The frog-themed PEPE meme coin returns powerfully as both the crypto market and PEPE grow stronger together. The boost in PEPE prices shows a new market acceptance that started after PEPE beat past its long-term resistance.

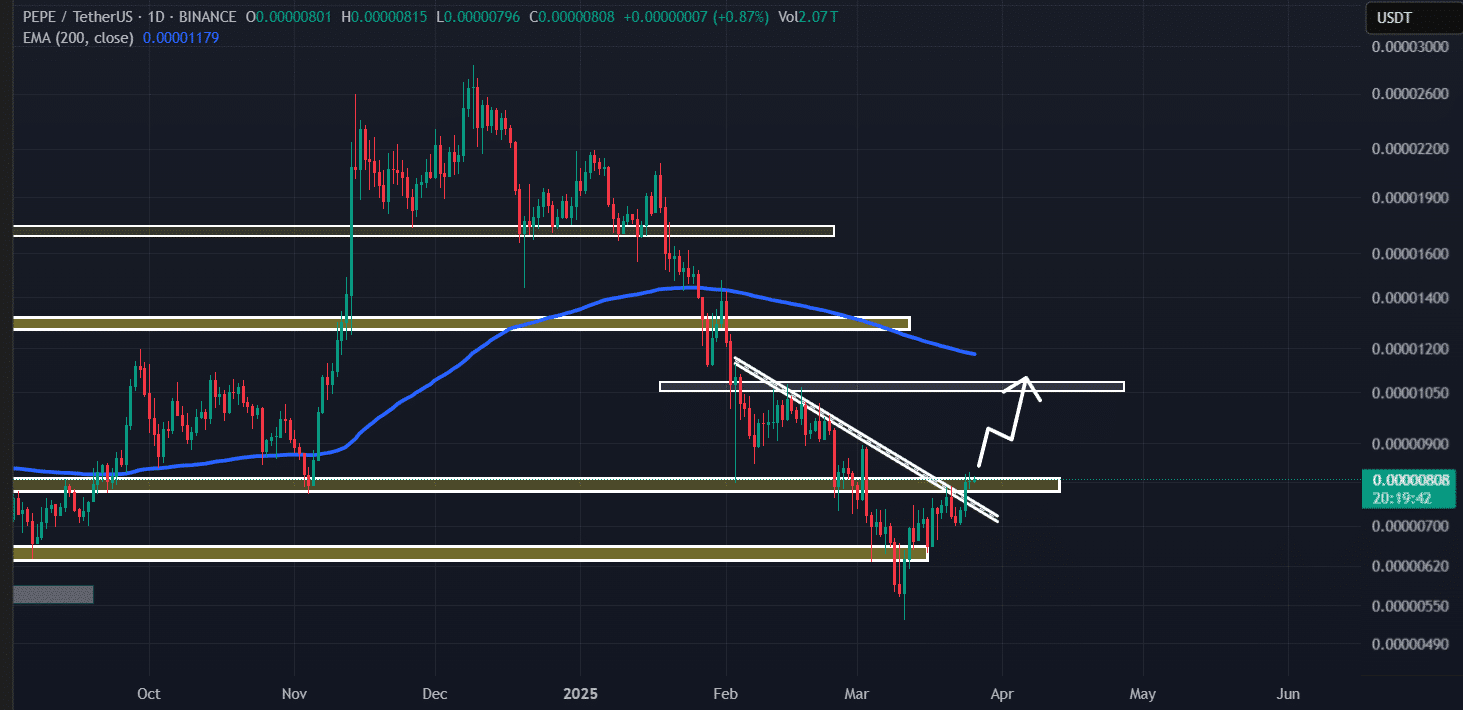

PEPE achieved a notable recent rally because it exceeded resistance set by a downward trendline that has protected the meme coin’s value since the start of February 2025. The market recovery and PEPE breaking through resistance are the main reasons why its price keeps rising.

Technical Indicators Signal More Gains for PEPE

Market analysts predict PEPE will stay in an upward pattern if its price stays above $0.0000080. The meme coin may increase 25% more thanks to its recent gains when market support stays strong.

PEPE shows strong bullish momentum in technical analysis through its 59 Relative Strength Index reading which still has space for more value rises. The processed buying orders show that investors see better days ahead for PEPE’s future value.

PEPE Jumps 11% Despite Declining Trading Volume

During our research PEPE demonstrated an 11% price jump to reach $0.0000087 at this moment. Because fewer traders and investors participated the daily trading volume dropped by 10% even though prices rose strongly.

