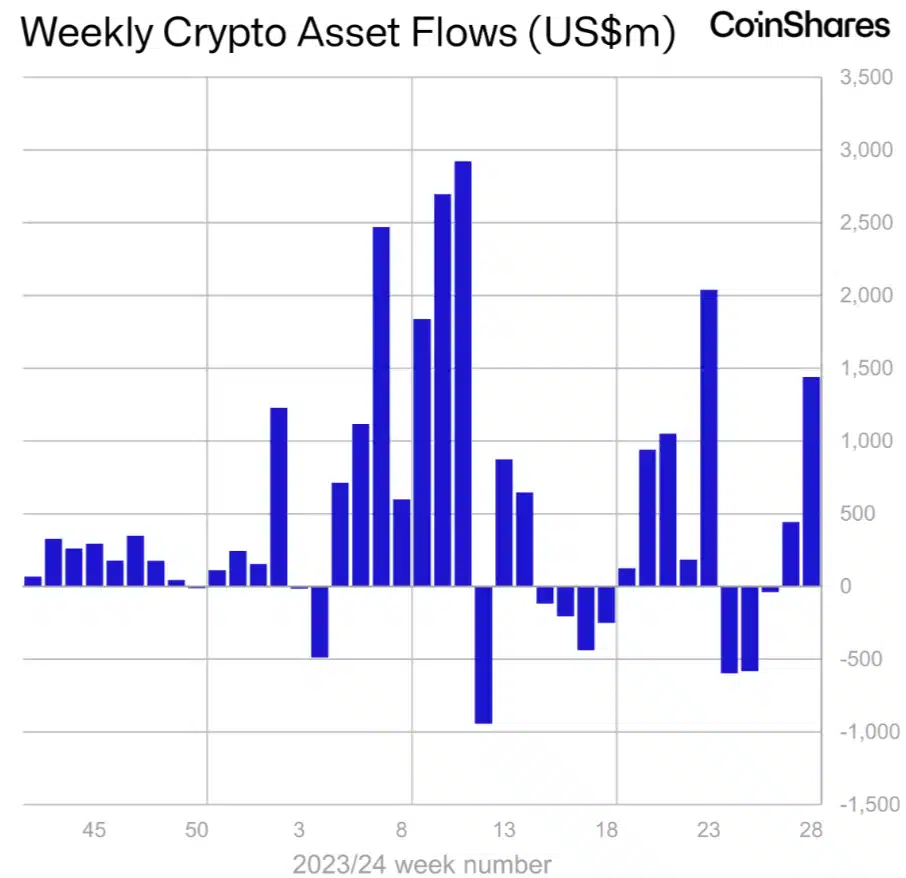

Inflows into digital asset investment products have hit a new record of over $17.8 billion year-to-date (YTD), pointing to the start of a potential crypto market recovery. This surge in investment signals renewed interest and confidence in the crypto market, with Bitcoin and Ether leading the charge.

