Ripple CEO Brad Garlinghouse made news this week by predicting that the stablecoin business could reach $1-2 trillion in the coming years. Garlinghouse, speaking on CNBC’s Squawk Box, highlighted rising institutional interest, asset tokenization, and an evolving regulatory environment as important drivers.

“The demand for transparency, regulation, and speed in global payments is propelling stablecoins forward in a way that reminds me of early Bitcoin adoption,” Ripple CEO Garlinghouse told the audience.

The stablecoin market is currently worth over $250 billion, with USDT and USDC leading the way. Ripple’s new stablecoin, RLUSD, is gaining traction as it is backed by BNY Mellon and integrated into Ripple’s business blockchain payment platform. With an early adoption of over $500 million in market value, RLUSD illustrates Ripple’s willingness to compete with Circle and Tether.

The Historical Path: From Niche to Necessity

Stablecoins originated as basic on-chain tools for liquidity and arbitrage. However, in the last five years, they have emerged as the fundamental layer for decentralized finance, cross-border settlements, and even corporate treasury administration.

In 2020, the whole stablecoin market was only $30 billion. By 2023, it had grown to $150 billion, thanks in significant part to DeFi protocols and CEX trading pairings. Regulatory clarity remained hazy, but with bipartisan US measures like the GENIUS Act on the table, stablecoins are poised to join the mainstream.

“Stablecoins will form the foundation of tokenized payments. Their programmability and 24/7 settlement capabilities make them preferable to traditional fiat,” said Henrik Andersson, CIO at Apollo Capital.

Mainstream banking organizations are beginning to embrace stablecoins. JP Morgan’s JPM Coin, Societe Generale’s EURCV, and Visa’s stablecoin settlement experiments have paved the way. With tokenized fiat infrastructure developing, stablecoins are poised for exponential development.

The Goal to $2 Trillion

There are three broad categories of triggers driving the stablecoin industry towards the trillion-dollar threshold:

- Institutional adoption: Stablecoins are being used by hedge funds, payment processors, and corporations for faster, cheaper remittance and settlements.

- Regulatory support: With laws like the GENIUS Act anticipated to pass in the United States Congress, legal certainty is expected to attract conservative investors.

- Monetary utility: In Latin America and Asia, stablecoins are used for savings, yield creation, payroll, and bond tokenization.

Ripple’s RLUSD isn’t the only stablecoin attracting attention. Circle (USDC) just posted its best quarter yet, with earnings up thanks to interest on US Treasury holdings. Circle’s stock (CRCL) rose 28% in Q2 2025 after a successful IPO, indicating increased investor confidence.

However, not all outlooks are as rosy. JPMorgan forecasts a more conservative $500 billion stablecoin market by 2028, noting retail adoption obstacles and competition from central bank digital currencies (CBDCs).

