The cryptocurrency market is showing signs of diverging strength, with Bitcoin consolidating above the $100,000 mark and altcoins enjoying notable rallies.

According to updated CoinMarketCap data as of May 15, 2025, Bitcoin (BTC) is trading at $102,295, maintaining a strong floor around the six-figure mark. Meanwhile, altcoins like Ether, Dogecoin, and Avalanche are demonstrating fresh momentum as risk appetite shifts from BTC to broader assets.

Bitcoin Battles Resistance: Is $130K in Sight?

The Bitcoin price is holding firm at $102,295 as bulls maintain control above the critical $100,000 psychological level. This consolidation phase suggests strength, with whales and institutional investors continuing to accumulate, over 83,000 BTC added in the past 30 days, according to Santiment.

The current price prediction outlook hinges on whether BTC can break the overhead resistance zone between $107,000 and $109,588. A confirmed daily close above this band could trigger a swift ascent toward the $130,000 mark, especially if ETF inflows and favorable macro trends persist.

The price remains above the 20-day EMA ($98,407), reinforcing bullish bias, but caution remains warranted. A breakdown below this support could pull BTC back to the 50-day SMA at $89,952, inviting temporary bearish pressure. Trading volume remains healthy, and RSI is stable, not yet overbought, suggesting the current trend has room to extend.

In summary, the Bitcoin price prediction remains bullish while above $100K. Traders should monitor volume closely near resistance zones and watch for macro catalysts like the U.S. CPI report or interest rate updates, which could tip momentum in either direction.

Ethereum Pauses Below $2,560: A Setup for $3K?

Ether is trading at $2,557.39 and attempting to regain momentum after briefly pushing above $2,550 resistance on May 13. Despite the pullback, the structure remains bullish in the short term. The price prediction outlook favors continuation if ETH can keep stabilizing above $2,550, with potential upside to $3,000 in the coming sessions. Buyers have consistently stepped in near support at $2,400, highlighting strong demand.

The Relative Strength Index is cooling from overbought territory, suggesting that the recent correction may be short-lived. As long as ETH remains above the 20-day EMA at $2,147, bullish sentiment stays intact. A drop below this level, however, could signal broader weakness and potentially invite sellers toward the $2,000 zone.

Fundamentals such as Ethereum staking growth and rising layer-2 activity support the long-term bullish case. Still, short-term traders should remain vigilant for volatility around macro news.

Overall, Ethereum’s price prediction for May favors an upside breakout, with the $2,550–$2,600 area as a launchpad. If momentum returns, $3,000 is within reach. On the downside, a loss of support at $2,147 would challenge bullish control and alter near-term expectations.

XRP Bulls Defend Ground: Is $3 Within Reach?

XRP is holding firm at $2.47, with bulls building strength just beneath key resistance at $2.65. Unlike in previous attempts, sellers have yet to force a major retreat, hinting at a shift in short-term sentiment. The price prediction for XRP improves significantly if buyers can manage a breakout above $2.65. Such a move would likely attract follow-through buying and push the token toward $3.00, with intermediate resistance anticipated between $3.00 and $3.40.

Technical indicators are favourable, with the price maintaining position above the 20-day EMA at $2.32. A drop below this level could flip sentiment bearish and spark a consolidation phase between $2.00 and $2.65. However, RSI remains neutral, leaving room for another leg upward.

XRP’s improving on-chain metrics, combined with its legal clarity and growing adoption in remittance corridors, enhance its upside thesis. If bulls capitalize on the current momentum, XRP could re-test multi-year highs. Yet, traders should watch for heavy selling at $2.65.

In the near term, XRP’s price prediction leans bullish while it holds above $2.32. A breakout confirmation with volume could trigger rapid movement toward $3.00, making this an important week for the altcoin.

BNB Hovers at Resistance: Breakout or Breakdown Ahead?

BNB is currently trading at $652.39, maintaining levels above the key breakout zone of $644. While bulls have successfully defended recent gains, the $675 resistance remains a formidable ceiling. The latest price prediction for BNB hinges on whether buyers can generate enough volume to force a close above this level. If achieved, BNB may rally toward its next major resistance near $745, unlocking fresh upside momentum.

