On-chain data has revealed that Ripple has moved 130 million XRP, worth approximately $283 million, to multiple unknown wallets. These large transfers are stirring questions about the near-term trajectory of the XRP price, especially as bearish technical patterns surface.

According to blockchain monitoring service Whale Alert, the transfers were completed on June 2, with the largest single movement involving 109 million XRP. The sending wallet, identified as “Mb3PEv,” transferred the funds to “DJoAys” and two other anonymous wallets. Interestingly, these wallets appear to have links to Ripple insiders, including Ripple chairman Chris Larsen, based on historic activity from December 2023.

This large-scale transaction took place shortly after Ripple’s routine monthly escrow unlock, further fueling speculation that the tokens might soon re-enter circulation and put downward pressure on the XRP price.

Technical Indicators Signal Possible Drop to $2

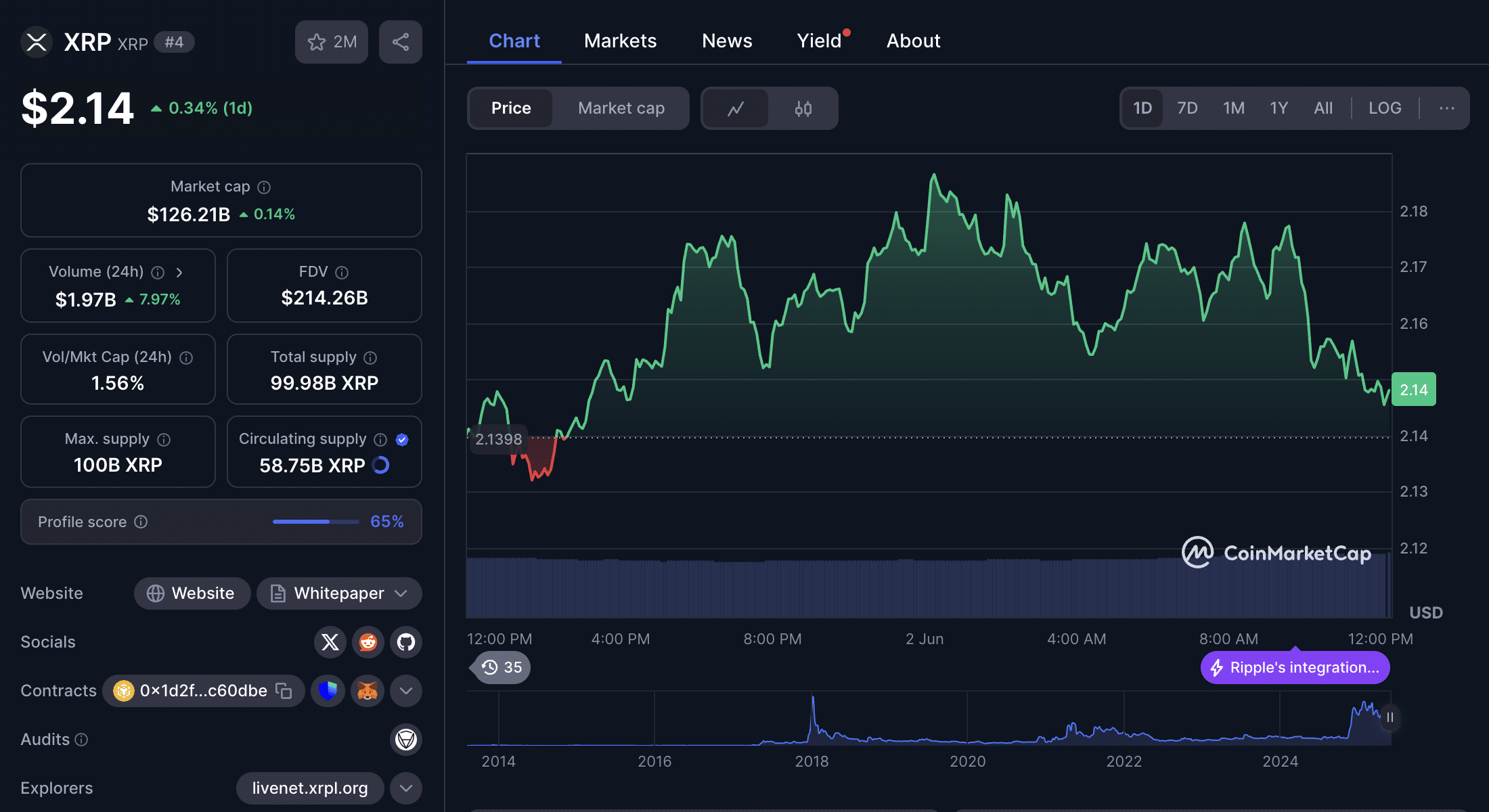

The XRP price currently hovers around $2.14, with a narrow trading range between $2.13 and $2.19 over the past 24 hours. Despite ongoing bullish narratives, such as growing institutional interest, potential ETF approvals, and rumors of U.S. strategic reserves including XRP, the token has struggled to maintain upward momentum.

