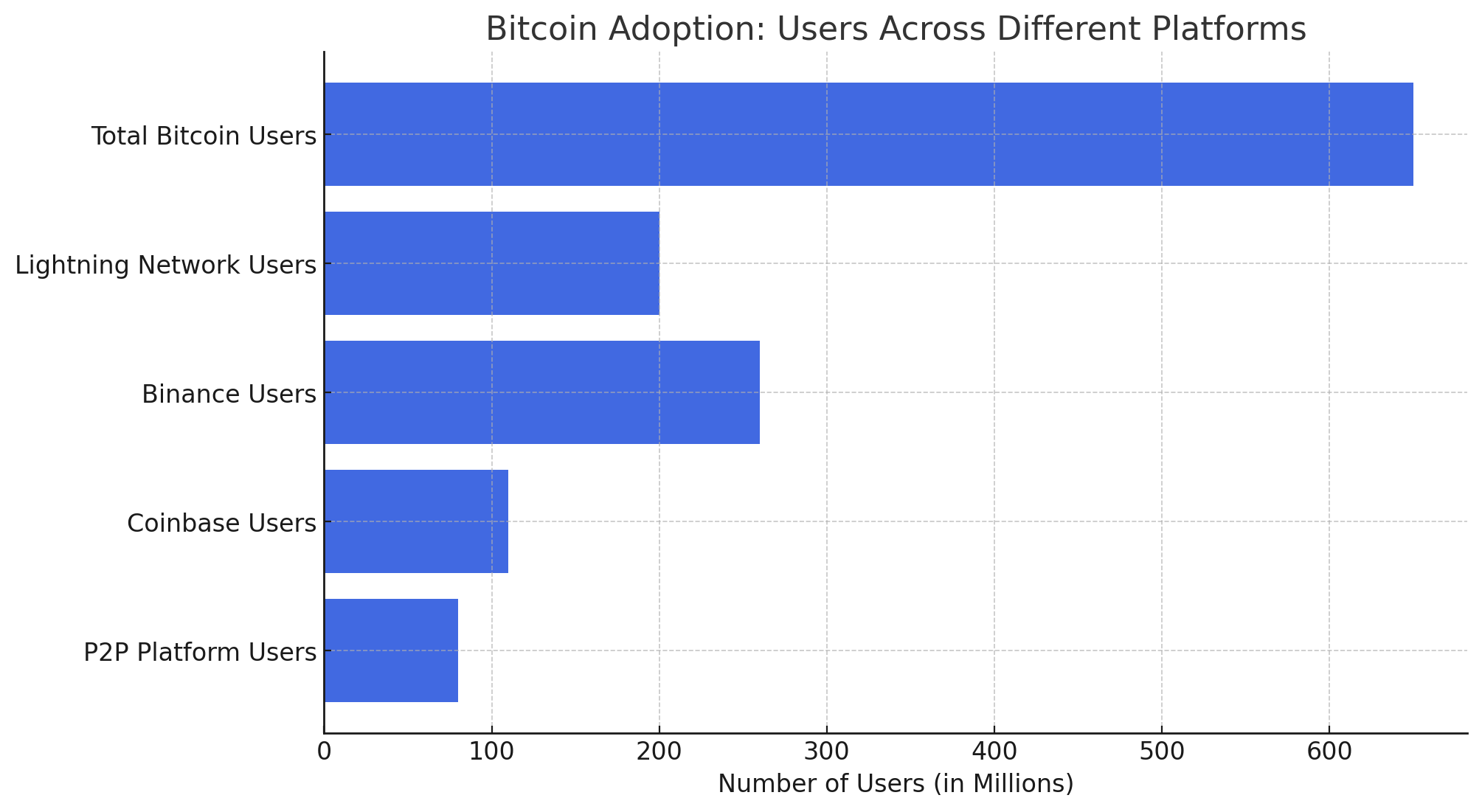

An evolution, Bitcoin is transcending its “digital gold” reputation to re-emerge as a practical medium of exchange. Recent reports highlight that over 650 million individuals now have access to Bitcoin, a surge largely attributed to the advancements of the Lightning Network. This development signifies a pivotal shift in Bitcoin’s journey, underscoring its growing utility in everyday transactions.

