Ripple is not just playing the crypto game anymore — it’s rewriting the rules. With its acquisition of Hidden Road, a traditional finance prime brokerage, Ripple has stepped squarely into institutional territory. And with FINRA’s latest green light, the move just got a lot more serious.

Ripple’s Hidden Weapon: Hidden Road Gains FINRA Approval

Ripple-backed Hidden Road has officially secured a broker-dealer license from the Financial Industry Regulatory Authority (FINRA), unlocking the firm’s ability to offer prime brokerage services, clearing, and financing across multiple asset classes — particularly fixed income — to institutional clients.

The approval is seen as a game-changer for Ripple’s long-term strategy. Industry watchers say this development not only legitimizes Ripple’s ambition to serve institutional finance but also signals its evolving identity beyond payments and crypto.

“Ripple is clearly positioning itself as a full-scale financial infrastructure provider,” noted a London-based fintech analyst. “This is no longer just about XRP — it’s about building a Wall Street-grade ecosystem around blockchain.”

From Blockchain Roots to Wall Street Ambitions

Hidden Road, once a relatively niche player, was acquired by Ripple in a $1.25 billion deal — a bold bet that traditional finance and blockchain are no longer parallel tracks but converging at high speed.

With this acquisition, Ripple becomes the first crypto-native firm to own and operate a multi-asset prime brokerage platform. This is significant because it opens doors for Ripple to offer integrated services including:

Institutional crypto custody

Cross-border settlements via the XRP Ledger

Real-time liquidity sourcing

Stablecoin-based trade collateralization

Ripple plans to deploy its upcoming stablecoin, RLUSD, as collateral for cross-asset financing — a move that could reshape how brokers approach credit and settlement efficiency.

Institutional Focus: What This Means for Finance

Hidden Road’s broker-dealer license doesn’t just give Ripple more regulatory credibility; it unlocks deeper partnerships with hedge funds, asset managers, and banks that traditionally avoid crypto-native firms.

With the license, Hidden Road can now clear U.S. Treasuries, repo trades, and even digital asset derivatives — all under the Ripple banner. This marks a substantial leap in Ripple’s ability to plug into the multi-trillion-dollar traditional finance ecosystem.

A Ripple spokesperson commented, “Our goal is to create a bridge between blockchain and the existing financial system. This milestone lets us deliver regulated, trusted, and scalable infrastructure to institutional players.”

What About XRP?

Although XRP itself wasn’t the focal point of the acquisition, the token still stands to benefit.

By integrating XRP Ledger into the post-trade infrastructure, Ripple could drastically reduce settlement times and costs for institutional trades. Faster clearing could lead to more liquidity, and that could ultimately translate to greater utility and demand for XRP.

