PEPE is at a critical juncture, with market sentiment and whale activity creating volatility. Despite a significant sell-off by a whale, the meme coin has shown notable price resilience. It remains uncertain whether a sharp decline or a potential rebound is ahead.

Whale Sell-Off Triggers Market Concerns

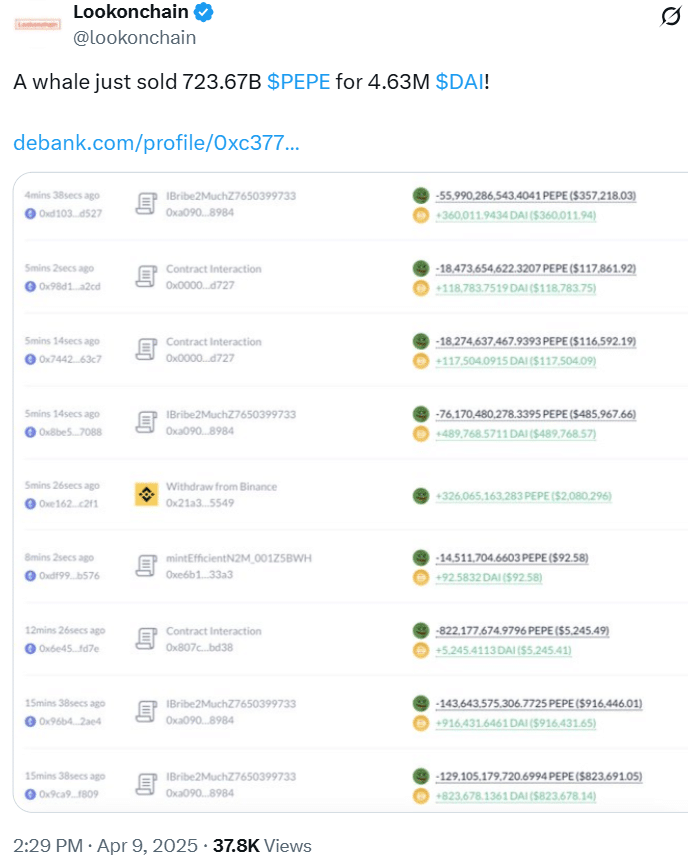

Recent on-chain data from blockchain tracking platform Lookonchain revealed a concerning event for PEPE holders: a crypto whale sold a staggering 723.67 billion PEPE tokens for 4.63 million DAI. This massive sell-off could have triggered widespread market anxiety, yet, surprisingly, PEPE’s price remained stable, even gaining 2.25% in value.

However, market experts warn that this stability could be short-lived. The sell-off volume and the resulting downward pressure from whales might spark an increase in selling activity, potentially leading to a major price correction. With the token trading near $0.000006720 at the time of writing, investors are closely monitoring its movements.

PEPE’s Price Action

Despite the large-scale sell-off, PEPE’s daily chart presents a curious pattern of recovery. A closer look reveals that the memecoin is forming a bullish double-bottom pattern on the daily timeframe. Although this pattern is not yet fully formed, it shows a potential price reversal. The two bottoms at the $0.0000058 support level signal that token could be on the cusp of a rebound.

Historically, the $0.0000058 price level has acted as a strong support zone, offering PEPE a chance for a price bounce each time it reaches this threshold. If history repeats itself, coin could see a significant price surge of up to 40%, potentially reaching the $0.0000089 mark.

What Could Trigger a Price Decline?

On the flip side, if PEPE fails to hold its support level, if the price dips below $0.0000056, the meme coin could be in for a steep decline, with some predicting a 33% drop to the next support level at $0.00000368.

These warning signs are underpinned by lower trading volumes, which have dropped by 6.50% in the past 24 hours. A reduction in trader participation signals a lack of confidence among investors, which could exacerbate the bearish outlook.

Whale Activity and its Influence on Market Sentiment

Whale activity remains a significant factor influencing the direction of the coin’s price. Blockchain analytics firm Coinglass has reported that intraday traders appear to be closely tracking the movements of these whales, betting on the potential for a price decline.

