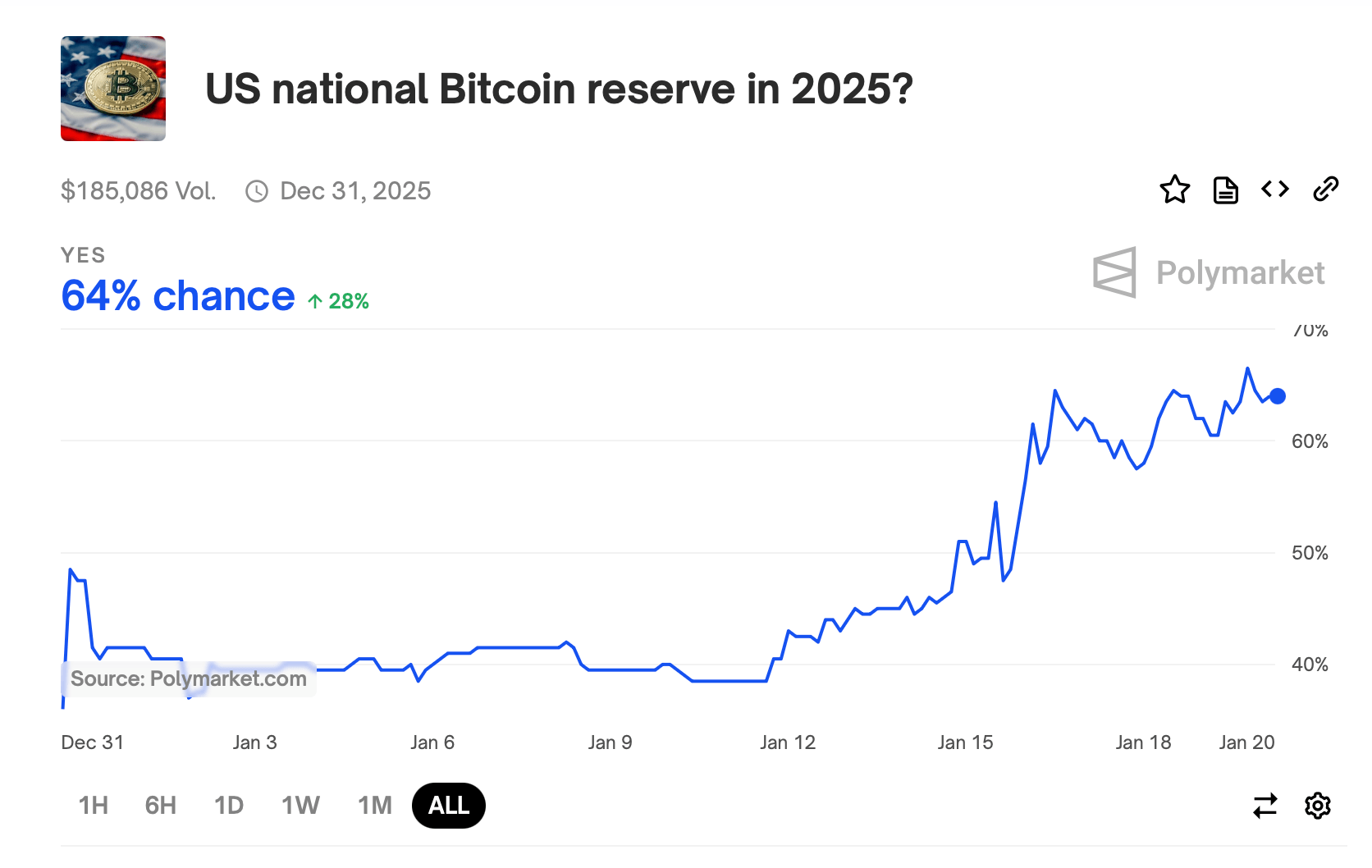

Polymarket bettors now place the probability of the United States creating a national Bitcoin reserve by the end of 2025 after today’s inauguration of Donald Trump at 64%.

A U.S. bitcoin reserve is a hot topic these days, with proponents pushing the idea that it could solidify the country’s dominance in digital finance. The proposal, championed under the BITCOIN Act introduced this year by Senator Cynthia Lummis, sets out plans for the federal government to accrue up to one million bitcoins over a five-year period.

Prediction Markets Show Growing Optimism for a U.S. Bitcoin Reserve

The strategy for acquiring bitcoin involves seizing BTC and other resources in order to diversify national assets, hedge against inflation, and fight for a role as the global reserve currency for the U.S. dollar.

The initiative is gaining increasing confidence in prediction markets. Many of the odds on Polymarket that have been placed on the proposal’s success on that market have risen from below 50% earlier this month to 64% due to optimism for the Trump administration’s pro-cryptocurrency bent.