The rising 20-day EMA at $627 and a positive RSI position both favor the bulls. These technical signals suggest strong underlying demand. However, repeated failures to breach $675 could lead to fatigue and trigger a short-term pullback. A drop below the 20-day EMA may signal a deeper correction toward the 50-day SMA at $603.

On-chain metrics show steady accumulation and increased interest from long-term holders, bolstering the bullish narrative. BNB’s utility in the Binance ecosystem and its consistent deflationary model (via quarterly token burns) add to its appeal. BNB’s short-term price prediction remains constructive, with a breakout possible if momentum increases. Traders should closely watch the $675 level, a confirmed close above could send BNB on a path toward $745, while a rejection risks a move back toward $603.

Solana Struggles Below $180: Can Bulls Regain Control?

Solana (SOL) is trading at $170.45 after facing rejection from the $180 resistance zone. The price action reflects hesitation at higher levels, but technicals still support a bullish bias. The 20-day EMA at $159 offers nearby support and has served as a reliable floor in recent weeks. If this level holds, Solana may attempt another leg up toward $180 and, potentially, $210.

Solana’s price prediction for the short term remains cautiously optimistic. A strong rebound off the 20-day EMA would indicate renewed buyer interest and validate the $159 level as firm support. If bulls break $180 convincingly, the next resistance lies near $210, a level aligned with Solana’s prior highs during its March breakout.

Conversely, if SOL fails to hold above the 20-day EMA, the uptrend could be compromised, and the price may revisit $153 or lower. Momentum indicators like RSI are neutral, suggesting traders are waiting for confirmation before initiating new positions. Solana remains one of the top-performing altcoins this year, benefiting from rapid ecosystem development and rising DeFi activity. For now, the Solana price prediction holds a bullish tone as long as $159 remains intact and macro sentiment stays risk-on.

Dogecoin Eyes $0.31 as Bullish Momentum Builds

Dogecoin (DOGE) is trading at $0.2264, and after bouncing off its previous breakout level at $0.21, momentum has started to favor the bulls. The 20-day EMA at $0.20 is rising, and the RSI is creeping into overbought territory, classic signs that a breakout could be imminent. If DOGE can breach the resistance near $0.26, the price prediction favors an extension toward $0.28, with a potential run at $0.31 if sentiment remains strong.

The meme coin continues to show resilience, especially as broader risk assets regain favor. Social sentiment surrounding DOGE has improved in recent weeks, and its role in micro-tipping, payments, and integration in X (formerly Twitter) helps sustain community engagement.

However, if DOGE fails to maintain support at $0.21, the bears could regain control. A break below this level would expose the price to a decline toward the 50-day SMA at $0.17, where long-term buyers may re-enter. Overall, the Dogecoin price prediction remains bullish in the short term as long as the price holds above key supports. A sustained move above $0.26 would likely accelerate upside momentum and put DOGE on track for another rally, potentially testing multi-month highs.

