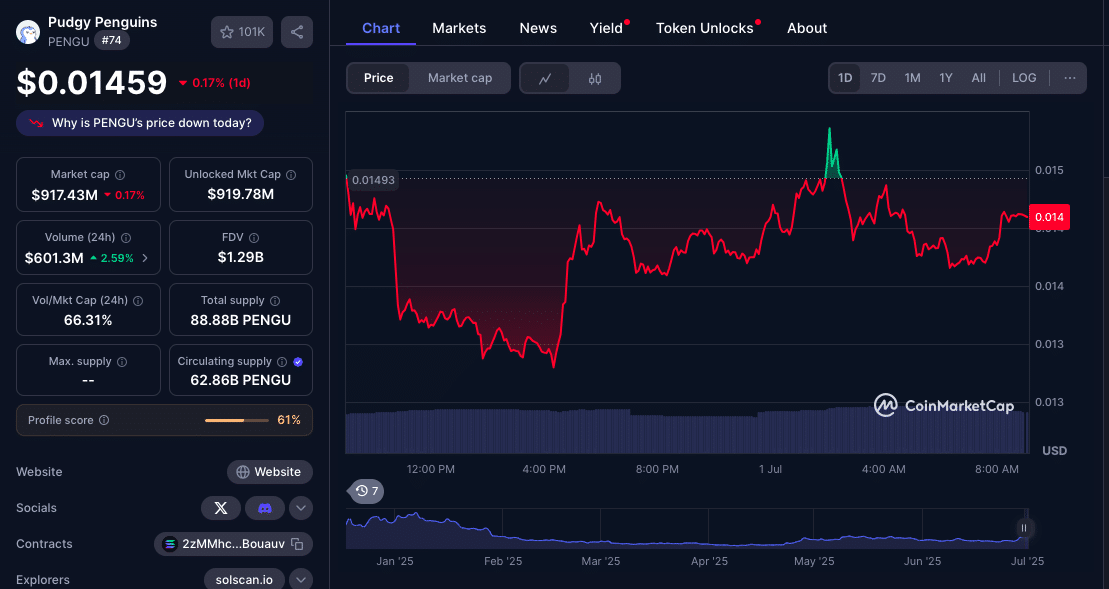

The PENGU price rally has gone against all expectations, going up 48% in 5 days as a combination of bullish catalysts, an ETF filing, whale accumulation and rising NFT sales has brought back investor confidence. The Pudgy Penguins token rebounded from a June 25 low of $0.0095 to hover around $0.014 by July 1, after weeks of sideways movement.

At the time of this writing, PENGU trades at $0.01457, experiencing a little downside as a result of profit taking pressure from the recent highs.

Whale Activity and ETF Filing Ignites the Spark

Momentum behind the PENGU price rally picked up pace after Canary Capital filed a 19b-4 form with the Cboe BZX Exchange, proposing a PENGU ETF. This was the first formal attempt to bring a meme token with NFT ecosystem ties into the institutional space. Although still early days, the filing got everyone talking.

On-chain data also showed significant whale activity. Over a 24 hour period, large holders reportedly bought around 200 million PENGU tokens, worth around $2.4 million at the time. According to Nansen, whale wallets holding over 10 million PENGU increased their total supply by over 11% in a week.

NFT Sales Provide the Fundamental Backing

Beyond speculative flows, fundamentals within the Pudgy Penguins ecosystem also improved. According to CryptoSlam, NFT sales volume was $1.498 million over the last 7 days, a 47% increase. Transaction count was up 41% due to demand for digital collectibles tied to the brand is growing.

Pudgy Penguins was in the top 10 NFT collections globally for the week, which is great for the token’s long-term value proposition. Analysts believe rising activity in the NFT space often precedes or parallels moves in the native token, especially in tightly linked ecosystems like Pudgy Penguins.

Technical Setup

On the charts, the PENGU price rally has not only broken short-term resistance but also created a good setup for continuation. The move above $0.011 left a fair value gap (FVG), a price imbalance that’s often retested in trending markets.

Swing traders are now looking for a pullback to the $0.0122-$0.013 area. This zone is the FVG and also overlaps with the long liquidation levels from the latest heatmap analysis. According to Coinglass, over-leveraged longs get absorbed in these zones and create demand-driven bounces.

On-Balance Volume (OBV) just made a new high, confirming accumulation. Chaikin Money Flow (CMF) is +0.1 and Money Flow Index (MFI) is heading towards 80, so momentum is strong and could continue higher.

Market Outlook: Resistance Ahead, But Bulls in Control

Short term indicators are bullish but traders are cautious near $0.0156. This was a top in early May and could pause further upside if profit taking emerges after the ETF hype.

But unless a whale sells or a macro level shakeout, a consolidation above $0.0135 would be a sign of strength. If the ETF narrative continues and NFT metrics keep going up, we could see a move to $0.017 or even $0.02 in the coming weeks.

Key PENGU Metrics from June 25 – July 1

| Metric | Value | Change (%) | Relevance |

| PENGU Price (Low → High) | $0.0095 → $0.0141 | +48.6% | Measures 5-day price rally post-ETF news |

| NFT Sales Volume (7-Day) | $1.498M | +47% | Indicates strong demand for ecosystem collectibles |

| Whale Accumulation (24H) | 200M PENGU | +11% holdings | Suggests conviction from large investors |

| Liquidation Heatmap Support | $0.0122 – $0.013 | — | Zone likely to trigger bullish reaction on retest |

| Next Resistance Level | $0.0156 | — | Short-term ceiling to watch for breakout confirmation |

Conclusion

The current PENGU price rally isn’t just hype. It’s backed by sharp on-chain accumulation, growing NFT sales and broader visibility thanks to the ETF filing. Traders have reasons to be bullish, but also to be cautious. The next few sessions will show if the fair value gap holds as support and if the price can break through $0.0156.

With strong technicals and fundamentals behind it, PENGU might just be looking towards a good breakout in Q3 2025.

Summary

PENGU price rallied 50% in 5 days on ETF optimism, whale accumulation and NFT demand. After rebounding from $0.0095, PENGU cleared $0.011 resistance with $1.5M in NFT sales and 200M tokens bought by whales. The ETF filing by Canary Capital boosted sentiment and OBV, CMF (+0.1), MFI support further upside. Traders eye the $0.012-$0.013 fair value gap for reentry, while $0.0156 resistance could slow gains.

FAQs

Why did PENGU price rally?

ETF news, whale accumulation and surging NFT sales.

What is the Canary PENGU ETF?

A proposed ETF by Canary Capital to give institutional access to the Pudgy Penguins ecosystem, combining NFTs and tokenized assets.

What is a fair value gap (FVG)?

A FVG is a price imbalance left during a move. It’s often revisited, making it a trade setup.

What resistance levels to watch?

$0.0156 is the next level. A confirmed break could take PENGU to $0.017-$0.02

Are whales still buying PENGU?

Whale wallets added 11% to their PENGU holdings in the last week.

Glossary

PENGU Token – The native token of the Pudgy Penguins NFT ecosystem, used for trading, governance and in-game utility.

ETF Filing (19b-4) – A SEC form filed to list an ETF, often a bullish catalyst for the underlying asset.

FVG (Fair Value Gap) – A price imbalance left after a move; often filled before the trend continues.

CMF (Chaikin Money Flow) – A measure of buying vs. selling pressure based on volume and price.

MFI (Money Flow Index) – Combines price and volume to show overbought/oversold conditions; above 50 is bullish.