The pump token price has seen a dramatic surge of over 20% in the past 24 hours, following a strategic buyback initiative led by the meme coin launchpad, Pump.fun. This unexpected move has sparked renewed investor interest and reignited discussions around the token’s long-term prospects.

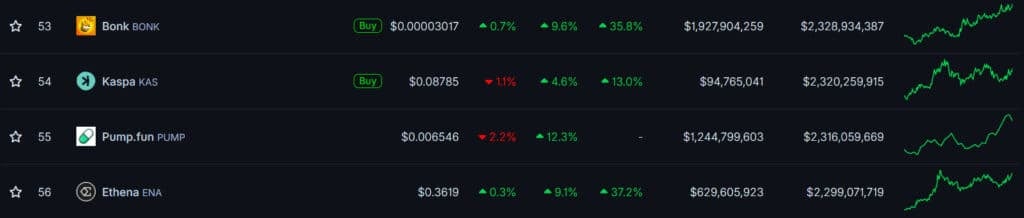

At its peak during the rally, Pump’s market capitalization soared to $2.4 billion, temporarily overtaking Bonk before the latter regained its lead. While the token had previously experienced sharp declines post-launch, this recovery has positioned it back in the spotlight.

Buyback Injects Fresh Momentum

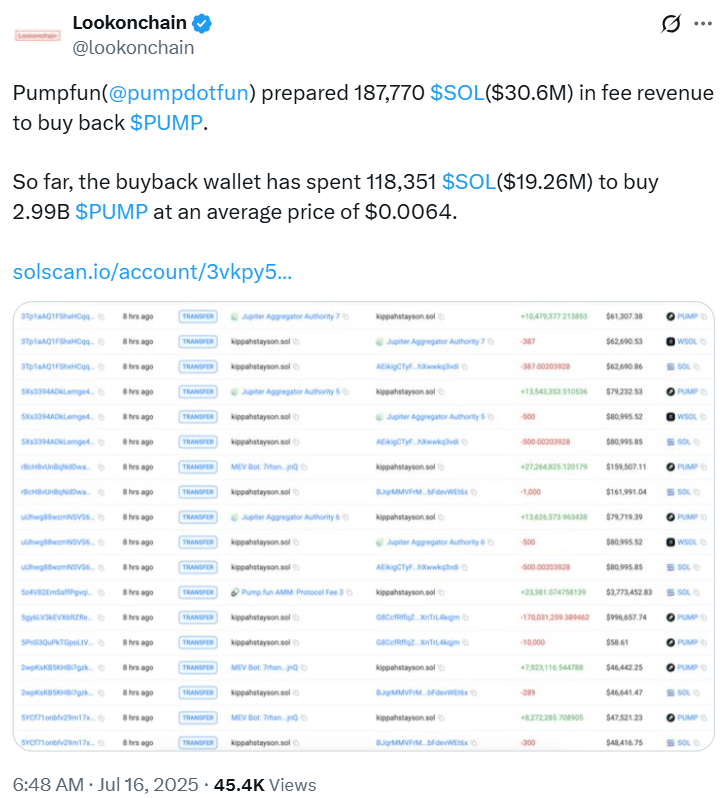

According to blockchain analytics platform Lookonchain, Pump.fun allocated 187,770 Solana, equivalent to approximately $30.6 million, from its fee reserves to carry out the buyback. Of that, 118,351 SOL, nearly $19.26 million, has already been spent to acquire roughly 2.99 billion Pump tokens at an average price of $0.0064.

This aggressive financial commitment has brought cautious optimism to a market that had been cooling off after the token’s turbulent start. Analysts believe the buyback is designed to demonstrate a commitment to investors while propping up short-term prices.

Overview of Launch and Initial Setbacks

Pump.fun made waves in the crypto space when it raised over $500 million in just 12 minutes during its token’s public sale. That event represented 15% of the total supply and gave the token an eye-catching fully diluted valuation of $4 billion.

Soon after, the pump token price was listed across major exchanges such as Coinbase, Bybit, KuCoin, Gate, MEXC, Bitget, and Hyperliquid, the latter of which also introduced perpetual contracts with up to 5x leverage.

However, the launch was followed by aggressive profit-taking from early investors, which led to a sharp price correction of more than 40%. The dramatic selloff resulted in skepticism about the token’s long-term viability.

Critics Question Token Utility

Despite the recent rebound in the pump token price, critics remain wary due to the token’s limited utility. Pump does not currently offer governance rights, staking features, or any form of revenue sharing.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Jul 2025 | $ 0.00495 | $ 0.005536 | $ 0.006801 | 1.24% |

| Aug 2025 | $ 0.005319 | $ 0.005485 | $ 0.005644 | 15.99% |

| Sep 2025 | $ 0.005248 | $ 0.005396 | $ 0.005606 | 16.55% |

| Oct 2025 | $ 0.00488 | $ 0.005137 | $ 0.005339 | 20.53% |

| Nov 2025 | $ 0.005123 | $ 0.005239 | $ 0.00533 | 20.65% |

| Dec 2025 | $ 0.005295 | $ 0.005407 | $ 0.005512 | 17.94% |

These omissions have caused concern among analysts who argue that structural weaknesses could undermine any short-term price recoveries fueled by buybacks or speculation. Without addressing these utility gaps, some experts believe the buyback could end up being a temporary fix rather than a sustainable growth strategy.

