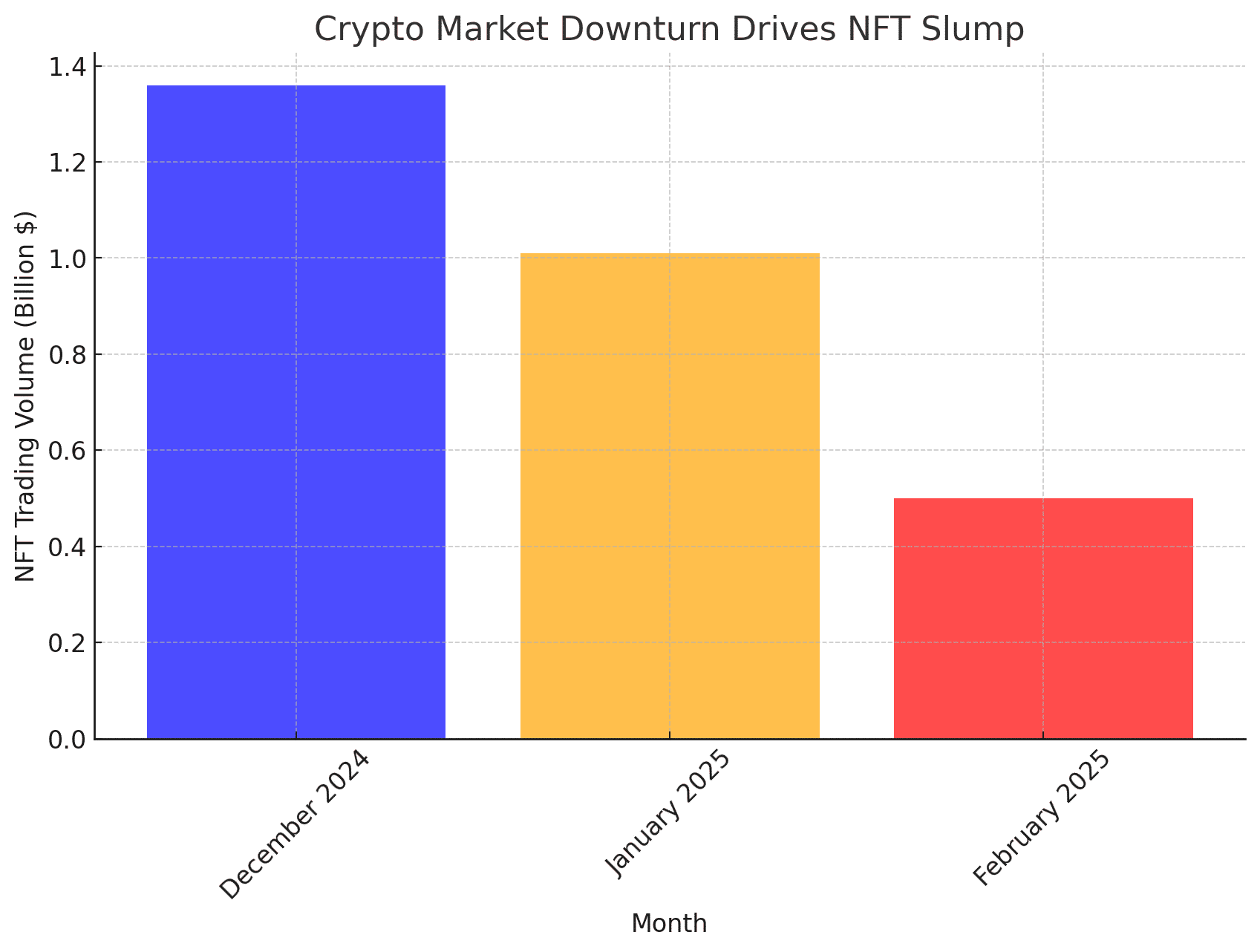

The NFT market is reeling from a severe liquidity crunch, with trading volumes plunging over 60% in February, continuing a decline that started in early 2024. This follows a 26% drop in January, reinforcing concerns that NFT speculation is losing steam amid worsening macroeconomic conditions.

According to DappRadar analyst Sara Gherghelas, NFT trading volume peaked at $1.36 billion in December before falling sharply in the first two months of 2025. The downturn aligns with broader cryptocurrency price movements, as Bitcoin (BTC) and other major assets experienced heavy losses following President Donald Trump’s proposed tariffs on key trading partners.

Despite the steep drop in speculative trading, NFT-related activity increased by 6%, suggesting a shift toward AI-powered assets and utility-driven projects. Could this signal a new phase of sustainable growth, or is the NFT hype fading for good?

Crypto Market Downturn Drives NFT Slump

The collapse in NFT trading volumes is closely tied to the crypto market’s turbulent performance. In December, the total crypto market cap hit an all-time high of $3.71 trillion, with Bitcoin surpassing $109,000 in January. However, much of these gains were wiped out by February, with the market reacting negatively to rising economic uncertainty and Trump’s aggressive trade policies.

As a result, speculative trading slowed dramatically, leading to an 8% drop in daily unique active wallets across decentralized applications (dApps). The decline in NFT sales reflects this pullback, as traders opted for less volatile assets in response to the market’s uncertainty.

