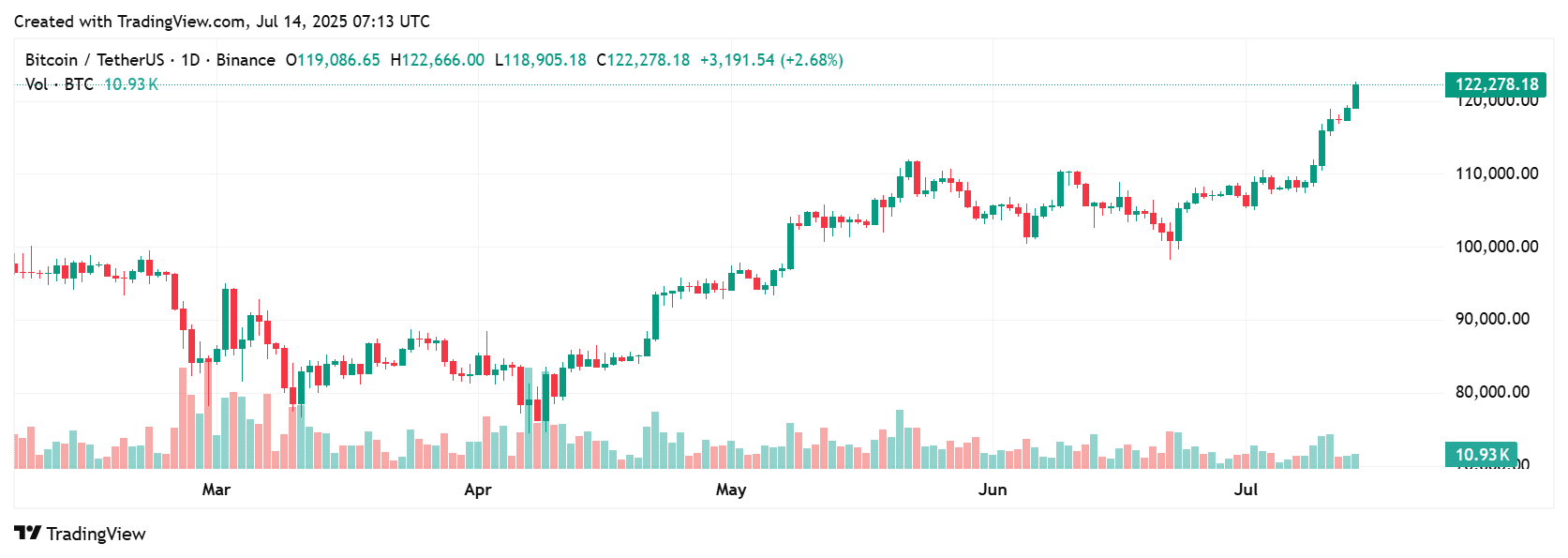

Bitcoin surpassed the $122,000 barrier for the first time on July 14, a historic milestone that coincides with increased institutional use and macroeconomic speculation. According to CoinDesk, the increase has been fueled by spot ETF demand, diminishing exchange supply, and anticipation of significant US inflation data due later this week.

Bitcoin’s meteoric run, which has seen the asset increase about 30% in 2025 alone, is viewed by many experts as a structural revaluation rather than a speculative surge. “This move isn’t just about retail FOMO, it’s being driven by institutional flows and shifting macro positioning,” Ledn CEO John Glover stated.

BTC reached a high of $122,390 on various trading platforms, with values above $121,207 during Asian trading hours. The new all-time high comes as broader crypto sentiment remains robust, with Ether and XRP joining the bullish wave.

Inflation Anticipation: U.S. Data Looms Large

Investors are anxiously awaiting the impending US inflation report, which is likely to be issued within the next 48 hours. A lower-than-expected figure might spark more rises, reinforcing Bitcoin’s function as a currency hedge.