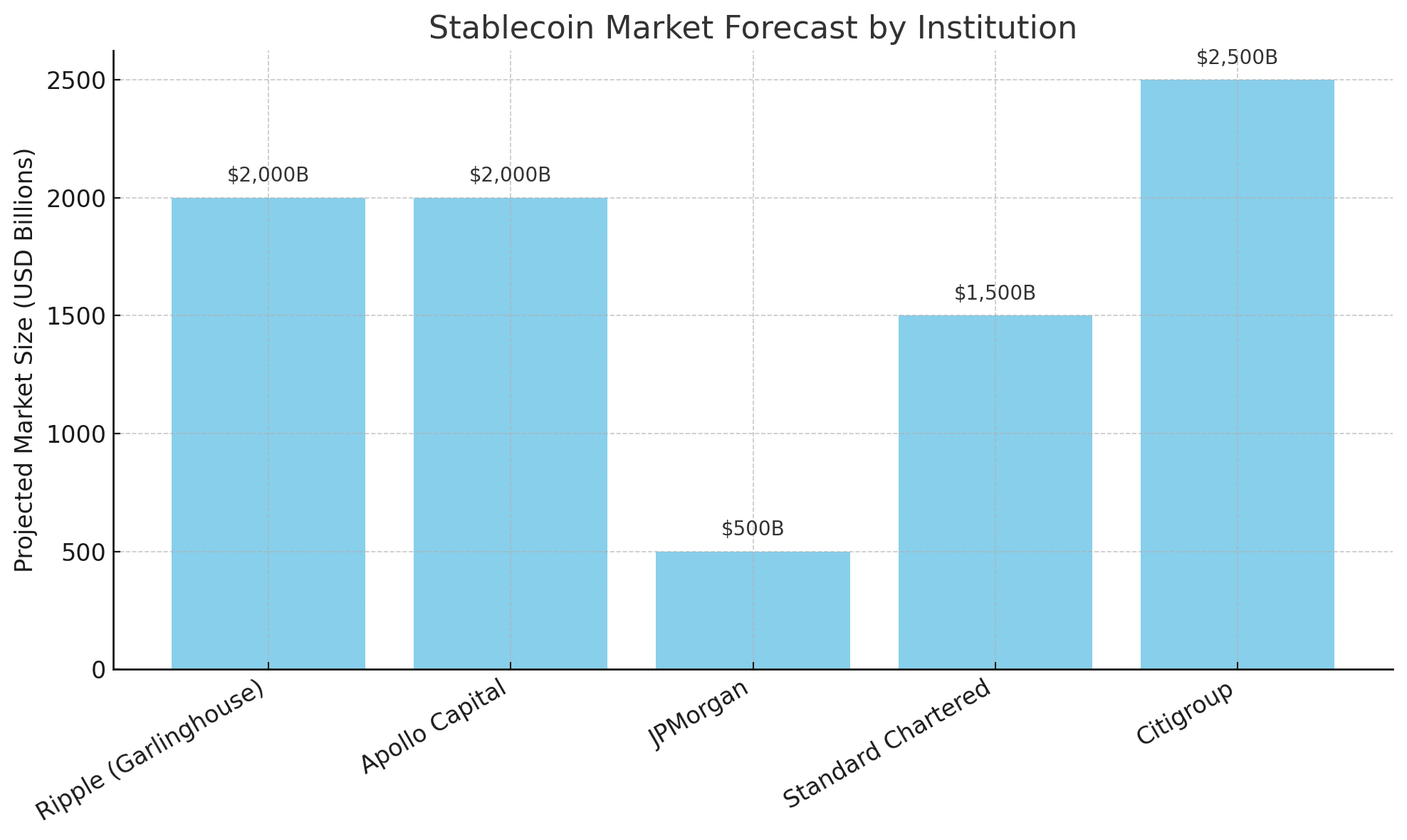

Stablecoin Market Forecasts

| Institution | Forecast Size | Target Year | Notes |

|---|---|---|---|

| Ripple (Garlinghouse) | $1–2 trillion | 2028 | Driven by RLUSD, regulatory support |

| Apollo Capital | $2 trillion | 2027–2028 | DeFi, payroll, and treasury tokenization |

| JPMorgan | $500 billion | 2028 | Crypto-native usage dominates |

| Standard Chartered | $1.5 trillion | 2029 | Assumes partial regulatory harmonization |

| Citigroup | $2.5 trillion | 2030 | Global adoption and integration with banks |

Investors Should Take Note

If Ripple CEO Garlinghouse’s prognosis is correct, stablecoins will no longer be specialized tools for cryptocurrency traders. They will be key components of the global payments stack. For investors, this offers potential not just in cryptocurrencies such as RLUSD, USDC, and USDT, but also in platforms, custodians, and protocols that enable their use.

It is a story that is consistent with escalating geopolitical developments. Nations aiming to avoid SWIFT, corporations looking to reduce FX slippage, and digital-native customers desiring speedier financial flow will all promote stablecoin adoption. The question is not “if,” but “when.”

Overview

Ripple CEO Brad Garlinghouse’s audacious estimate that the stablecoin industry would exceed $1-2 trillion in the next several years. It identifies the major causes of this expansion, including as institutional acceptance, regulatory clarification through the GENIUS Act, and the increasing usage of stablecoins in global payments. Ripple’s RLUSD stablecoin compares estimates from big financial organizations, such as JPMorgan and Citigroup, and examines how this trend might transform banking.

FAQs

Q: What is a stablecoin?

A: A cryptocurrency pegged to a stable asset like the U.S. dollar, designed to minimize price volatility.

Q: What is RLUSD?

A: Ripple’s enterprise-grade stablecoin, backed 1:1 with USD and managed via institutional-grade custody.

Q: Why is the GENIUS Act important?

A: It would legalize and regulate USD-backed stablecoins, unlocking U.S.-based adoption.

Q: Are stablecoins safe?

A: If backed by reserves and issued under regulatory oversight, they are generally low-risk compared to volatile tokens.

Glossary of Key Terms

Stablecoin market growth: The increase in global stablecoin supply and utility across financial sectors.

RLUSD: Ripple’s enterprise-focused stablecoin.

GENIUS Act: Proposed U.S. legislation to regulate and authorize stablecoins.

CBDC: Central Bank Digital Currency issued by governments.