On the technical front, the daily chart reveals a troubling ‘death cross’ pattern: the 50-day simple moving average (SMA) has crossed below the 200-day SMA. Such a crossover traditionally signals a weakening market trend and can lead to significant price drops if selling pressure intensifies. Other tools, such as Bollinger Bands and exponential moving averages, are also reflecting growing bearish sentiment.

The Relative Strength Index (RSI) is another concern. At 40, the RSI approaches the oversold zone. This indicates reduced buying power and suggests that more traders are stepping back, likely Escrow Unlock due to macroeconomic uncertainties such as ongoing U.S.-EU tariff disputes.

Leverage and Tariffs Intensify Market Risk

Adding to the pressure on XRP price, analysts have noted that recent price gains were largely driven by leveraged long positions. These highly speculative bets can accelerate downward moves when sentiment shifts, making XRP vulnerable to rapid sell-offs.

According to insights from CryptoQuant, the current setup could create favorable conditions for shorting, provided risk management strategies are in place. The muted 4% rise in trading volume over the past 24 hours further suggests a lack of strong buyer conviction, reinforcing the idea that caution dominates the market.

Moreover, broader market conditions remain tepid. Concerns over global economic trends and lingering uncertainty surrounding tariff policies are pushing many investors to adopt a wait-and-see approach, delaying fresh inflows into volatile assets like XRP.

Ripple’s Transaction History Raises Eyebrows

While large transfers from Ripple aren’t new, the timing and scale of this particular batch have triggered renewed speculation. Past transfers to similar wallets occurred just before notable price corrections, adding to fears that the recent $283 million movement could precede another dip in XRP price.

Some market watchers believe that these transactions could simply be internal wallet rebalances or strategic reserve movements. Still, others argue that Ripple’s intention might be to gradually release XRP into the market, especially if the company anticipates lower valuations ahead.

Market Sentiment Remains Divided

Community sentiment around XRP price is currently split. On one hand, proponents remain hopeful about potential catalysts such as ETF approvals and greater institutional adoption. On the other, technical analysis and macro headwinds suggest that the path of least resistance could be downward.

Despite the weakening trend, not all hope is lost. Some traders view this as a potential dip-buying opportunity, especially if external fears like those surrounding trade tariffs, begin to ease. A revival in risk appetite could prompt a short-term bounce, although such a move would need strong volume support to signal sustainability.

Conclusion: XRP Price at a Crossroads

Ripple’s $283 million XRP transfer has come at a time of heightened technical and macroeconomic tension. With the emergence of a death cross and weakened RSI, the outlook for XRP price in the short term remains bearish. The coin risks falling to $2 or even lower if selling pressure intensifies or leveraged long positions unwind.

However, the situation is not entirely bleak. Strategic investors may find opportunity in the downturn, particularly if market conditions stabilize. For now, the focus remains on whether XRP can hold its current support levels or if it will breach key psychological thresholds.

FAQs

What is a death cross and why is it significant for XRP price?

A death cross occurs when the 50-day moving average crosses below the 200-day moving average. It’s a bearish signal suggesting a possible extended downtrend in XRP price.

Why did Ripple transfer 130 million XRP?

The transfers are likely part of routine operations or reserve strategies, though the timing has raised concerns about a possible dump, especially as they follow Ripple’s monthly escrow unlock.

Is XRP still a good investment amid this volatility?

XRP remains a popular token with strong fundamentals, but short-term traders should be cautious due to the current bearish indicators and macroeconomic pressures affecting XRP price.

Could the XRP price drop below $2?

Technical patterns and market sentiment suggest that a drop to $2 is possible, especially if selling intensifies or broader market conditions deteriorate.

Glossary

XRP Price: The current market valuation of one XRP token, commonly influenced by trading activity, news, and macroeconomic trends.

Death Cross: A bearish technical chart pattern where a short-term moving average crosses below a long-term moving average.

RSI (Relative Strength Index): A momentum indicator used to measure the speed and change of price movements.

Escrow Unlock: A scheduled release of XRP tokens held by Ripple, typically occurring monthly and adding supply to the market.

Whale Alert: An on-chain analytics tool that tracks large cryptocurrency transactions and provides public alerts.