Arizona is poised to become the first U.S. state to officially invest public funds in Bitcoin. The state’s Senate Finance Committee recently approved the “Arizona Strategic Bitcoin Reserve Act” (SB1025), signaling a significant shift toward integrating digital assets into public investment portfolios.

Arizona’s Bold Step into Digital Assets

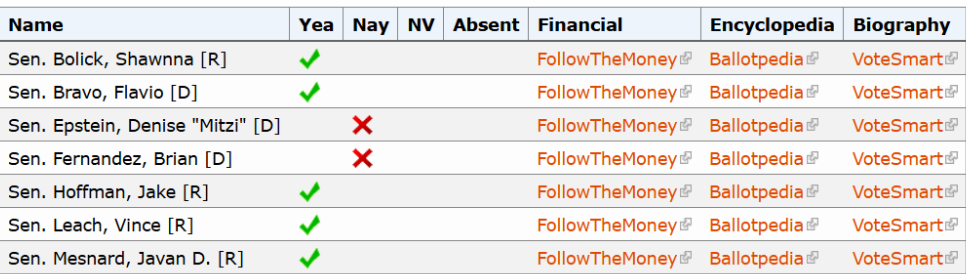

On January 27, the Arizona Senate Finance Committee voted 5-2 in favor of SB1025, a bill co-sponsored by Senator Wendy Rogers and Representative Jeff Weninger. This legislation permits the state to allocate up to 10% of its public funds, including those managed by the state treasurer and retirement systems, into virtual currencies like Bitcoin. The bill also outlines provisions for securely storing these digital assets, potentially within a federal Strategic Bitcoin Reserve if established by the U.S. Treasury.

Result Passed;

A Growing Trend Among States

Arizona’s initiative reflects a broader movement among U.S. states exploring the inclusion of Bitcoin in their investment strategies. As of January 27, eleven states have introduced similar Bitcoin reserve bills. Dennis Porter, CEO and co-founder of the Satoshi Action Fund highlighted Arizona’s pioneering role, stating,

“Arizona is the first state to have a bill specifically focused on creating a Bitcoin reserve pass through a legislative committee.”

He also noted that at least 15 states, and potentially 16, are introducing Bitcoin reserve bills.

Leadership Aligns with Crypto-Friendly Policies

The federal landscape is also shifting with the recent confirmation of Scott Bessent as Treasury Secretary. Confirmed by the Senate with a 68-29 vote, Bessent is known for his pro-Bitcoin stance and opposition to a central bank digital currency. His appointment aligns with President Trump’s economic policies and signals a potential federal endorsement of Bitcoin-related initiatives. Bessent’s support could pave the way for the establishment of a federal Strategic Bitcoin Reserve, complementing state-level efforts like Arizona’s.

Implications for the Future

If SB1025 becomes law, Arizona will set a precedent as the first state to officially invest public funds in Bitcoin. This move could encourage other states to follow suit, leading to a more widespread adoption of digital assets in public investment portfolios. The combination of state initiatives and supportive federal leadership suggests a future where Bitcoin and other cryptocurrencies play a significant role in government financial strategies.

As Arizona leads the charge, the intersection of public funds and digital assets will be a space to watch, with potential implications for financial innovation and economic policy across the United States.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What is Arizona’s Strategic Bitcoin Reserve Act (SB1025)?

It’s a proposed bill allowing Arizona to invest up to 10% of public funds in Bitcoin and other digital assets, marking a significant shift in state investment strategies.

Why is this bill important?

If passed, Arizona would be the first U.S. state to officially invest public funds in Bitcoin, setting a precedent for digital asset adoption in government portfolios.

Who supports the Bitcoin reserve bill in Arizona?

The bill is co-sponsored by Senator Wendy Rogers and Representative Jeff Weninger and recently passed the Senate Finance Committee with a 5-2 vote.

What’s next for the bill?

The bill now moves to the Senate Rules Committee for further debate and amendments before a potential vote in the full Senate and House.