The Pi Network (PI) is under intense market pressure as its price slips below the critical $1 level. Fueling this decline, crypto analyst Justin Bons labeled the project a “potential scam,” sparking concerns and further eroding investor trust. Despite minor technical recoveries, the overall sentiment remains bearish, and indicators suggest more turbulence may lie ahead.

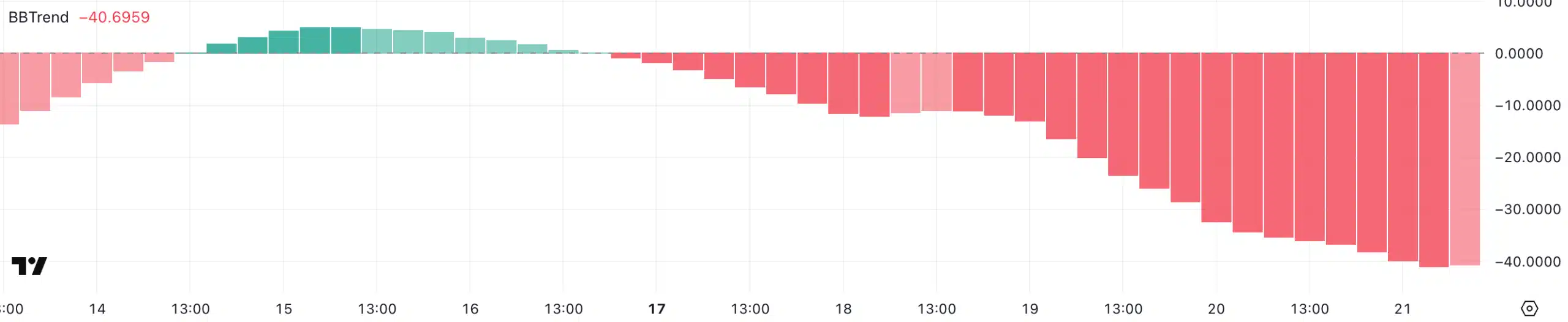

BBTrend Signals Strong Downtrend

The Bollinger Band Trend (BBTrend) indicator has plummeted to an all-time low of -40.69, signaling a deepening bearish momentum for Pi Network. BBTrend values below zero typically point to persistent downtrends, and in this case, it has remained negative for the past five consecutive days.

This continued negative pressure suggests a sustained lack of buying interest, making a short-term recovery less likely. If the current trajectory holds, the PI token could face further declines in the coming days.

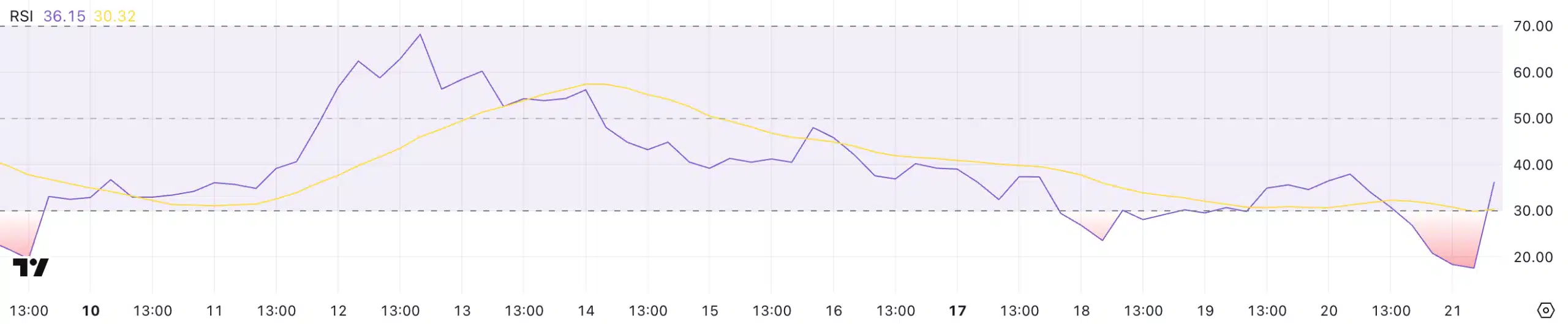

RSI Offers Hope—But Not Enough

The Relative Strength Index (RSI) for PI recently bounced from a heavily oversold zone at 17.5 to 36.15, providing a brief moment of relief for holders. However, the current RSI level remains in bearish territory, well below the neutral 50 mark.

Unless RSI continues to rise toward 50 or higher, any upward momentum may prove short-lived. The market still lacks the strength needed to support a solid reversal.

Will PI Slide Below $0.90?

After breaching the $1 threshold, PI is now hovering near $0.90—a critical support level. A break below this point could trigger a sharper correction, with the next major support areas lying at $0.81 and $0.62.

On the flip side, any meaningful rebound would first need to overcome resistance at $1.23. A sustained move above that could open the path to $1.79, but such a rally would likely require a significant shift in investor sentiment and confidence—something currently in short supply.

Investor Trust on Thin Ice

Justin Bons’ accusations against Pi Network sparked major backlash across social media, deeply impacting investor perception. As fear and doubt spread, buying activity has remained weak and sporadic.

Most market participants are adopting a wait-and-see approach, and current price bounces have been driven by low-volume trades—further underlining the fragile state of market confidence.

In this environment, a strong statement or strategic move from the Pi Network development team may be essential to restoring credibility and calming investor nerves.

Outlook

With technical indicators still flashing red and community sentiment rattled, Pi Network’s road to recovery appears steep. The Bit Journal will continue monitoring developments closely, as any shift in the narrative—or unexpected announcement—could reshape PI’s near-term trajectory.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!