Over the last 24 hours, traders have placed substantial long and short positions based on key price levels. With $1.76 million worth of long positions built at the support level of $0.00000618 and $2.85 million in short positions at $0.00000655, the market sentiment is tilting toward a bearish trend.

The Role of Over-Leverage in PEPE’s Future

The presence of over-leveraged positions indicates that traders are heavily relying on short-term price movements. This heightened leverage could lead to volatile swings in PEPE’s value, with short sellers poised to take advantage of any potential breakdown below the key support levels. Should PEPE fail to hold its ground at critical price points, the next few days could see further downward pressure, especially if the sell-off intensifies.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Mar 2025 | $ 0.000007657 | $ 0.00001538 | $ 0.00002578 | 285.05% |

| Apr 2025 | $ 0.00002347 | $ 0.00003020 | $ 0.00003582 | 434.93% |

| May 2025 | $ 0.00001887 | $ 0.00002290 | $ 0.00002811 | 319.88% |

| Jun 2025 | $ 0.00002580 | $ 0.00002736 | $ 0.00003050 | 355.59% |

| Jul 2025 | $ 0.00001995 | $ 0.00002442 | $ 0.00002758 | 311.88% |

| Aug 2025 | $ 0.00001669 | $ 0.00001928 | $ 0.00002143 | 220.04% |

| Sep 2025 | $ 0.00001688 | $ 0.00001933 | $ 0.00002039 | 204.51% |

| Oct 2025 | $ 0.00001298 | $ 0.00001465 | $ 0.00001640 | 144.88% |

| Nov 2025 | $ 0.00001379 | $ 0.00001479 | $ 0.00001605 | 139.66% |

| Dec 2025 | $ 0.00001413 | $ 0.00001417 | $ 0.00001421 | 112.27% |

Market Outlook: What Does the Future Hold for PEPE?

As PEPE continues to navigate the crypto landscape, its future remains uncertain. The memecoin’s recent price rally, combined with the potential for significant sell-offs, creates a delicate balance for investors.

Traders must remain vigilant, closely tracking price movements and adjusting their strategies based on the evolving market conditions. If PEPE can maintain its key support level and avoid a breakdown, a potential rebound is certainly within the realm of possibility. However, a failure to hold these levels could lead to a more significant decline in the near term.

Conclusion

Despite recent sell-offs by crypto whales, PEPE has shown resilience, maintaining a stable price. The potential formation of a bullish pattern offers hope, though whale activity and bearish sentiment remain significant concerns. If the coin holds its key support levels, a rebound could lead to substantial gains.

However, failure to do so could result in a sharp decline. Investors should stay vigilant to market trends and whale movements, as these will be key in determining whether token continues its upward momentum or faces further downward pressure. The coming days will be crucial in shaping its price direction.

Frequently Asked Questions (FAQs)

1: Why did PEPE’s price remain stable after the massive whale sell-off?

Despite the sell-off, PEPE’s price showed resilience, maintaining stability and even gaining 2.25%.

2: What could happen if PEPE breaks its support level?

A breakdown below the support level of $0.0000056 could trigger a 33% decline, reaching the next support at $0.00000368.

3: How does whale activity affect PEPE’s price?

Whale activity can exert significant pressure on PEPE’s price, influencing market sentiment and potential price movements.

4: Is PEPE likely to experience a rebound?

If PEPE holds its key support levels, a rebound is possible, with the potential for a 40% surge in price.

Appendix: Glossary of Key Terms

Memecoin – A type of cryptocurrency primarily created for fun or as a joke, often gaining popularity through social media or viral trends.

Whale – A term used to describe individuals or entities that hold large amounts of cryptocurrency, capable of influencing market movements.

Sell-Off – The rapid sale of assets, often triggered by market sentiment or large investors, which can lead to price declines.

Support Level – A price level at which an asset tends to find buying interest, preventing further price declines.

Price Rebound – A recovery in the price of an asset after a period of decline, often driven by renewed buying activity.

Over-Leverage – The use of borrowed funds to increase the potential return on an investment, which can increase risk during market volatility.

References

AMB Crypto – ambcrypto.com

CoinGlass – coinglass.com

CoinMarketCap – coinmarketcap.com

TradingView – tradingview.com