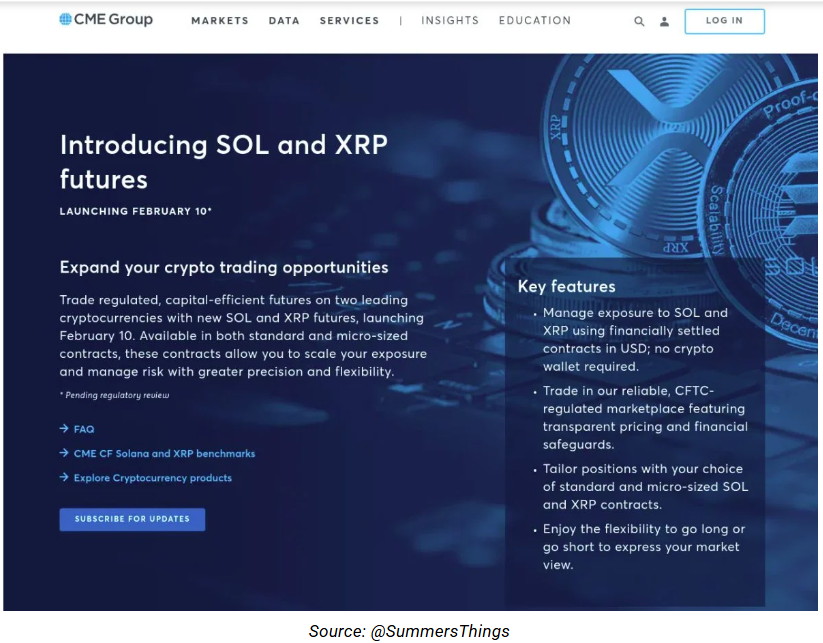

In a highly anticipated move, the Chicago Mercantile Exchange (CME) has reportedly scheduled futures contracts for XRP and Solana to debut on February 10th of 2025, pending the necessary regulatory go-ahead. This news was unintentionally shared after a leaked webpage on CME’s staging site was promptly taken down, though not before generating widespread online chatter across the financial industry regarding the development’s implications.

CME’s Expansion into Altcoin Futures

The leaked details revealed Chicago Mercantile Exchange’s plans to offer both conventional and micro-sized futures agreements for Solana and XRP. The standard contracts for Solana would encompass 500 units of SOL, while the micro agreements would contain 25 SOL. XRP futures are projected to be accessible in lots of 50,000 XRP for typical contracts and 2,500 XRP for the smaller versions. All deals would be settled in American dollars, giving dealers diverse means like direct futures, basis trades at the conclusion of the index, and sizeable trades.

James Seyffart, a Bloomberg ETF analyst, commented on the possible launch, stating that

“If the provisional site accurately reflects CME’s intentions, the 10th of February is likely the debut date.” He further noted this type of move is “mostly anticipated,” indicating CME’s strategic expansion into the altcoin futures marketplace.

Market Reaction and Price Movements

The anticipation of these new futures contracts has already impacted the market. Following the leak, both XRP and SOL experienced a 3% price surge, reflecting investor optimism about the forthcoming trading options. As of January 23, 2025, XRP is trading at $3.14, while Solana stands at $251.28.

Regulatory Landscape and Industry Implications

The introduction of XRP and Solana futures contracts on the CME exchange aligns with the burgeoning institutional interest in diversifying into novel cryptocurrency assets. This consequential move takes place against the backdrop of progressive regulatory changes. Upon assuming the presidency, Donald Trump instituted a more cryptocurrency-accommodating administration, appointing Paul Atkins as the new SEC chairman. Atkins is known for advocating less restrictive crypto policies, a strategic shift expected to expedite the approval and debut of diverse digital asset-pegged monetary instruments.

In December 2024, Volatility Shares submitted a registration statement with the SEC towards a Solana futures-based ETF that seeks to follow Solana’s cost movements through CFTC-regulated futures agreements. This registration encompasses products supplying 1x, 2x levered, and -1x inverse exposure to Solana, allowing dealers to benefit from both ascending and declining price action. Such initiatives indicate a developing demand for regulated investment vehicles within the digital currency sphere.

Future Outlook for Crypto ETFs

The impending launch of XRP and Solana futures on CME could pave the avenue for the emergence of exchange-traded finances (ETFs) based totally on those digital belongings. Industry experts foresee a tidal wave of recent crypto ETFs in 2025, including the ones focusing on XRP and Solana. Bloomberg analyst Eric Balchunas noted that following the approval of Bitcoin and Ethereum ETFs, the market is likely to discern ETFs for different cryptocurrencies, stating,

“We predict a tsunami of cryptocurrency ETFs next year… then possibly Litecoin… then HBAR… and afterwards XRP/Solana.”

The evolving regulatory panorama, coupled with burgeoning institutional interest, suggests a promising destiny for diversified crypto investment products. The anticipated approval of extra crypto ETFs is predicted to draw substantial capital inflows, further legitimizing and stabilizing the cryptocurrency market. New rules may additionally support a wider variety of token-based ETFs seeing the light of day, delivering greater risk-adjusted returns for traders.

Summing Up

The forthcoming introduction of XRP and Solana futures contracts on the CME exchange represents a landmark moment denoting the maturing cryptocurrency market. By expanding the array of derivatives available and embracing digital assets, this progressive step reflects a regulatory approach that is increasingly receptive. As the sphere continues evolving, market participants can look ahead to a milieu for cryptocurrency exchange and investment that is more encompassing and governed.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. What are XRP and Solana futures?

XRP and Solana futures allow dealers to speculate on the impending pricing of XRP and Solana devoid of fundamentally possessing the underlying resources.

2. When will XRP and Solana futures launch on CME?

A leaked page proposed a plausible launch on February 10, 2025, pending official endorsement, but CME has not validated this date.

3. Why is this launch significant?

The rollout could attract institutional investors, furnish hedging instruments, and pave the route for added regulated crypto investment vehicles like exchange-traded funds.