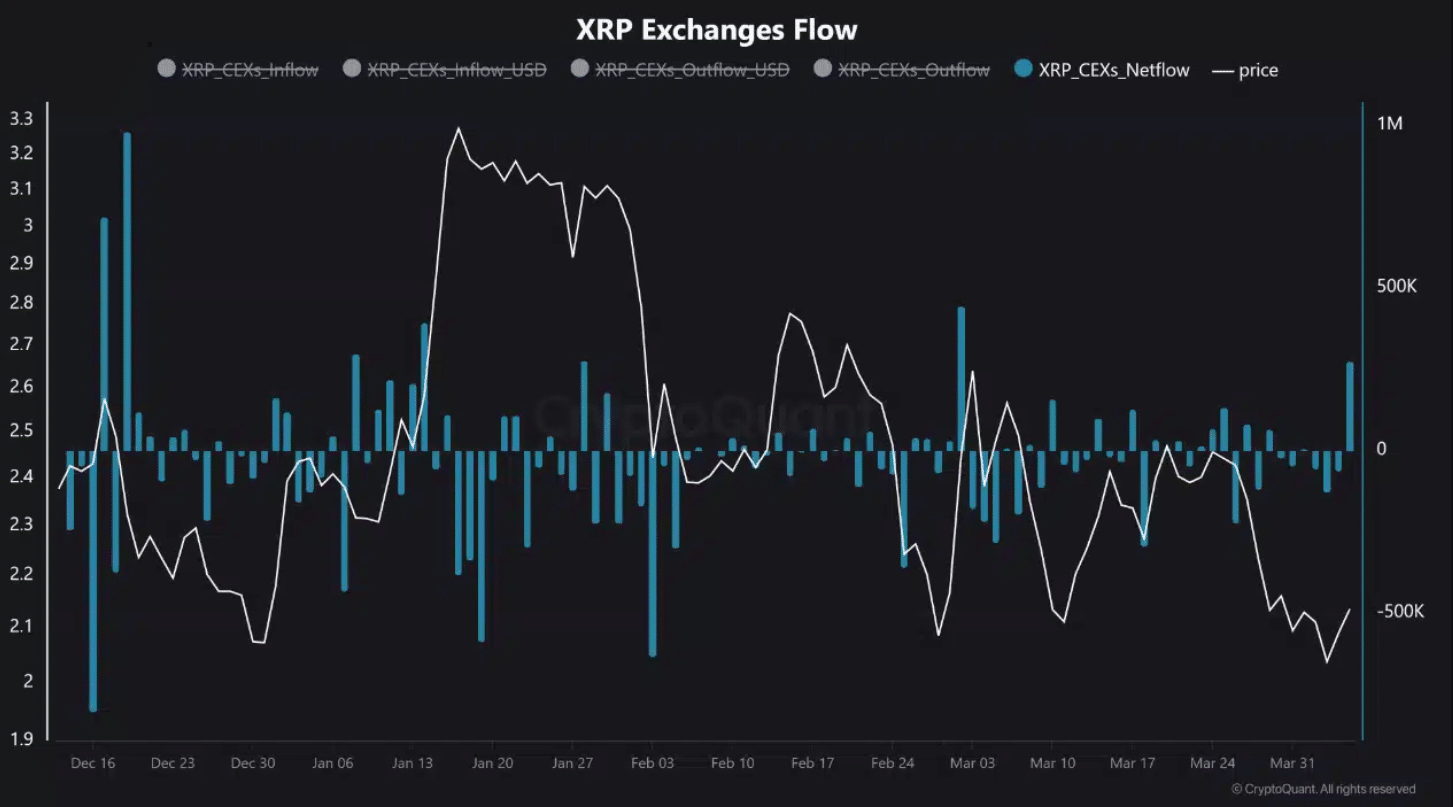

As Bitcoin drags beneath the $74,000 mark, the cryptocurrency market witnessed a notable development: a net inflow of 275,000 Ripple’s XRP tokens into centralized exchanges. This movement has sparked discussions among financial analysts, crypto enthusiasts, and blockchain developers regarding its implications for XRP’s price trajectory and the broader market sentiment.