A New Record for Digital Asset Inflows

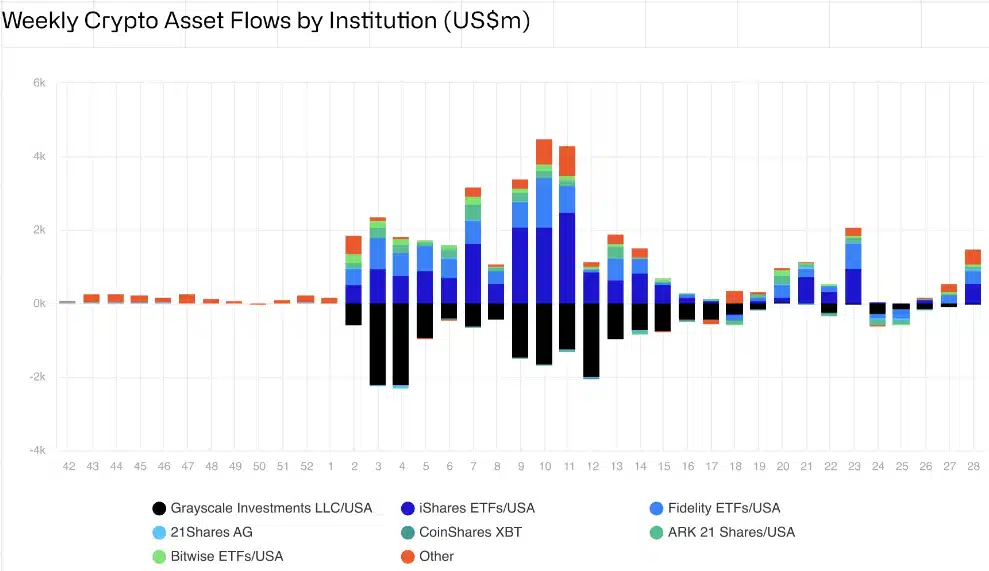

According to CoinShares data, the year-to-date inflows for 2024 have reached $17.8 billion, significantly surpassing the previous record of $10.6 billion set in 2021. Last week alone, cryptocurrency investment products saw a total of $1.44 billion worth of inflows, highlighting the increasing appetite for digital assets among investors.

The lion’s share of these inflows is attributed to United States-based buyers, while Switzerland has also bought record amounts of digital assets. CoinShares noted, “Regionally, the US led with US$1.3bn for the week, although the positive sentiment was seen across all other countries, most notable being Switzerland (a record this year for inflows), Hong Kong and Canada with US$58m, US$55m and US$24m respectively.”

Bitcoin and Ether Dominate Inflows

Bitcoin experienced its fifth-largest weekly inflow on record, amounting to over $1.35 billion. This substantial influx helped the world’s first cryptocurrency rebound above the significant $60,000 mark. Meanwhile, short Bitcoin-related investment products experienced their largest weekly outflows since April 2024, totalling over $8.6 million.

The renewed interest in Bitcoin can be partly attributed to the recent price decline caused by the German government selling BTC. According to CoinShares,

“We believe price weakness due to the German Government bitcoin sales and a turnaround in sentiment due to lower than expected CPI in the US prompted investors to add to positions.”

Ether also saw significant inflows, totalling over $72.1 million for the past week. The growing interest in Ether is likely due to the anticipation of the first spot Ether exchange-traded fund (ETF) in the US, which could launch for trading in the coming weeks.

Investors Eye Bitcoin and Ether for Growth

The increasing inflows into Bitcoin and Ether highlight the confidence investors have in these leading cryptocurrencies. Bitcoin’s strong performance and Ether’s promising future with the potential launch of a spot ETF are driving factors behind this trend.

US spot Ether ETF issuers are expecting to receive final comments from the Securities and Exchange Commission (SEC) by early this week, according to an industry source familiar with the matter. Several issuers, including VanEck and 21Shares, filed amended registrations this week in hopes of receiving the SEC’s final signoff to begin listing spot Ether ETFs. Eight spot issuers are awaiting regulatory approval in the US.

The anticipation of a spot Ether ETF is significant as it represents a new way for investors to gain exposure to Ether without directly buying the cryptocurrency. This could lead to even more inflows into Ether as the ETF provides a more accessible and regulated investment option.

The Future of Bitcoin and Ether

The record-breaking inflows into digital asset investment products suggest a bright future for the crypto market, with Bitcoin and Ether at the forefront. The substantial inflows into Bitcoin indicate strong investor confidence, despite recent price fluctuations. Ether’s growing inflows, spurred by the potential launch of a spot ETF, point to a promising outlook for the cryptocurrency.

As the crypto market continues to evolve, Bitcoin and Ether are likely to remain key players. The increased institutional interest and the development of new investment products like ETFs will continue to drive demand and growth for these leading cryptocurrencies.

In conclusion, the record inflows into digital asset investment products are a positive sign for the crypto market, suggesting a potential recovery. With Bitcoin and Ether leading the charge, investors are showing renewed confidence in the future of cryptocurrencies. The coming weeks and months will be crucial as the market anticipates the launch of the first spot Ether ETF and monitors the ongoing performance of Bitcoin. The continued interest and investment in these digital assets underscore their importance and potential in the evolving financial landscape.