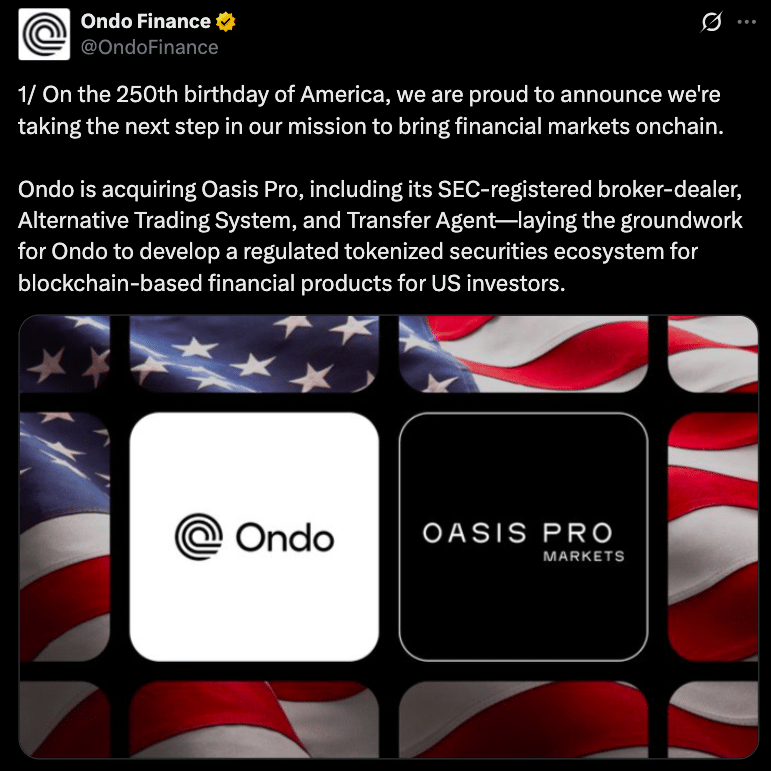

According to the latest industry reports, Ondo Finance, a tokenization company focused on real-world assets (RWAs), announced that it has acquired Oasis Pro, a U.S.-based financial technology company with multiple securities licenses. The deal gives Ondo a broker-dealer registration, an Alternative Trading System (ATS), and transfer agent approval; the three essential regulatory pillars needed to launch and operate compliant tokenized securities in the U.S.

The acquisition will allow Ondo to serve U.S. investors in ways previously impossible due to regulatory constraints. While the deal is still subject to regulatory approval, it’s a big deal for tokenized asset markets seeking to be legitimized under U.S. securities law.

“This unlocks the next major chapter of tokenized finance,” said Nathan Allman, CEO of Ondo Finance. “This acquisition will empower us to realize our vision of building a robust and accessible tokenized financial system, backed by the strongest regulatory foundations.”

Full-Spectrum Acquisition: Broker-Dealer to Transfer Agent

Under the acquisition, Ondo Finance will own three regulated entities that are the operational core of Oasis Pro Markets LLC:

A broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a FINRA member.

An Alternative Trading System (ATS) approved to operate digital asset trading infrastructure.

A registered Transfer Agent (TA) to maintain official ownership records for securities on-chain.

These will allow Ondo to issue, trade and service tokenized securities with full regulatory support, a rare feat in the digital asset space.

“We are proud to join forces with Ondo Finance, a true innovator in tokenized finance,” said Pat LaVecchia, CEO of Oasis Pro. “This acquisition combines our brokerage platform and licenses with Ondo’s existing institutional-grade infrastructure and products, a comprehensive foundation for a regulated tokenized securities ecosystem.”

Oasis Pro’s Regulatory History

Founded in 2019, Oasis Pro has been one of the first companies to offer compliant infrastructure for digital securities in the U.S. Its operations are approved by the SEC and FINRA. The company was the first in the U.S. to settle digital securities using both fiat currency and stablecoins, including USDC and DAI.