Key NFT Market Performance Metrics:

- December NFT Trading Volume: $1.36 billion

- January Decline: -26%

- February Drop: -50%

- Total Decline Since December: Over 60%

Despite these declines, profile picture (PFP) NFTs remained dominant, allegedly generating $243 million across 76,385 sales, followed by gaming NFTs with $41 million in trading volume. Meanwhile, sports NFTs saw the highest transaction count, with 659,097 sales worth $7.7 million.

AI-Powered NFTs Gain Momentum as Traditional Speculation Fades

While overall NFT trading volumes tumbled, a new trend is emerging: AI-powered NFTs. According to DappRadar, NFT-related activity bucked the downtrend, rising 6% in February, largely due to growing interest in AI-generated digital assets.

Analysts suggest that NFTs with real-world applications, engagement features, and AI-driven interactivity are now outperforming purely speculative collectibles.

Sara Gherghelas, Blockchain Analyst at DappRadar:

“The increasing integration of artificial intelligence into NFT projects signals a shift toward more dynamic, interactive digital assets with enhanced utility. Speculative trading may fluctuate, but NFTs with strong utility and real-world applications will drive long-term adoption in Web3.”

This shift suggests that NFT adoption isn’t disappearing, it’s evolving. As more projects incorporate AI and decentralized applications, NFT-based assets could become less reliant on speculative trading cycles.

NFT Market Rebounds in 2024, But Still Far from Peak Years

Despite the recent downturn, the NFT market closed 2024 on a relatively positive note, reportedly recording $8.83 billion in total sales; a 1.1% increase from 2023’s $8.7 billion.

However, these figures pale in comparison to the peak years of 2021 and 2022, when NFT sales hit $15.7 billion and $23.7 billion, respectively. The market has since declined by over 60% from those all-time highs, reflecting a broader reset in digital collectibles.

Top NFT Sales by Blockchain in 2024:

- Ethereum (ETH): $3.1 billion

- Bitcoin (BTC): $3.1 billion

- Solana (SOL): $1.4 billion

Ethereum remains the dominant NFT chain, boasting $44.9 billion in all-time sales, with Solana and Bitcoin trailing at $6.1 billion and $4.9 billion, respectively.

Despite the slowdown, the final quarter of 2024 saw a resurgence, with NFT sales climbing 18% in October, followed by a six-month high of $562 million in November and $877 million in December. This suggests that NFT markets are still experiencing cycles of renewed interest, even if overall trading volumes remain below peak levels.

Expert Insights: Will NFTs Recover, or Is the Market in Permanent Decline?

As NFT trading volumes plunged over 60% in February, experts are debating whether this signals the end of speculative hype or the beginning of a more sustainable market shift. While some analysts warn that NFTs are losing mainstream interest, others point to the rise of AI-powered and utility-driven NFTs as evidence that the industry is evolving rather than collapsing.

Kevin Carter, NFT Market Analyst:

“The 60% drop in trading volume is a clear sign that the speculative phase of NFTs is fading. AI-powered and utility-driven NFTs are likely to take the lead moving forward.”

Elaine Murphy, Web3 Strategist:

“The fact that NFT activity increased 6% despite lower volumes suggests shifting user behavior. It’s no longer just about flipping assets—people want engagement and innovation.”

Paul Matthews, Crypto Economist:

“Ethereum and Bitcoin continue to dominate NFT sales, but Solana’s growth shows there’s demand for lower-cost NFT ecosystems. Expect NFT gaming and AI-driven assets to thrive.”

Conclusion: What’s Next for the NFT Market?

The NFT market is undergoing a transformation, moving away from high-frequency speculation toward more sustainable, utility-driven models. The 60% drop in February’s trading volume reflects a shift in trader behavior, with investors becoming more selective about where they place their money.

As AI-powered NFTs gain traction and utility-based projects emerge, the market may enter a new phase of growth—one focused on long-term engagement rather than short-term speculation. However, the broader crypto market remains a key factor, meaning that NFT recovery will likely depend on Bitcoin’s stability and macroeconomic trends.

For now, NFTs are evolving, but whether this signals a new era of growth or an extended cooldown remains to be seen.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why did NFT trading volumes drop over 60% in February?

The decline follows a broader crypto market downturn, with traders shifting focus away from speculative NFT trading to less volatile investments.

2. Are AI-powered NFTs becoming the next big trend?

Yes. AI-powered NFTs gained traction in February, offering more interactive and engaging digital assets, marking a shift toward utility-driven adoption.

3. Will the NFT market recover in 2025?

NFT sales remain far below their 2021-2022 peaks, but a shift toward AI, gaming, and utility-driven NFTs could fuel long-term growth.

4. Which blockchains dominate the NFT market?

Ethereum leads with $44.9B in all-time sales, followed by Solana ($6.1B) and Bitcoin ($4.9B), showing growing multi-chain adoption.

Glossary

NFT (Non-Fungible Token): A unique digital asset stored on a blockchain, often representing artwork, collectibles, or virtual goods.

PFP NFTs: Profile picture NFTs, a category of NFTs used as digital avatars and collectibles.

AI-Powered NFTs: NFTs that integrate artificial intelligence, allowing for interactive or evolving digital assets.

Falling Wedge Pattern: A technical analysis formation indicating a potential bullish breakout.