The Lightning Network: Powering Bitcoin’s Transactional Renaissance

The Lightning Network (LN) is at the forefront of Bitcoin’s transformation into a scalable medium of exchange. LN addresses Bitcoin’s scalability challenges by enabling rapid, low-cost transactions, making it more suitable for daily use. A recent report emphasizes, “Lightning transforms Bitcoin into the scalable medium of exchange initially envisioned.” This technology facilitates microtransactions and pay-per-use services, broadening Bitcoin’s applicability across various sectors.

Widespread Adoption: 650 Million and Counting

The estimate of 650 million Bitcoin users stems from the integration of LN across major platforms. Centralized exchanges like Binance, with nearly 260 million users, and Coinbase, along with peer-to-peer platforms such as Paxful, contribute significantly to this figure. This widespread adoption indicates a growing comfort and familiarity with Bitcoin as a transactional tool.

Real-World Applications: From Retail to Remittances

Bitcoin’s utility is expanding into tangible, real-world applications. In regions with unstable monetary systems, Bitcoin serves as a reliable digital cash alternative. For instance, Pick n Pay, a major African retailer, has implemented LN to streamline Bitcoin payments. Carel van Wyk, founder of MoneyBadger, notes,

“Lightning payments are currently the fastest payment method at the till, comparable to ‘tap-to-pay’ card payments, with lower fees than credit or debit cards.”

Additionally, LN is revolutionizing remittances by enabling swift, low-cost international transfers, thereby enhancing financial inclusion.