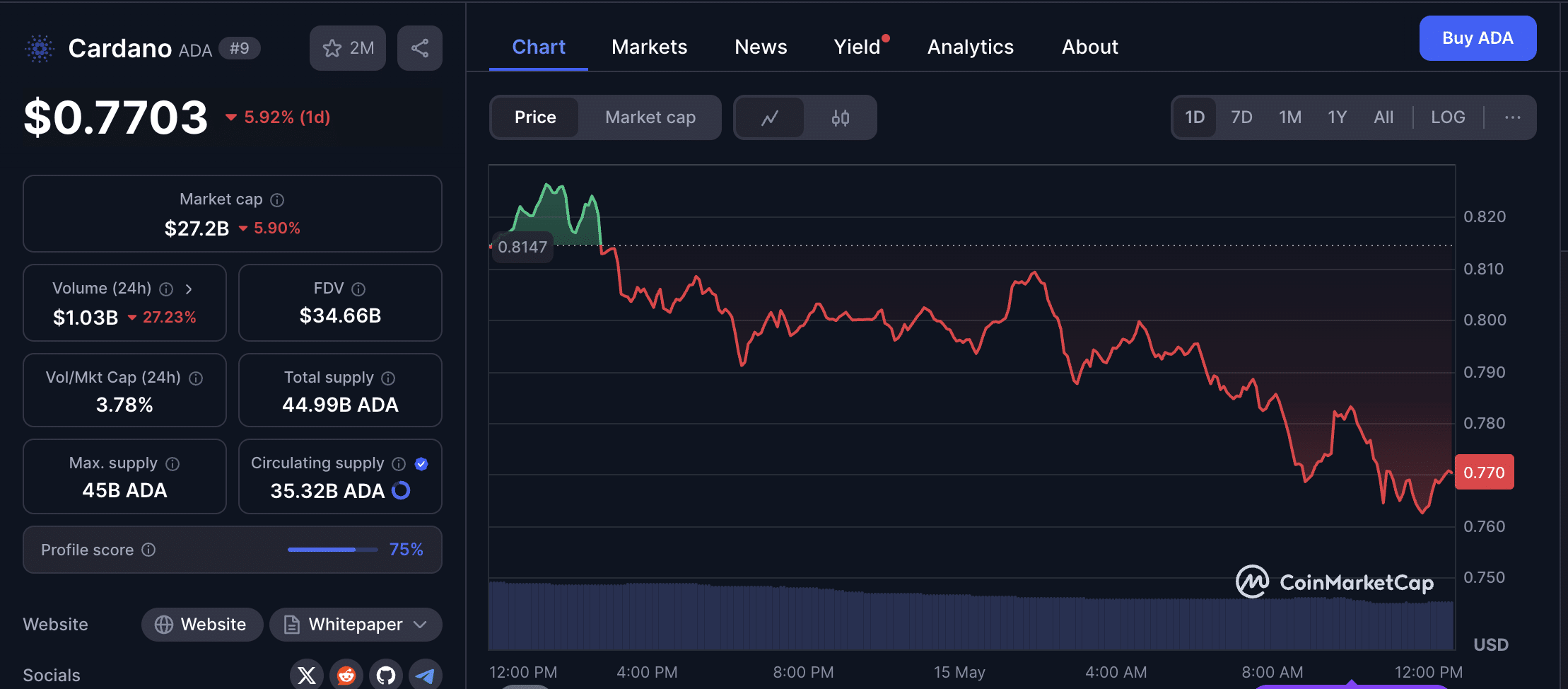

Cardano’s Bullish Pattern Holds: Will ADA Hit $1.00?

Cardano (ADA) is currently priced at $0.77 and is showing remarkable resilience after successfully defending the neckline of its inverse head-and-shoulders pattern. This technical setup, often a precursor to major bullish moves, is fueling optimism among ADA holders. If bulls can push the price above the overhead resistance at $0.86, the price prediction for ADA targets a potential rally toward the $1.01 pattern objective.

Technical indicators remain favourable. The RSI is hovering in bullish territory, and the 20-day EMA is trending upward, offering dynamic support. These signals suggest that buying pressure is consistent, especially on minor dips. Volume has remained steady, indicating that momentum could accelerate with a breakout above $0.86.

However, failure to break out soon or a drop below the neckline would weaken the setup significantly. A breakdown may drag the ADA/USDT pair back toward the 50-day SMA at $0.68, which would represent a key test for medium-term sentiment. With increasing smart contract adoption, Cardano’s fundamentals remain solid. If ADA holds current levels and breaks resistance, the bullish price prediction remains valid. Traders should watch for volume confirmation to validate the next leg up toward the $1.00 milestone.

SUI Consolidates: Is a Breakout Above $4.25 Next?

SUI (SUI) is trading at $3.71 and continues to coil within a tight consolidation range between $3.90 and $4.25. This sideways movement reflects a healthy period of accumulation, often preceding strong directional moves. The SUI price prediction turns significantly bullish if buyers can breach the $4.25 resistance, which would open the doors for a surge to $5.00 and a retest of the all-time high at $5.37.

On the downside, immediate support lies at $3.90, with stronger technical backing near the 20-day EMA at $3.57. A drop below this level may prompt a short-term correction, but such dips are likely to be viewed as buying opportunities given the overall bullish structure.