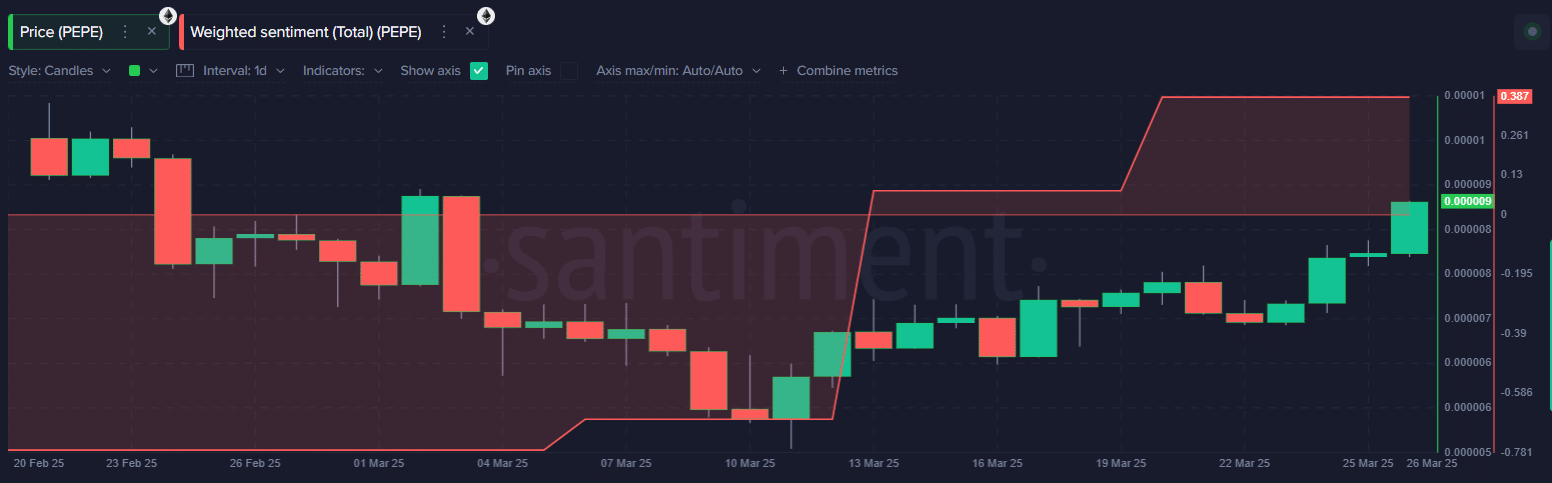

Blockchain analytics firm Santiment reveals that more investors have become long-term holders which supports PEPE’s positive market move. Statistics show PEPE holders are growing their investment position in this memecoin because more people bought tokens between 100,000 and 1,000,000 and between 1,000,000 and 10,000,000 tokens.

Social Sentiment Boosts PEPE’s Market Confidence

The market sees both social dominance and sentiment for PEPE surge beyond standard technical analysis. Since March 1, 2025, traders and investors have shown more confidence in PEPE as their buying sentiment grew from -0.77 to +0.387. The rising positive views on social media push PEPE prices to grow further.

The overall positive trends for PEPE in technical analysis and on-chain measurements show that further upward price movements should continue during the next week.

Investors will track whether PEPE keeps its price momentum as long-term holders support the rally and market sentiment keeps rising. Investors watch PEPE to see if its recent gains will continue as the entire crypto market starts strengthening.

Conclusion

PEPE will continue its upward trend if it keeps its current positive market movement while staying above its important support points. Strong investor optimism combined with the market’s positive outlook and technical market conditions show memecoin PEPE will keep rising. Volume patterns and market dynamics let traders determine if PEPE will keep its rising trend.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Why did PEPE’s price surge?

PEPE broke key resistance and gained 11% amid market recovery.

2. What signals PEPE’s bullish trend?

Its RSI is 59, and holding above $0.0000080 suggests further gains.

3. How has investor sentiment changed?

Sentiment rose from -0.77 to +0.387, showing growing optimism.

4. What could affect PEPE’s price?

Support levels, market sentiment, and trading volume trends.

Glossary of Key Terms

Memecoin – A cryptocurrency based on internet memes, often community-driven.

Bullish – A trend where prices rise, showing strong investor confidence.

Breakout – When a price moves beyond resistance or support levels.

Resistance Level – A price point where an asset struggles to go higher.

RSI (Relative Strength Index) – A tool measuring price momentum; above 50 is bullish.

Long-Term Holders – Investors keeping assets for extended periods.