Colombian neobank Littio has made a significant move by transitioning from Ethereum vaults to OpenTrade vaults on the Avalanche blockchain. With the infrastructure provided by OpenTrade, Littio will offer savings accounts backed by U.S. Treasury Bonds, allowing users access to secure, dollar-based savings options. This shift marks a pivotal moment for Avalanche (AVAX), an altcoin project that has caught the attention of Turkish investors.

New On-Chain Financial Products in Latin America

Tokenization is unlocking new investment opportunities, particularly in regions like Latin America, where inflation has driven investors toward more stable assets. In 2022, Latin America contributed 9.1% of global crypto value, a 40% increase from 2021. Littio aims to provide dollar-based savings options to the nearly 70% of Latin America’s population that remains unbanked due to strict regulations and disproportionate fees.

With OpenTrade’s Yield Pots, Littio offers users a seamless way to convert pesos into USD Coin (USDC), which can then be saved, transferred, or spent via Littio’s app or bank card. OpenTrade’s B2B2C model also enables businesses to access on-chain products such as U.S. Treasury-backed loans and structured credit. In just four months, Yield Pots have processed over $80 million in transactions, delivering approximately $250,000 in returns to users.

Switching from Ethereum to Avalanche

Littio is shifting its operations from ETH-based vaults to Avalanche to meet increasing regional demand. Avalanche’s EVM compatibility, fast transactions, and low fees make it an attractive option for Littio’s financial inclusion mission. The switch further demonstrates Avalanche’s effectiveness in supporting institutional-level projects.

As reported by The Bit Journal, Ava Labs has been making headlines with its strategic partnerships. Morgan Krupetsky, Head of Institutions and Capital Markets at Ava Labs, expressed excitement over OpenTrade’s RWA-backed yield products, saying:

“Littio and OpenTrade showcase how Avalanche can enable access to compelling products and services for the unbanked population, leveraging traditional rails. I’m excited to see real-world businesses building on the Avalanche platform with OpenTrade’s RWA-backed yield products.”

Avalanche Gains Momentum as Littio Moves from Ethereum to OpenTrade Vaults

In a major milestone for blockchain-powered financial inclusion, Colombian neobank Littio has transitioned from Ethereum-based vaults to OpenTrade vaults on Avalanche, marking a strategic shift that enhances access to U.S. Treasury-backed savings products. This pivot enables Littio users—particularly in Latin America—to convert local currencies into USD Coin (USDC) and access yield-bearing savings accounts secured by U.S. Treasuries.

The move is designed to serve the 70% of the Latin American population that remains unbanked and leverages Avalanche’s speed, cost-efficiency, and EVM compatibility to scale operations. With OpenTrade’s Yield Pots, Littio customers can now invest seamlessly on-chain while businesses gain access to institutional-grade financial products.

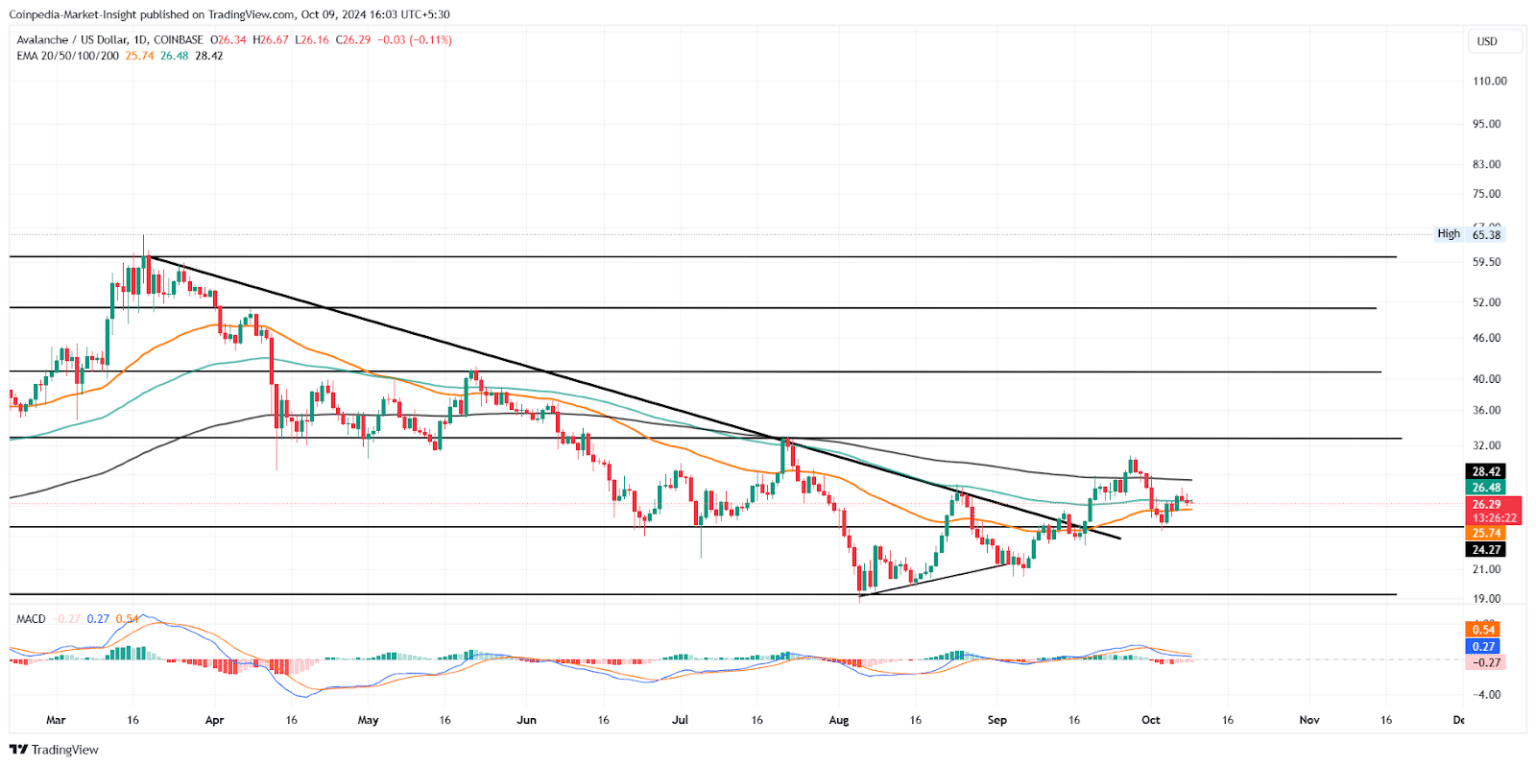

This strategic shift has also reinforced the AVAX token’s price forecast, with technical indicators like MACD and EMA pointing to a potential rally from $24 to $34, should broader market conditions improve. Littio’s transition underscores the growing utility of real-world asset (RWA) tokenization and Avalanche’s rising stature as a decentralized infrastructure for global finance.

AVAX Price Forecast

Crypto analyst Elana R is optimistic about AVAX’s price movement. On the daily chart, a trendline breakout indicates a potential short-term reversal. The altcoin recently surpassed the 50-day EMA and briefly broke above the 200-day EMA before retesting the $24 support level. Should the broader crypto market recover, AVAX could rally from $24 to $34 by the end of the month. The MACD and signal lines, nearing a bullish crossover, further support the potential upside. On the downside, the next support levels are at $19.54 and $17.28.

For more insights into this significant development, follow The Bit Journal for the latest updates.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!