CryptoQuant data confirms this inflow, noting it’s the largest for XRP in weeks. This comes at a time when overall altcoin momentum is slowing and traders are wary of Bitcoin’s next step. Bitcoin’s sideways action acts like a pause button on confidence, especially for secondary tokens like XRP.

When Exchanges Light Up: Risk Rotation or Smart Hedging?

Token inflows to exchanges typically imply preparation to sell. That doesn’t guarantee dumping, but it sets the scene for volatility. April’s move marks a return of XRP to trading floors, signaling a possible rotation out of riskier positions—or a setup for a sharp market play.

The backdrop? Bitcoin is stuck below a resistance ceiling, with global altcoin fatigue and whispers of tightening regulations in South Korea. These all weigh heavily on sentiment. Asian investors, who represent a key demographic for Ripple (XRP), may be repositioning early.

XRP Isn’t Crashing—But Sentiment Is Shifting

There’s no crash—yet. XRP is still trading above $2.00, hovering near $2.14 at press time. But behavior is changing. Capital is moving with purpose. When tokens move in bulk to exchanges, it usually means one thing: liquidity is about to meet demand.

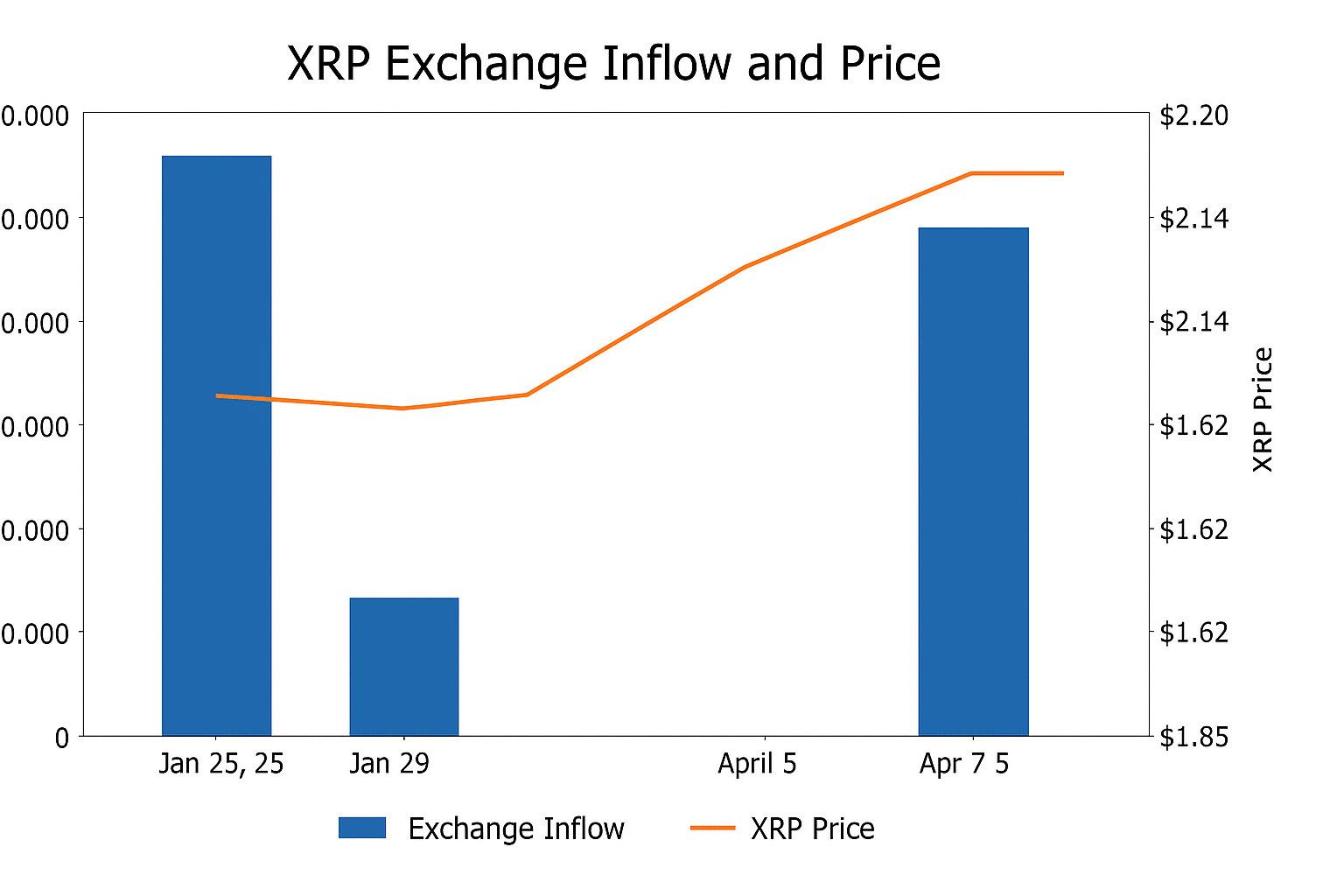

This pattern mirrors January 2025, when similar inflows led to a price dip within days. Analysts are watching closely. If Bitcoin fails to punch past its $74K resistance, XRP might face downward pressure. But if Bitcoin rallies, Ripple (XRP) could pivot just as fast.

XRP Price Snapshot: Before and After the Move

| Date | Exchange Inflow | XRP Price |

|---|---|---|

| Jan 25, 2025 | 280,000 XRP | $1.85 |

| Jan 29, 2025 | – | $1.62 |

| Apr 5, 2025 | 275,000 XRP | $2.14 |

| Apr 7, 2025 | TBD | TBD |

Source: CryptoQuant, CoinMarketCap

Silver Lining: Could This Be a Setup for a Breakout?

Despite the cautious tone, there’s an optimistic angle. Exchange inflows don’t always lead to panic selling. Sometimes, they precede rallies when smart money anticipates a reversal. XRP’s fundamentals remain strong, especially with Ripple continuing to push for institutional adoption and cross-border payments.