The RSI remains neutral, allowing room for upward expansion. Furthermore, SUI has seen growing traction in Web3 applications and Layer-1 integrations, which adds to its investor appeal. These developments provide a solid foundation for sustained upside once technical breakout levels are cleared.

As long as bulls defend $3.90 and maintain upward pressure, the SUI price prediction stays optimistic. A decisive move above $4.25 with strong volume could trigger rapid gains, attracting breakout traders and shifting market momentum in SUI’s favor.

Chainlink Presses Higher: Can LINK Break the Pattern?

Chainlink (LINK) is currently trading at $16.27 and pushing up against the resistance line of its long-standing descending channel pattern. This critical level has proven difficult to breach in the past, but the current structure suggests the bulls are gaining traction. The price prediction outlook for LINK improves dramatically if a daily close above the resistance line is confirmed, which could spark a rally toward $21.30.

Technical indicators back this bullish setup. The 20-day EMA at $15.43 is trending higher, and the RSI is approaching overbought territory, both signs that buying interest is intensifying. If LINK can maintain pressure and pierce the resistance line, a sustained breakout is likely, especially with supportive volume.

Conversely, if bulls fail to clear resistance, the price could fall back toward the neckline and the 50-day SMA at $13.96. A close below this level would suggest that consolidation may continue within the descending channel.

Fundamentally, Chainlink continues to play a critical role in blockchain infrastructure, particularly in decentralized oracles and interoperability solutions. The LINK price prediction remains bullish as long as it stays above $15 and continues pressing against the channel boundary.

Avalanche Rebounds Strongly: Can AVAX Push Toward $36?

Avalanche (AVAX) is trading at $23.91 and has recently bounced off the critical support at $23.50, reinforcing this level as a key bullish threshold. The current structure reflects a constructive recovery, with buyers stepping in at higher lows, a typical sign of strengthening sentiment. The AVAX price prediction remains positive as long as the token stays above the 20-day EMA, which is now climbing at $22.63.

A break above the nearby resistance at $28.78 would confirm bullish continuation, potentially lifting the price toward $31.73. If momentum persists, AVAX could rally further toward $36, testing prior swing highs from earlier in the year. The RSI is recovering from midline territory, and the MACD shows signs of a bullish crossover, suggesting that price acceleration could be imminent.

However, if AVAX fails to sustain above $23.50, it may fall back toward $19 — a level that previously attracted strong buying interest. This would likely slow momentum but not entirely shift the trend, given the broader altcoin strength and Avalanche’s growing DeFi ecosystem. Overall, the AVAX price prediction stays bullish in the near term, supported by rising moving averages, improving volume, and its successful defense of support. A breakout above $28.78 could confirm the next leg of the rally.

Conclusion: Insights Point to Broader Altcoin Strength

The latest price prediction insights indicate that while Bitcoin maintains a solid consolidation above $100,000, altcoins are gaining traction across the board. Technical setups across ETH, DOGE, ADA, and SUI signal strength and further upside if support levels hold. Traders should monitor macro catalysts and resistance zones for confirmation of breakout continuation or consolidation.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

What is the current Bitcoin price prediction?

Bitcoin is expected to retest $109,588 if it holds above $100,000. A breakout could take it to $130,000.

Which altcoins are currently strongest?

ETH, DOGE, ADA, and AVAX are showing strong technical setups.

Is it altcoin season?

Several indicators, including rising altcoin volumes and falling Bitcoin dominance, suggest altcoin season may be underway.

What is the risk for Bitcoin in the short term?

A drop below $98,407 (20-day EMA) could trigger profit-taking.

Which levels should traders watch this week?

$107K–$109K for BTC resistance, $3K for ETH, $0.86 for ADA, and $28.78 for AVAX.

Glossary

Price prediction: A forward-looking analysis estimating the future value of a cryptocurrency based on technical and fundamental indicators.

20-day EMA: A moving average over the last 20 days used to track short-term trends.

SMA: Simple Moving Average, often used to identify long-term trends.

Breakout level: A price level that, when breached, indicates a strong directional move.

All-time high (ATH): The highest price a cryptocurrency has ever reached in its trading history.