Since the start of November, Bitcoin (BTC) has shattered multiple all-time highs (ATH), now trading above the $80,000 mark. This bullish surge has caught the attention of market experts, with famed trader Peter Brandt recently identifying a rare pattern that signals further potential upside for Bitcoin. Brandt noted that this unique formation shares a striking resemblance with past gold price movements, which saw major gains following a similar setup. If this pattern holds true, Bitcoin could be on course to reach $200,000 in the long term.

Bitcoin Hits New ATH: Will the Rally Continue?

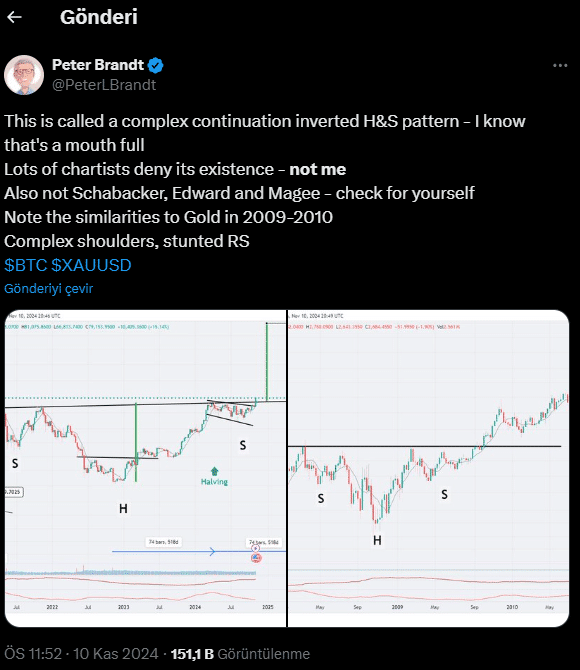

Bitcoin’s price has surged past multiple ATHs since the beginning of the month, now trading at $81,182.21, marking a 2.82% increase over the past 24 hours. Amidst this rally, legendary investor Peter Brandt shared insights on a rare pattern in BTC’s chart, describing it as an inverted “head and shoulders” continuation. Brandt posted comparisons of Bitcoin and gold charts, noting that Bitcoin’s current pattern mirrors gold’s 2010 rally, where gold prices more than doubled after breaking through a $1,000 resistance level. If Bitcoin follows this trend, the cryptocurrency could ultimately reach $200,000 — a projection in line with numerous bullish forecasts, including those by Brandt.

The Growth “Pattern” in BTC’s Ecosystem

Bitcoin’s continued growth is driven by a vibrant ecosystem of developers, institutional investors, and retail participants. High-profile entities such as MicroStrategy and Metaplanet are bolstering Bitcoin’s demand and scarcity through substantial investments. MicroStrategy, for instance, has announced plans to invest $42 billion in Bitcoin over the coming years, following its initial crypto investments in 2020, which have yielded a $20 billion profit. Additionally, as nations consider adding Bitcoin to reserves, the asset’s adoption expands, fueling further growth.

Cardano’s recent success in integrating Bitcoin liquidity into its DeFi ecosystem via Grail Bridge exemplifies the expanding use cases for BTC, adding momentum to the anticipated growth cycle.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!