PEPE, the meme-inspired cryptocurrency, has taken the crypto world by storm with a staggering 43.80% PEPE price rally over the past month. This impressive surge has triggered a spike in investor FOMO (fear of missing out), with early investors seeing substantial gains.

As of press time, PEPE’s price stands at $0.00001301, reflecting a 9.73% drop in the past 24 hours. However, despite the short-term dip, PEPE continues to stand out in a market characterized by profit-taking and liquidation.

Trump’s Truth Social Post Ignites Bullish Sentiment for PEPE

A key event that has stirred excitement within the meme coin community was the unexpected appearance of PEPE’s iconic frog mascot in a post by U.S. President Donald Trump on Truth Social. This image sparked bullish sentiment, driving further interest in PEPE’s potential.

As a result, PEPE’s Open Interest surged by 9.81%. This increase reflects growing investor confidence in the token’s potential. In addition, trading volume jumped by 31.8%, with more than $2.7 million worth of PEPE trades taking place in just 24 hours. This spike indicates heightened market activity and strong interest in the coin.

Overview of PEPE’s Price Movements

PEPE price journey from a meme-based token to a top contender in the memecoin space has been largely fueled by viral content and celebrity endorsements. In December 2024, Elon Musk’s brief use of a PEPE-themed image as his profile picture sent the coin to an all-time high of $0.00002825. Since then, PEPE has remained a subject of speculation, with many wondering if the coin could surpass Dogecoin as the leading meme coin.

The price of PEPE price has been shaped by a combination of celebrity-driven momentum and investor sentiment, both of which have contributed to its recent price surge. The coin’s price and trading volume are largely influenced by the attention it garners on social media platforms and from high-profile figures.

Can PEPE Reach 1 Cent?

The idea of PEPE price reaching $0.01 has captured the imagination of traders. However, analysts warn that such a price target would be incredibly challenging given the coin’s current market cap of approximately $5.9 billion and its circulating supply of 420.69 trillion tokens. For PEPE to reach 1 cent, it would need to surge by about 715,000%, pushing its market cap to around $4.21 trillion. This would surpass the valuations of global giants like Apple and NVIDIA, making it a highly improbable scenario in the near future.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| May | $0.0000130 | $0.0000138 | $0.0000145 | -99.1% |

| June | $0.0000110 | $0.0000116 | $0.0000122 | -99.3% |

| July | $0.0000102 | $0.0000108 | $0.0000114 | -99.3% |

| August | $0.0000104 | $0.0000107 | $0.0000109 | -99.4% |

| September | $0.0000102 | $0.0000105 | $0.0000107 | -99.4% |

| October | $0.0000104 | $0.0000108 | $0.0000112 | -99.3% |

| November | $0.0000106 | $0.0000109 | $0.0000112 | -99.3% |

| December | $0.0000105 | $0.0000108 | $0.0000110 | -99.4% |

The sheer size of PEPE’s circulating supply presents a significant barrier to achieving such lofty price targets. With trillions of tokens in circulation, even massive price increases would result in a market cap that exceeds the total value of the world’s largest economies. This makes PEPE price future price potential more speculative, with many analysts suggesting that its growth may face limitations due to supply constraints.