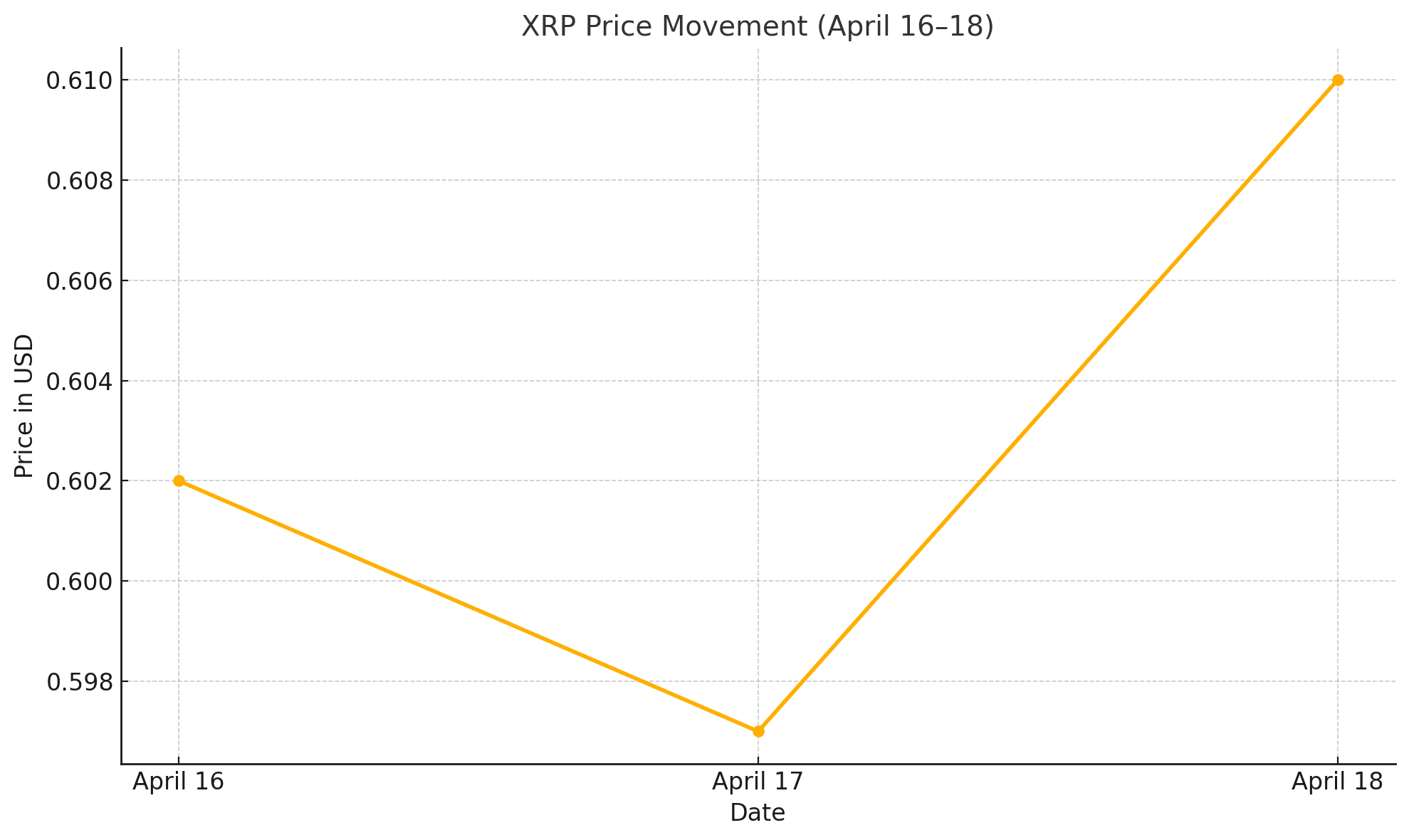

At press time, XRP is trading at $0.61, up 2.1% over the past 24 hours. Market analysts believe the regulatory approval and institutional positioning may provide long-term bullish momentum.

XRP Price Table

| Date | Price (USD) | 24h Change | Market Cap |

|---|---|---|---|

| April 18 | $0.61 | +2.1% | $33.2 Billion |

| April 17 | $0.597 | -1.3% | $32.5 Billion |

| April 16 | $0.602 | +0.5% | $32.8 Billion |

Conclusion

Ripple’s acquisition of Hidden Road and the newly acquired FINRA broker-dealer license is more than a headline — it’s a signal of serious intent. As traditional and decentralized finance increasingly intertwine, Ripple is carving a path few others in the space have dared to tread. With institutional finance now within arm’s reach, Ripple’s long game appears more strategic — and ambitious — than ever.

FAQs

What is Hidden Road?

Hidden Road is a prime brokerage firm that offers institutional clients services like clearing, financing, and trading support across multiple asset classes.

Why did Ripple acquire Hidden Road?

Ripple aims to expand its services beyond crypto payments and into full-fledged financial infrastructure, tapping into institutional finance.

How will XRP benefit from this?

By integrating XRP Ledger into brokerage infrastructure, Ripple could boost XRP’s utility in institutional settlements.

What is RLUSD?

RLUSD is Ripple’s upcoming USD-backed stablecoin designed for use in enterprise-grade finance and collateralization of trades.

Glossary of Key Terms

Broker-Dealer License: Regulatory permission allowing firms to trade securities on behalf of clients and themselves.

Prime Brokerage: A bundled service provided to institutional clients for trading, lending, and operational needs.

FINRA: Financial Industry Regulatory Authority, a U.S. regulatory body overseeing broker-dealer firms.

XRP Ledger: A decentralized blockchain platform designed for fast and low-cost cross-border payments.

Stablecoin: A digital asset pegged to the value of a fiat currency, like the U.S. dollar.

Sources:

FINRA – Broker-Dealer Registration – FINRA Official Site