Oasis Pro has been an active member of FINRA’s Crypto Working Group since 2020 and has helped develop securities compliance frameworks for tokenized products. These will now be part of Ondo’s foundation.

Market Context: Tokenization’s Long-Term Growth Projections

Tokenized assets; digital representations of traditional securities or commodities; are one of the most exciting applications of blockchain. According to a joint report by Boston Consulting Group and Ripple, the total value of tokenized real-world assets could reach $18.9 trillion by 2033.

Institutional interest in assets like tokenized bonds, U.S. Treasuries and real estate is growing as blockchain offers faster settlement, transparency and programmable compliance.

Ondo has already gone global with its tokenized products OUSG (U.S. Treasury notes) and USDY (yield-bearing stablecoins) with over $1.4 billion in assets under management. These products are currently offered outside the U.S. via our Global Markets platform and the Oasis Pro acquisition now allows us to offer compliant products in the U.S. market.

Future Plans: Building a U.S. Compliant Tokenized Marketplace

Pending regulatory approval, Ondo will use Oasis Pro’s infrastructure to launch a fully compliant U.S. based tokenized securities platform. This will include primary issuance and secondary trading, with an ATS and transfer agent system that can process ownership and settlement entirely on-chain.

Through integration with leading crypto wallets, exchanges, and custody providers, Ondo aims to build a bridge between traditional securities regulation and blockchain-based financial products.

“Pat brings deep experience in the digital asset space, particularly around building regulatory-compliant platforms,” said Nathan Allman, commenting on LaVecchia’s addition to the Ondo team.

Once integrated, Ondo is expected to provide a seamless trading experience for institutional and individual investors looking to get exposure to tokenized U.S. equities, bonds and structured products.

Legal Safeguards and Disclaimers

Ondo has clarified that neither it nor its affiliates have been registered as a broker-dealer or member of FINRA or SIPC. The acquisition of Oasis Pro Markets LLC does not immediately allow Ondo to offer U.S. securities; rather the licenses will be used through the acquired entity once the regulatory process is complete.

Also USDY and OUSG offered on Ondo’s platform are not registered under the U.S. Securities Act of 1933 and are not available to U.S. persons, unless via exemptions. These products are also not SIPC insured as they are not held in a regulated broker-dealer account.

More info on ondo.finance and within its published disclosures.

Conclusion

The acquisition of Oasis Pro is a decisive achievement in the tokenized securities space. By acquiring fully licensed U.S. infrastructure, Ondo Finance is among the first to build a compliant, scalable and blockchain native financial system. With institutional-grade infrastructure, real assets, and a firm regulatory footing, the company is well set and ready to play a leading role in the next phase of tokenization

For Ondo Finance press enquiries, email: [email protected]

Summary

Ondo Finance has acquired Oasis Pro, a SEC-registered broker-dealer, ATS and transfer agent. Ondo now has the regulatory infrastructure to serve US investors, including trading and settlement for digital securities. With over $1.4 billion in assets already under management and a global presence, Ondo Finance is now building a US-based tokenized ecosystem. Deal is pending regulatory approval.

FAQs

What licenses did Ondo get from Oasis Pro?

A broker-dealer, ATS and transfer agent.

Is the deal done?

No, pending regulatory approval.

Will US investors now have access to Ondo’s tokenized products?

Not until regulatory approval and integration through Oasis Pro. Currently, Ondo’s main products are restricted to non-US users.

How much assets does Ondo manage in tokenized assets?

Ondo has over $1.4 billion in assets under management across its tokenized products.

What is the size of the tokenized asset market?

According to BCG and Ripple, tokenized real-world assets could be $18.9 trillion by 2033.

Glossary

ATS (Alternative Trading System): A regulated platform that matches buy and sell orders outside traditional exchanges.

Transfer Agent: A party that manages investor ownership records and handles security transfers.

Broker-Dealer: A firm that buys and sells securities for clients and itself, registered with the SEC.

Tokenized Securities: Traditional financial assets represented digitally on a blockchain.

RWAs (Real-World Assets): Physical or financial assets that are tokenized for blockchain-based access and trading.