Current Market Sentiment and Investor Interest

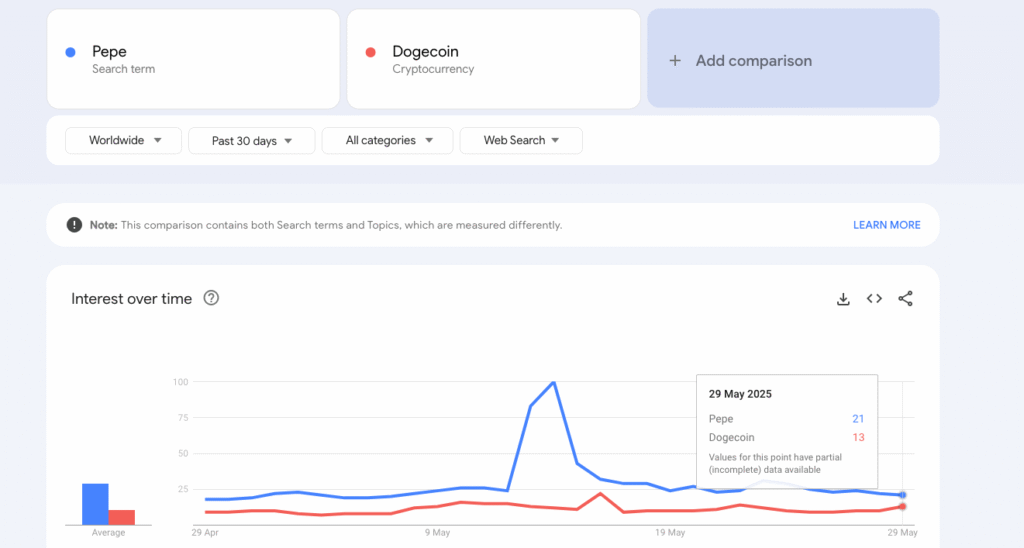

PEPE’s growing market presence is also reflected in rising search interest. Despite a drop from its peak search interest score of 100 on May 14, PEPE’s current index stands at 21, which is still higher than that of Dogecoin, despite Dogecoin’s market cap exceeding $32 billion. This continued interest suggests that PEPE price could continue to dominate the meme coin space if it maintains momentum.

Moreover, PEPE’s Weighted Funding Rate has remained positive for nine consecutive days, indicating strong bullish sentiment. This suggests that more traders are betting on the PEPE price to continue rising, reinforcing the growing interest and confidence in the token’s future.

Technical Analysis: PEPE Price Outlook

PEPE’s price is forming a bullish double bottom structure, indicating potential for a significant price increase. Analysts have set price targets of $0.00001872 and $0.00002745 in the coming weeks. A pullback to the golden zone (0.618 Fibonacci level) could present an ideal buying opportunity for investors looking to capitalize on PEPE’s continued upward momentum.

The key support zone for PEPE lies between $0.00001120 and $0.00001200. This range marks a recent breakout level that has been successfully defended by bulls, signaling that the coin may be poised for further growth.

Conclusion

While PEPE’s short-term price fluctuations are significant, the coin’s long-term viability remains uncertain. The increasing investor interest, coupled with rising search activity, indicates that PEPE price could continue to thrive within the meme coin market.

However, its path to higher price targets, such as $0.01, faces substantial obstacles due to its massive circulating supply and the speculative nature of meme coins. As always, investors should proceed with caution, understanding the inherent risks associated with investing in highly volatile assets like PEPE.

Frequently Asked Questions (FAQ)

1- What is PEPE coin?

PEPE is a meme coin inspired by the Pepe the Frog meme, which gained popularity within the cryptocurrency community due to its viral nature.

2- Why has PEPE price surged recently?

PEPE’s recent surge is driven by social media hype, celebrity endorsements, and increasing market interest, particularly among meme coin enthusiasts.

3- Can PEPE reach $0.01?

Reaching $0.01 would be a massive challenge for PEPE price, given its huge circulating supply and the market cap required to reach that price.

4- How is PEPE’s market sentiment right now?

PEPE’s market sentiment is bullish, with positive funding rates, increasing search interest, and strong trading volume signaling continued investor confidence.

Appendix: Glossary of Key Terms

PEPE Coin – A meme-inspired cryptocurrency based on the Pepe the Frog meme.

FOMO – Fear of missing out; the anxiety that drives people to invest in trending assets.

Open Interest – The total number of outstanding contracts, such as options or futures, that have not been settled.

Market Capitalization – The total value of a cryptocurrency, calculated by multiplying the current price by its circulating supply.

Bullish Sentiment – Positive market outlook where investors expect the price to rise.

Trading Volume – The total amount of an asset traded during a specific period.

Weighted Funding Rate – The interest rate paid by traders in long positions to those in short positions, indicating market sentiment.

Reference

Crypto News – cryptonews.com