Pepe Coin, born from the internet’s meme-fueled subcultures, has grown into one of the top coins in the crypto space. Pepe’s surprising strength during market turmoil has forced analysts to reevaluate its long-term viability. Questions abound about what could be next. Will Pepe Coin go back to all-time highs, or will investor fatigue and growing competition send it into oblivion?

As meme coin cycles mature, Pepe price prediction becomes more relevant for both speculative investors and long term holders. With on-chain metrics showing whale accumulation and broader crypto sentiment turning bullish, Pepe’s price is back in the spotlight. July’s bounce has given hope back, but analysts are divided; some calling for a steep correction, others a breakout.

Pepe Price Predictions

Bull Case: Meme Coin Mania and On-Chain Support

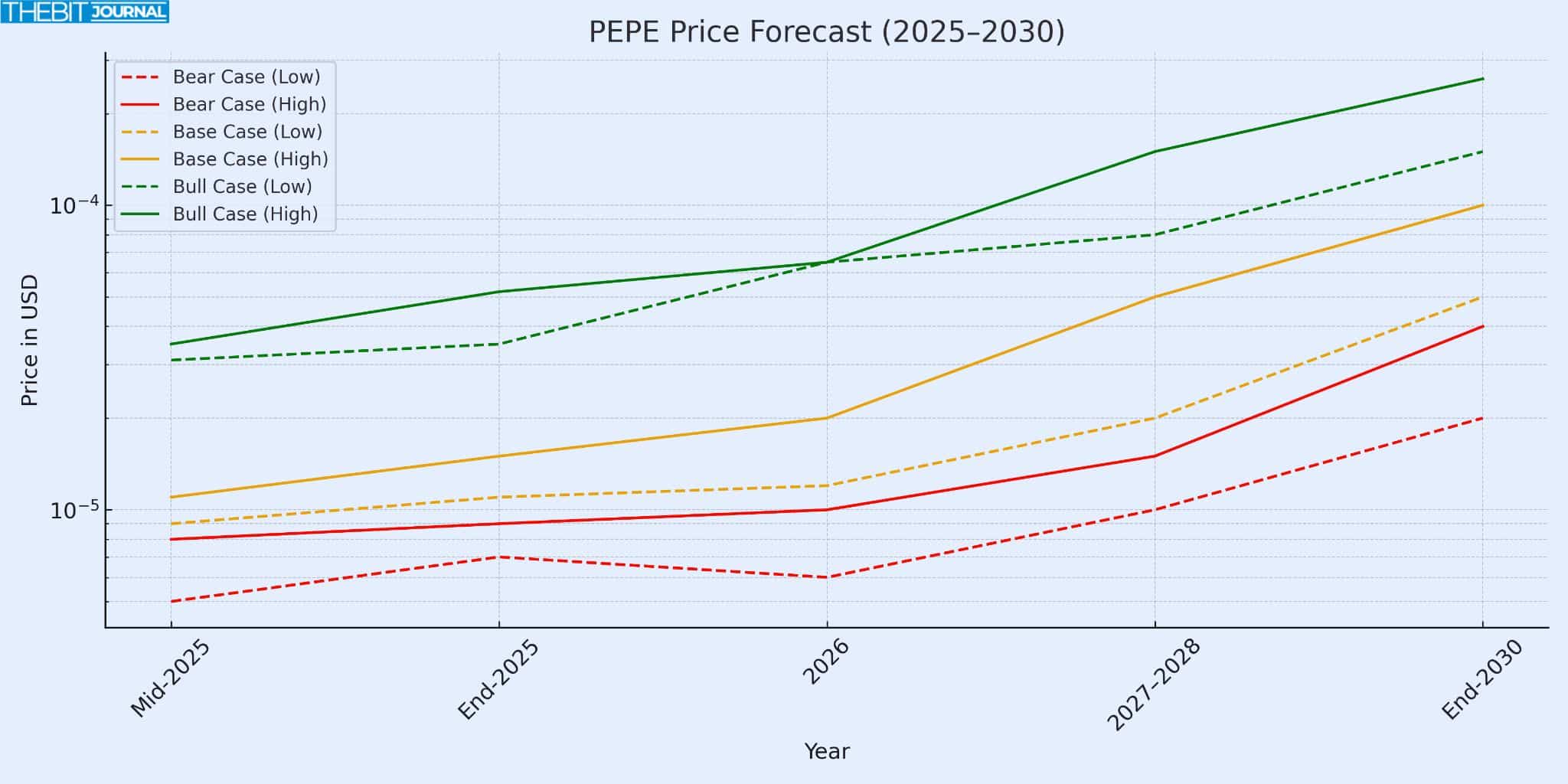

In a bull scenario, PEPE breaks out of the falling wedge, establishes sustained whale accumulation and benefits from renewed retail interest. According to analysts, PEPE could reach $0.0000312 by end of July 2025. This is a 200% increase from current levels.