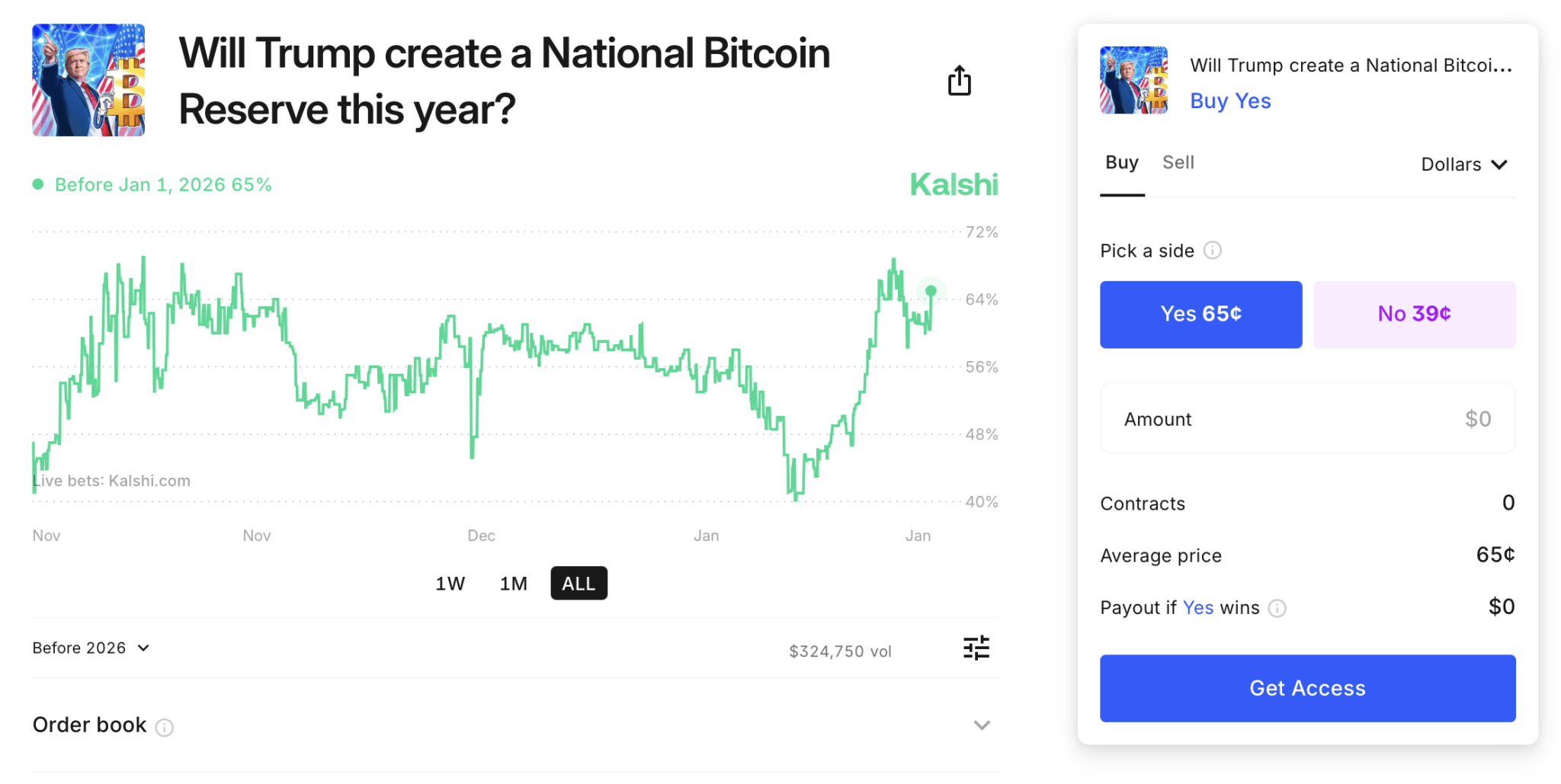

The other prediction platform, Kalshi, also puts a high confidence value on the BTC reserve, although it estimates a 65% chance of the reserve showing up. The lead up to the inauguration has been dominated by policy conversation focused on digital asset adoption and financial innovation, and it is a theme that the administration has focused on.

Although support is growing, there are still critics. Bitcoin’s infamous volatility, the organizational difficulties associated with managing such a reserve, and the inherent tension to cryptocurrency’s devalued premise are all claimed by the opponents.

Digital Yuan vs. Bitcoin Reserve: The U.S. Response to Global Pressure

Economic considerations have, similarly, been raised, indicating apprehensions about whether cash can be taken from gold stocks or Federal Reserve surpluses without imbalance in numerous economic structures.

A U.S. BTC reserve would mirror a growing global trend of governments trialing digital asset integration. For instance, China is well ahead of the game on digital yuan, and this is putting added pressure on U.S. policymakers to do something quickly.

With the proposal likely to have big implications for the global financial system and the role of cryptocurrencies in the U.S. national strategy to come, prediction markets such as Polymarket and Kalshi are still a decent predictor of public sentiment.

Conclusion

A U.S. bitcoin reserve could transform global finance and catapult the country into the forefront of digital finance. Even so, prediction markets are increasingly confident, but volatility and economic impacts have yet to be ironed out. The U.S. is widely pressured to strengthen its role in this disruptive space as governments worldwide sell for digital assets.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

- What is the U.S. Bitcoin Reserve proposal?

It’s a plan to acquire up to one million bitcoins over five years to diversify assets, hedge inflation, and support the U.S. dollar as a global reserve currency. - Why are prediction markets optimistic?

Polymarket and Kalshi show 64%-65% confidence, citing the Trump administration’s pro-crypto policies and focus on financial innovation. - What are the main criticisms?

Concerns include bitcoin’s volatility, management challenges, and potential economic risks from reallocating resources like gold reserves. - How does this compare globally?

The proposal reflects a global trend, with nations like China advancing digital currencies like the digital yuan.