NEAR price rise, NEAR has, allegedly, experienced short liquidations that have reached up to $1 million over the last 24 hours. This significant liquidation level underscores the intense market activity surrounding the token as retail and short sellers are forced to cover their position in the market.

The significant volume of short contracts that are being liquidated stands to curb any bearish attempts on the asset. Officials say this could drive the NEAR price rise higher and lead to greater price stability in the coming days. The bullish sentiment continues to grow, and experts hope that NEAR will be able to sustain itself at its present level.

Current Price Performance and Future Outlook

“In line with the recent 37.86% NEAR price rise, NEAR is currently valued at $6.02. The NEAR Protocol price rise went close to breaching the $6.06 resistance market, which coincides with the 23.6% Fibonacci retracement level”. Despite all the buzz, NEAR still has work to do to close above the resistance, as now it is hovering just below the mark. If the breach attempt fails, analysts believe the NEAR price rise could reverse, potentially falling to a critical support level at $5.20. If NEAR loses the bullish sentiment building around it, it may spiral into further decline. Assets like Bitcoin (BTC) and Ethereum (ETH) may influence NEAR’s price movement.

Conclusion

The recent NEAR price rise, according to data, paired with the substantial short liquidation, shows that NEAR beats are most likely to retreat. The increasing demand indicated by the sharp uptick in the CMF and high level of short liquidations suggests a growing bullish market sentiment. According to reports, NEAR has a lot of work to do to sustain its current momentum and convert the 23.6% Fibonacci retracement level into a support level; this will be crucial for its continued growth and upward trajectory.

Investors are advised to monitor these levels closely in order to make more informed decisions. The NEAR price rise has the potential to continue its upward trend if the bullish market sentiment continues. As more events happen, The BIT Journal helps you stay updated with news of recent developments in the Crypto Market.