Pyth Network is quickly emerging as the go-to solution for perpetual futures trading across various leading blockchain networks. The blockchain oracle solution has captured a dominant market share in this niche, making significant strides in the world of decentralised finance (DeFi).

Dominance Across Multiple Blockchains

The Pyth Network has successfully carved out a leading perpetual futures trading market share on most of the blockchain networks on which it operates. Impressively, Pyth controls 100% of the perpetual futures trading volume on some of the top blockchain networks, including Solana, Avalanche, Sui, Aptos, Fantom, Injective, and Ton. This unparalleled dominance is a testament to the effectiveness and reliability of the Pyth Network.

Marc Tillement, the director of the Pyth Data Association, highlighted the reasons behind this success. According to Tillement, the Oracle solution’s permissionless and easy implementation model plays a crucial role. He elaborated during an interview at EthCC:

“The best [feature] is that our catalogue of over 500 price feeds is available everywhere. So you launch a new chain on day one, and you can have over 100 crypto markets… They can do the update themselves. So it’s a mix of on-demand plus permissionless.”

Growth Fueled by Market Demand

The growth trajectory of the Pyth Network is nothing short of impressive. Recently, Pyth Network surpassed $600 billion in cumulative trading volume, as announced in a July 8 X post. This milestone underscores the network’s rapid adoption and widespread use within the blockchain ecosystem.

A significant contributor to this remarkable achievement has been the Ethereum layer-2 network, Blast. Tillement explained the impact of Blast on Pyth’s trading volumes:

“From six months ago, blast is a major actor because futures perps on Blast are doing about $1 billion volume a day. So they’re almost a third of the volume of the past month.”

The anticipation surrounding the Blast (BLAST) token debut, which saw $2 billion worth of tokens airdropped to early users at the end of June, also played a part. However, most of Pyth’s growth is organically market-generated. Tillement shared his optimism for the future:

“The growth is mostly market-generated. We could be the same protocol as today, but if the bull market happens, I won’t be shocked if our volume is going to 10x.”

The Role of Blockchain Oracles

Understanding the significance of blockchain oracles is key to appreciating the Pyth Network’s achievements. Blockchain oracles are third-party solutions that connect blockchains to external data sources. This capability is crucial for enabling smart contracts to interact with real-world data, bridging the gap created by the siloed nature of blockchain networks.

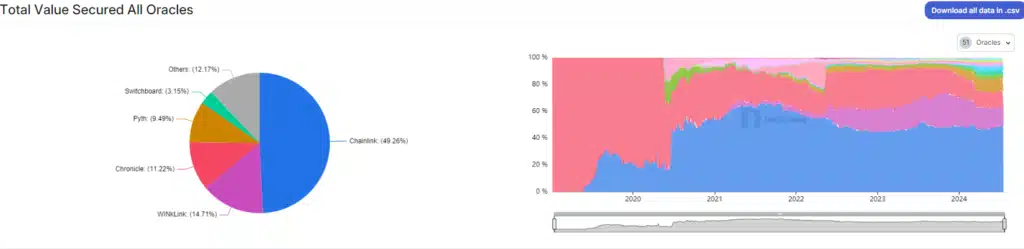

Blockchain oracles have become a fundamental component of the DeFi space, securing vast amounts of digital assets. According to DefiLlama data, blockchain oracles are securing over $51 billion worth of digital assets across all blockchains. Among these, Chainlink stands as the largest oracle solution, securing over $25.4 billion in total value across 399 protocols and controlling over 49% of the cumulative oracle total value secured (TVS).

Pyth Network’s Position in the Market

Despite the competition, the Pyth Network has established itself as a significant player. Currently, Pyth is the fourth largest oracle, securing over $4.9 billion in TVS across 201 blockchain protocols. This gives Pyth Network control of 9.49% of the overall oracle TVS, a notable achievement in a competitive market.

The success of the Pyth Network can be attributed to its innovative approach and the trust it has built within the blockchain community. By offering a permissionless and easy-to-implement oracle solution with an extensive catalog of price feeds, Pyth has positioned itself as a vital tool for perpetual futures trading.

In conclusion, the Pyth Network is revolutionising perpetual futures trading and setting new standards in the blockchain oracle space. Its impressive market share, innovative model, and robust growth potential make it a key player to watch in the evolving landscape of decentralised finance. As Pyth continues to expand and adapt, it is poised to play an even more significant role in the future of blockchain technology.