TRON’s native currency TRX is indicating the formation of strength just above a significant accumulation zone, pointing towards bullish continuation in the event that prevailing conditions continue. With increasing whale accumulation, robust holder profitability, and technical setup still in the works, TRX price seems to be primed for a potential push towards the $0.29–$0.30 resistance region.

TRX Price Near Accumulation Zone

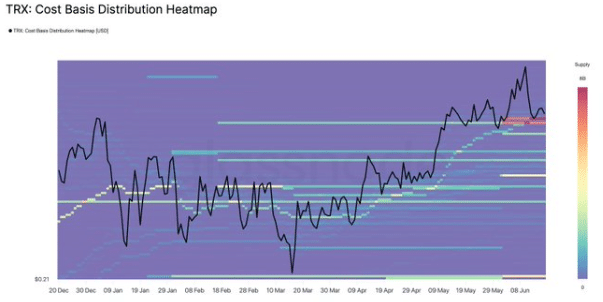

TRX price is now consolidating at the $0.274 level, barely above a pivotal on-chain support cluster of $0.26 to $0.27. Over 14 billion TRX are now staking in this cost-basis cluster, one of the most important support clusters in the new cycle.

This range of accumulation indicates long-term investor confidence and serves as a psychological and structural benchmark for the token. At present, the asset holds above its important trendline that has been in place since March, providing further technical support.

In spite of small adjustments in recent sessions, TRX remains to respect its upward trendline, which has served as dynamic support. This sustained uptrend, combined with consistent support at the Fibonacci levels of $0.27 and $0.28, supports the bullish setup.

Further, the MACD indicator is now displaying a crossover, which tends to indicate a likelihood of a return of uptrend momentum. If price action remains above the trendline, bulls may aim for the $0.30 resistance in the short to midterm.

Most Holders Are Profitable because of Low Sell Pressure

IntoTheBlock’s on-chain data shows that more than 75% of TRX holders are profitable. Only about 11% are in loss, with the rest being at breakeven.

This profitability breakdown is significant: when a majority of holders are in the profit zone, selling pressure is significantly less. With TRX price trading above the cost-basis cluster, the likelihood of panic-selling or severe breakdowns is few, creating a cushion for rallies in the future.

Whale Accumulation Leads to Institutional Confidence

In the last couple of days, TRX price has recorded a 9.5% rise in whale holdings, which proves the return of large-scale entities’ interest. Long-term holder addresses also surged more than 38%, whereas the retail wallet increase was modest at more than 4%.

This discrepancy indicates that institutional or large-scale investors are spearheading the ongoing era of stealth accumulation. Such tactical positioning tends to be a precursor to appreciation in prices once supportive technical and macro conditions overlap.

TRON’s network activity also has good signs. New wallet creations increased more than 30% last week, while active addresses had a lesser but significant increase. Meanwhile, a decline in zero-balance addresses indicates improved user retention and utility.

These trends also show that not only are new users joining the TRON network, but they’re using its services—either through staking, DeFi activity, or participation in the network.

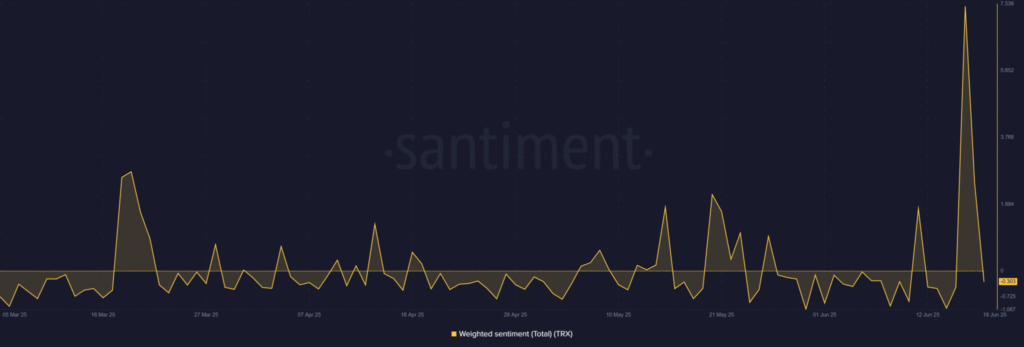

Sentiment analysis by Santiment indicates that market sentiment recently peaked, followed by an abrupt pullback. While extreme sentiment tends to create volatility, this reset could be healthy for TRX, avoiding an overheated rally and clearing the way for more sustainable price action.

With market enthusiasm now cooled, a steady return of positive sentiment, combined with technical support and accumulation, could supply the fuel needed to drive the next leg higher.

Can TRX Price Reach $0.30?

With its position above key support and strong cost basis, TRX price is in a good position to continue higher. Support from long-term holders, increasing whale exposure, and strengthening network fundamentals are all positive factors.

And if the uptrend line remains intact and general sentiment continues to improve, a shift towards the $0.29–$0.30 range is not impossible in the upcoming sessions. Yet any persistent breakdown below $0.26 would negate the setup and return attention back to lower levels of support.

Conclusion

TRON’s current perspective indicates a seasoned network with increasing investor faith. From on-chain metrics to technical indications, the puzzle pieces are coming together for potential upswings, though naturally, confirmation will hinge on whether key levels are respected and larger market conditions hold out.

FAQs

- What is the present support level for TRX Price?

TRX is consolidating above a solid support zone of $0.26-$0.27, where there are more than 14 billion tokens stored, based on Glassnode data.

- Are TRX holders profitable now?

Yes, over 75% of TRX holders are “in the money” and are holding tokens at profit, lowering the chances of strong sell pressure.

- What does whale accumulation do for TRX Price?

An increase in whale and long-term investor holdings reflects optimism regarding TRX’s potential future price and usually leads to rising price action.

- Is the TRON network expanding?

Yes, TRON has experienced a large number of new wallets as well as a reduction in zero-balance addresses, which indicates better user retention and increasing utility.

Glossary

- Whale

A crypto term to explain entities or institutions that possess extensive quantities of a particular cryptocurrency and can drive market trends.

- Cost-Basis Cluster

A price band in which the majority of token holders purchased their tokens, commonly serving as a resistance or support level in the market.

- MACD (Moving Average Convergence Divergence)

A technical tool used to detect changes in momentum in the direction of price trends, commonly indicating potential reversals or continuations.

- Fully Diluted Valuation (FDV)

The overall market cap of a crypto asset with all tokens assumed to be in circulation to determine long-term valuation and risk of dilution.

Sources