The US House of Representatives failed to garner sufficient support to overturn President Joe Biden’s veto of a resolution that impacts a Securities and Exchange Commission rule regarding banks’ treatment of cryptocurrency as a liability on their balance sheets.

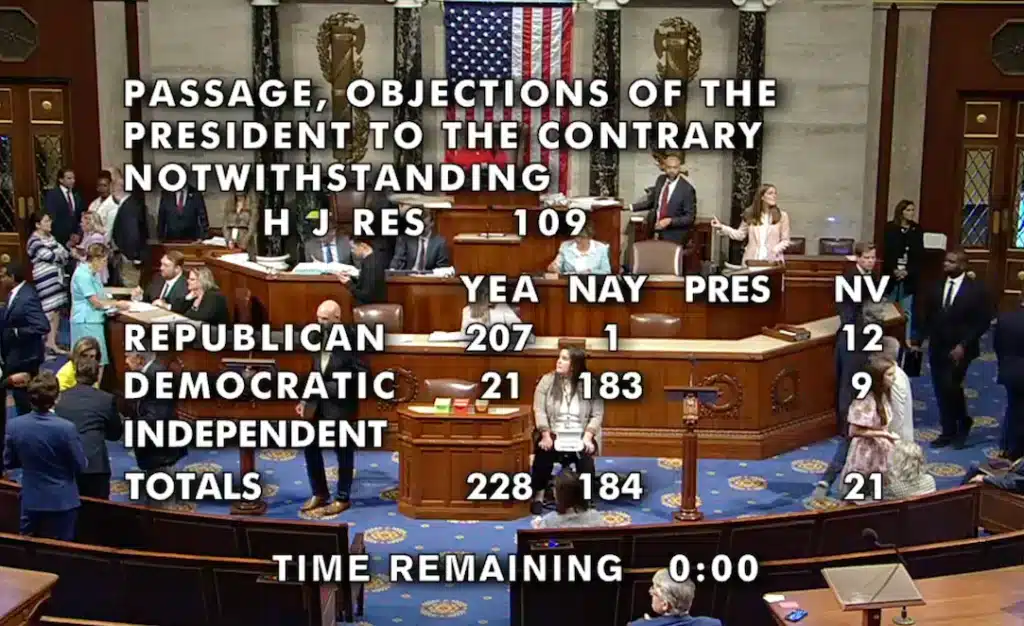

House members voted to override President Biden’s veto of H.J.Res. 109, which resulted in the overturning of SEC Staff Accounting Bulletin (SAB) No. 121. However, the vote fell short by 60 votes, which required a two-thirds majority. Based on the outcome of the vote, it seems that the veto will likely remain in place. This means that US banks may face restrictions in their ability to serve as crypto custodians for their customers unless there are changes in future legislation.

“It did not have to be this way,” Representative Patrick McHenry stated on July 10 before a potential vote. “On digital assets, on the regulation of digital assets, on the functioning of a new asset class that a substantial number of Americans and the world are using. […] The Biden administration has been given every opportunity to work with this Congress on digital asset policy and to come to a reasonable resolution on digital asset policy.”

“The crypto industry and its allies have long chided the SEC for not providing enough clarity for how crypto assets should be regulated,” said Representative Maxine Waters, quoting opposition to SAB 121. “It’s just that the industry didn’t like the answer they got.”

In a surprising turn of events, President Biden made it clear that he would veto H.J.Res. 109, mere hours before it successfully passed in the House. This bill received support from 21 Democratic representatives, resulting in a vote of 228 to 182. The Senate mirrored the House’s actions, with a vote of 60 to 38 in favour of the resolution on May 16. The US president vetoed the legislation on May 31.

Since assuming office in 2021, President Biden has issued 12 vetoes, and Congress has not overridden any of them. In December 2020, the US lawmakers in the House successfully overrode a presidential veto, specifically with the National Defense Authorization Act.

Crypto And Its Impact On Politics

Some individuals in the cryptocurrency community have expressed their disapproval of the Biden administration’s actions regarding legislation that supports the industry, including the joint resolution. In a surprising move, the White House and SEC have both come out strongly against the passage of the Financial Innovation and Technology for the 21st Century (FIT21) Act. This bill aims to provide much-needed clarity on the regulation of digital assets.

The vote came after policymakers, such as Representatives Ro Khanna and Joe Neguse, as well as Biden adviser Anita Dunn, engaged in a roundtable meeting with industry leaders to discuss crypto. Initial reports indicated that President Biden was expected to attend the event, but his July 10 schedule did not include any plans to do so. The CEO of the Crypto Council for Innovation, Sheila Warren, characterized the roundtable as a positive and constructive move towards addressing crypto in a nonpartisan manner.

Can Crypto Regulation Find Common Ground After President Biden’s Veto?

The failure to override President Biden’s veto of H.J.Res. 109 underscores the ongoing complexities and divisions within the U.S. government regarding cryptocurrency regulation. While the Biden administration and the SEC remain firm on maintaining restrictions, proponents of clearer and more accommodating digital asset policies continue to push for change. This vote highlights the need for ongoing dialogue and collaboration between policymakers and industry leaders to navigate the evolving landscape of digital assets. The outcome suggests that future legislative efforts will be crucial in determining the role and regulation of cryptocurrencies in the U.S. financial system.