Competitive Pressures Build in the Launchpad Ecosystem

Pump.fun is also facing increasing competition from emerging platforms like LetsBonk. LetsBonk has recently overtaken Pump.fun in daily launchpad volume and token graduation rates.

These gains come at a time when Pump.fun trading volume has seen a significant downturn, from $11.6 billion in January to just $3.65 billion in June, according to DefiLlama. In July so far, its DEX volume stands at approximately $885.6 million, a fraction of its previous performance.

Strategic Changes to Regain Market Share

To counteract these challenges and reinforce the pump token price, Pump.fun has taken steps beyond the buyback. It recently acquired analytics platform Kolscan, a move intended to improve data insights and market analysis. The platform has also introduced time-weighted average price (TWAP) buybacks funded through its fee wallets.

These strategies aim to improve the efficiency of buyback execution while presenting a more data-driven and proactive market stance.

Technical Indicators Point to Mixed Outlook

Technical analysis of the pump token price shows that it recently broke through the $0.006 resistance level, turning it into support during a retest. This move is generally seen as bullish in the short term.

However, the relative strength index revealed a bearish divergence, with the indicator making a lower high while the token’s price reached a higher peak. This development coincided with a 2.7% retracement shortly afterward.

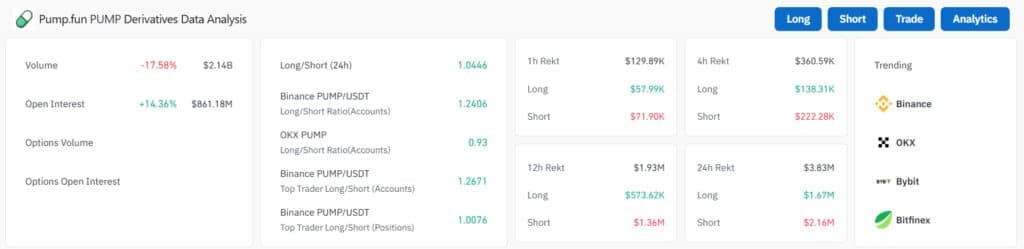

On-Balance Volume (OBV) indicators suggest that buying pressure remains strong. Open interest in the token has increased by 8.85% in the past 24 hours, reaching $937.7 million, according to data from Coinalyze.

Conclusion

The pump token price recovery highlights how strategic interventions, such as large-scale buybacks, can revive investor interest and drive short-term momentum. However, the long-term trajectory of the token will depend heavily on how Pump.fun addresses fundamental concerns regarding utility and competition.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Summary

Pump token price surged over 20% after Pump.fun initiated a massive buyback using over $19 million in Solana. The move briefly pushed its market cap above $2.4 billion before stabilizing. Despite a rocky debut and criticism over limited token utility, the buyback has revived investor interest.

As competition in the memecoin space intensifies, Pump.fun is adopting strategic changes, including acquiring analytics firm Kolscan. Technical indicators show mixed signals, leaving the token’s long-term outlook dependent on broader platform improvements.

Frequently Asked Questions (FAQ)

1- What is driving the recent surge in Pump token price?

The recent rally is largely due to a buyback by Pump.fun, which has spent over $19 million in SOL to purchase back PUMP tokens and restore investor confidence.

2-How high did the Pump token price rise?

The Pump token price jumped more than 20% within 24 hours, pushing its market cap briefly to $2.4 billion.

3- Where can Pump token be traded?

Pump is available on major exchanges including Coinbase, Bybit, KuCoin, MEXC, Bitget, and Gate. It is also traded on Hyperliquid with up to 5x leverage.

4- What are the concerns about the Pump token?

The main criticisms center on its lack of functionality—there’s no governance, staking, or yield-generating mechanism currently associated with PUMP.

Appendix: Glossary of Key Terms

Pump Token Price – The current trading value of the PUMP cryptocurrency token in the open market.

Buyback – A strategy where Pump.fun repurchases its own tokens to reduce supply and support the token’s price.

Solana (SOL) – A fast, low-cost blockchain platform used to fund Pump.fun’s token buyback.

Fully Diluted Valuation (FDV) – The estimated total market value of a token if all its supply were in circulation.

DEX (Decentralized Exchange) – A platform that allows users to trade cryptocurrencies directly without intermediaries.

TWAP (Time-Weighted Average Price) – A trading algorithm that spreads large orders over time to minimize price impact.

On-Balance Volume (OBV) – A technical tool that tracks cumulative trading volume to gauge buying and selling pressure.

References

Cryptobriefing – cryptobriefing.com

Crypto.News – crypto.news

CoinCentral – coincentral.com