Bitcoin’s surge is viewed as a preemptive response to both the collapsing US currency and the Federal Reserve’s uncertainty. Earlier this month, Fed Chair Powell hinted at a “data-dependent” strategy, which the market took as dovish. As a result, Bitcoin’s image as digital gold is regaining popularity.

“Bitcoin is responding exactly as a store-of-value asset should,” stated a CryptoQuant analyst. “With inflation uncertainty rising, investors are moving to hard assets, and BTC is leading the charge.”

ETF Inflows Continue to Power the Market

Spot Bitcoin ETFs, notably those from BlackRock and Fidelity, have had consistent inflows throughout Q2 and into July. According to Bloomberg, US-based Bitcoin funds now handle more than $64 billion in assets, up from $48 billion two months ago.

This flood of cash is strengthening the bull market and reducing short-term volatility. Furthermore, the dwindling exchange supply has increased upward pressure. According to Glassnode statistics, Bitcoin’s exchange balances have dropped to their lowest level since mid-2022, indicating that more investors are opting for long-term storage over trading.

At the same time, short positions are being eliminated. Over $276 million in leveraged shorts were liquidated in the last week, sending prices up and driving bears out of the market. Analysts believe this feedback loop will continue if macroeconomic conditions stay good.

Bitcoin Price Table

| Date | Price (USD) | 24h Change | Weekly High | Volume (24h) |

|---|---|---|---|---|

| July 14 | $122,356 | +4.6% | $121,207 | $82.3 Billion |

| July 13 | $115,380 | +3.1% | $116,040 | $69.5 Billion |

| July 12 | $112,750 | +2.7% | $113,870 | $66.8 Billion |

Regulatory Tailwinds: Crypto Week & U.S. Bills

The current Crypto Week in Washington has also fueled the market’s confidence. New legislative initiatives, such as the CLARITY Act and the FIT21 bill, seek to provide more specific rules for digital asset taxes and categorization.

While none of the proposed legislation has yet been approved, the tone in Washington appears to be trending toward reasonable regulation rather than outright prohibition. This tone is helping cryptocurrency re-enter the mainstream discourse.

“The tale is growing. Crypto is no longer just about memes or volatility; it is also being considered in terms of financial infrastructure, according to a Blockchain Association policy strategist.

Summary

Bitcoin rise beyond $122,000 is more than simply a technical breakthrough; it reflects a combination of institutional demand, favorable regulation, and macroeconomic tailwinds. As U.S. inflation data approaches, traders are eyeing $125K as the next resistance level, with some bullish forecasts indicating Bitcoin might reach $130K-$150K by year-end if present trends continue.

This rise, characterized by ETF inflows, less liquid supply, and increased political legitimacy, suggests that Bitcoin may be entering a new age. For both investors and institutions, the message is clear: Bitcoin is no longer a speculative fringe; it is becoming foundational.

FAQs

What caused Bitcoin to reach $122,000?

A combination of ETF inflows, macroeconomic uncertainty, shrinking exchange supply, and U.S. regulatory momentum drove the surge.

How is inflation data connected to Bitcoin’s price?

Bitcoin is often seen as a hedge against inflation. Lower inflation expectations can reinforce its store-of-value narrative and attract more capital.

Are institutions buying Bitcoin now?

Yes, major asset managers like BlackRock and Fidelity are seeing steady ETF inflows, signaling sustained institutional interest.

Could Bitcoin continue to rise this year?

If macroeconomic and regulatory conditions remain favorable, analysts believe BTC could target $130K–$150K by year-end.

Glossary of Key Terms

ETF (Exchange-Traded Fund) – A type of investment fund traded on stock exchanges that holds assets like Bitcoin, enabling exposure without direct ownership.

Inflation Data – Economic statistics measuring changes in consumer prices, which can affect asset valuations and investor sentiment.

Exchange Supply – The amount of Bitcoin available on trading platforms; lower supply usually supports higher prices.

Short Liquidation – When a short position is forcibly closed due to rising prices, often pushing the asset price even higher.

CLARITY Act – A proposed U.S. bill aimed at clarifying digital asset classifications and taxation frameworks.