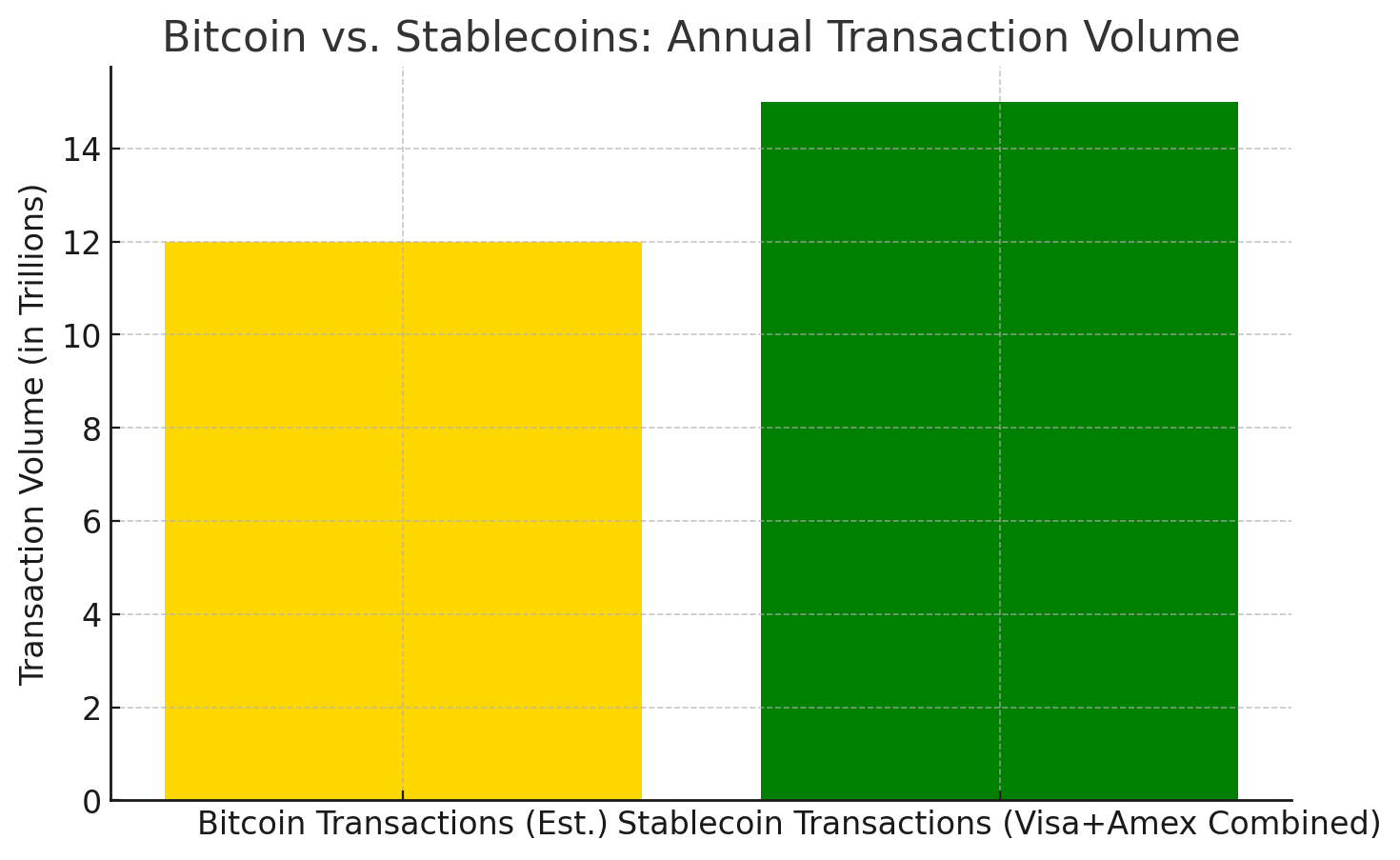

Bitcoin vs. Stablecoins: Navigating the Digital Currency Landscape

While stablecoins offer a non-volatile medium of exchange, they are tethered to fiat currencies and subject to centralized control. In contrast, Bitcoin operates on a decentralized network, immune to inflationary pressures and governmental interventions. The report articulates, “Stablecoins are not digitally native… they are essentially IOUs that promise to be redeemable for reserves held in the traditional financial system.” Bitcoin’s decentralized nature ensures its value is determined by global consensus, offering a distinct advantage over stablecoins.

Conclusion: Bitcoin’s Evolving Role in the Global Economy

The resurgence of Bitcoin as a medium of exchange, propelled by the Lightning Network, marks a significant milestone in its evolution. With over 650 million people now having access, Bitcoin is increasingly woven into the fabric of daily transactions, from retail purchases to international remittances. As this trend continues, Bitcoin’s role in the global economy is poised to expand, fulfilling its original vision as “peer-to-peer digital cash.”

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs on Bitcoin’s Shift to a Medium of Exchange

1. How is Bitcoin shifting from a store of value to a medium of exchange?

Bitcoin’s adoption as a payment method is growing due to the Lightning Network, which enables fast and low-cost transactions. More retailers, remittance services, and users are now using BTC for everyday purchases.

2. What is the Lightning Network, and why is it important?

The Lightning Network is a layer-2 solution for Bitcoin that facilitates instant transactions with minimal fees, making Bitcoin more practical for daily spending.

3. How did researchers estimate 650 million Bitcoin users?

The report compiled user data from major crypto platforms like Binance, Coinbase, and peer-to-peer networks such as Paxful, which collectively serve millions of users.

4. How does Bitcoin compare to stablecoins as a payment method?

While stablecoins provide price stability, they are centralized and tied to fiat currencies. Bitcoin, however, is decentralized, resistant to inflation, and gaining traction as a borderless payment solution.

5. Can Bitcoin really replace traditional payment systems like Visa or Mastercard?

While Bitcoin payments are growing, major credit card networks still process far more transactions daily. However, Bitcoin’s use in cross-border payments, micropayments, and remittances is rapidly expanding.

Glossary of Key Terms

Bitcoin (BTC): A decentralized digital currency used as both a store of value and a medium of exchange.

Lightning Network (LN): A layer-2 scaling solution that enables fast, low-cost Bitcoin transactions.

Layer-2 Solution: A technology built on top of a blockchain to improve scalability and transaction speed.

HODL: A slang term in the crypto community meaning to hold Bitcoin long-term rather than spending or selling.

Stablecoins: Cryptocurrencies pegged to fiat currencies (e.g., USDT, USDC) to maintain a stable value.

Remittances: Money transfers, often sent by individuals working abroad to their home countries.

Peer-to-Peer (P2P) Transactions: Direct transactions between individuals without intermediaries like banks.