Source: CryptoQuant

If Bitcoin stabilizes or surges, Ripple (XRP) could ride that wave. The altcoin has shown resilience before. Its legal clarity in the U.S., following partial wins in regulatory battles, provides a foundation that other tokens lack. This could turn today’s caution into tomorrow’s momentum.

What Comes Next? Watching Bitcoin, Watching Volume

Short-term, eyes are locked on Bitcoin. Its failure to break above $74K could pressure altcoins. If that resistance holds, XRP might test lower support zones—possibly around $1.95. But if Bitcoin punches through, XRP could surge to $2.30 and beyond.

Market watchers should focus on volume spikes, sentiment indicators, and regulatory headlines. Exchange balances, whale wallet movements, and Asia-Pacific policy updates will all shape XRP’s path in the coming days.

Frequently Asked Questions

What does XRP’s 275,000-token inflow mean?

It signals a possible increase in selling pressure, as large volumes moving to exchanges often precede trades.

Is XRP likely to drop in the short term?

It depends on Bitcoin’s next move. If Bitcoin fails to rally, XRP could decline. If Bitcoin surges, XRP might rally too.

Could this inflow be a bullish signal?

Yes. Sometimes, large exchange deposits are made in anticipation of a breakout or liquidity event.

What should traders watch next?

Bitcoin’s performance, exchange order books, and news from Asia regarding crypto regulations will be key indicators.

Glossary

Net Inflow: The difference between tokens entering and exiting exchanges. A high net inflow often implies selling intentions.

Centralized Exchange (CEX): A trading platform controlled by a company, allowing users to buy, sell, or hold cryptocurrencies.

Resistance Level: A price point where an asset historically struggles to move above, often attracting selling.

Risk Rotation: When investors shift their capital from riskier to more stable assets based on market sentiment.

Liquidity: The availability of assets for trading without causing large price swings. High liquidity allows for smoother trades.

Sources

.CoinDesk