Extending the timeline; analysts forecast PEPE to $0.000035 in 2025; $0.0084 in 2027, $0.0122 in 2028 and $0.0258 in 2030. This assumes a continuation of meme coin cycles; periodic liquidity injections and PEPE remaining relevant in crypto culture.

Base Case: Sideways Drift with Mild Volatility

Under the base case, PEPE trades in a relatively stable range between $0.000008 and $0.000015 in 2025. Experts for example see July 2025 price at $0.0000094–$0.0000111 . Investors can expect a flat price in mid-2025 at $0.000011. This reflects a natural cooling after the initial meme rush with minor bounces but no big moves.

Bear Case: Extended Correction and Macro Drag

In a less optimistic scenario, PEPE goes back to its recent lows. A drop of 23-25% with PEPE at $0.000008 is predicted in mid-July 2025 . This is the same trajectory as other meme tokens post peak. Weak macro conditions; a hawkish Federal Reserve, reduced crypto appetite or waning meme mania; could extend the correction and keep PEPE between $0.000005–$0.000008 in 2026.

Long-Term Bull vs Bear

Bull: PEPE reclaims the meme coin dominance, hits new highs by 2027–2030. This requires network effects, new hype and good crypto market.

Bear: PEPE stagnates after its 2024 peak. Without momentum it consolidates in a narrow range, while macro trends and competition kill the upside.

Price Forecast Table (2025–2030)

Here’s a consolidated forecast based on analysis:

| Year | Bear Case Low | Base Case Avg | Bull Case High |

| Mid-2025 | $0.000005–0.000008 | $0.000009–$0.000011 | $0.000031–$0.000035 |

| End-2025 | $0.000007–$0.000009 | $0.000011–$0.000015 | $0.000035–$0.000052 |

| 2026 | $0.000006–$0.000010 | $0.000012–$0.000020 | $0.000065 |

| 2027–2028 | $0.000010–$0.000015 | $0.000020–$0.000050 | $0.00008–$0.00015 |

| End-2030 | $0.000020–$0.000040 | $0.000050–$0.000100 | $0.00015–$0.00026 |

Expert Forecasts Set the Range

Coindesk analysts see an upside to $0.000035 by end of 2025, in the long term, they predict a move to $0.0258 by 2030. CoinCodex projects 227% to $0.0000232. Telegaon and CoinPedia are aligned at $0.000028–$0.000036 by end of 2025.

Analytical models diverge on growth speed but converge on framing Pepe price prediction within 2025’s upper nybbles of $0.00002–$0.000036.

Key Drivers of Pepe Price Prediction

On-Chain Metrics & Whale Behavior tend to affect Pepe price. Sustained accumulation and falling balances are the signs of buildup. Meme coins have euphoric cycles followed by sharp retracements and PEPE’s past is a perfect example of that.

Crypto friendly regulation and global liquidity can fuel the bull run; while restrictive monetary policy can kill it. Additionally, meme relevance is dependent on community engagement. Big narrative shifts like anew meme narrative, can trigger new rallies.

Layer-2 memes like Little Pepe (LILPEPE) could also siphon users and liquidity from PEPE.

Conclusion

The long term Pepe price prediction is a tightrope between speculation and structural risk. In the bullish scenario; PEPE is seen to go up several hundred percent, driven by meme cycles and social attention. In the Bear scenario, PEPE sees another phase of price correction, capped upside and sideways drifts. Neutral conditions offer range bound stability.

PEPE is at a juncture, its future will be determined by how it stays relevant, attracts whales and navigates macro factors. Given the meme coin environment; volatility is high, hence traders and investors are advised to manage risk and enter carefully.

Summary

Long-term Pepe price prediction goes three ways: bullish ($0.000035 by mid-2025, $0.00015–$0.00026 by 2030); base-case stability of $0.000009–$0.000020; or bearish collapse of $0.000005–$0.000008. Bull cases rely on meme resurgence, macro liquidity and whale accumulation. Bears hinge on cooling hype, competition and macro headwinds.

FAQs

Why does Pepe price prediction have such wide price ranges?

Meme coins are volatile. Outcomes depend on sentiment cycles; macroeconomic influence, whale behavior and cultural relevance.

Is hitting $0.00003 in 2025 realistic?

Multiple analysts forecast $0.000028–$0.000036; assuming supportive market dynamics and meme cycles.

Could PEPE reach $0.0258?

Analysts suggests this by 2030 in bull scenarios. It represents exponential growth, requiring sustained momentum and favorable crypto trends.

How does PEPE compare with newcomers like Little Pepe?

PEPE has an established community but Layer-2 innovations like Little Pepe could divert attention and capital, dampening PEPE’s upside.

Glossary

Falling Wedge: Bullish technical reversal pattern.

Whale Accumulation: Large holders buying tokens, often before rallies.

Meme Cycle: Hype and collapse patterns in meme assets.

Macro Liquidity: Overall capital availability impacting risk assets.

Layer-2 Meme Tokens: Meme coins built on scalable blockchain extensions.