According to various court records and commentaries on the law, the Ripple SEC Lawsuit has reached its final chapter. The case has been in the courts for over three years. Still, recent news suggests that both Ripple and the U.S. Securities and Exchange Commission are now sitting in anticipation of a court decision regarding a joint motion filed by both parties.

That decision could have a long-ranging impact on either future digital asset standing in the U.S. or, specifically, XRP.

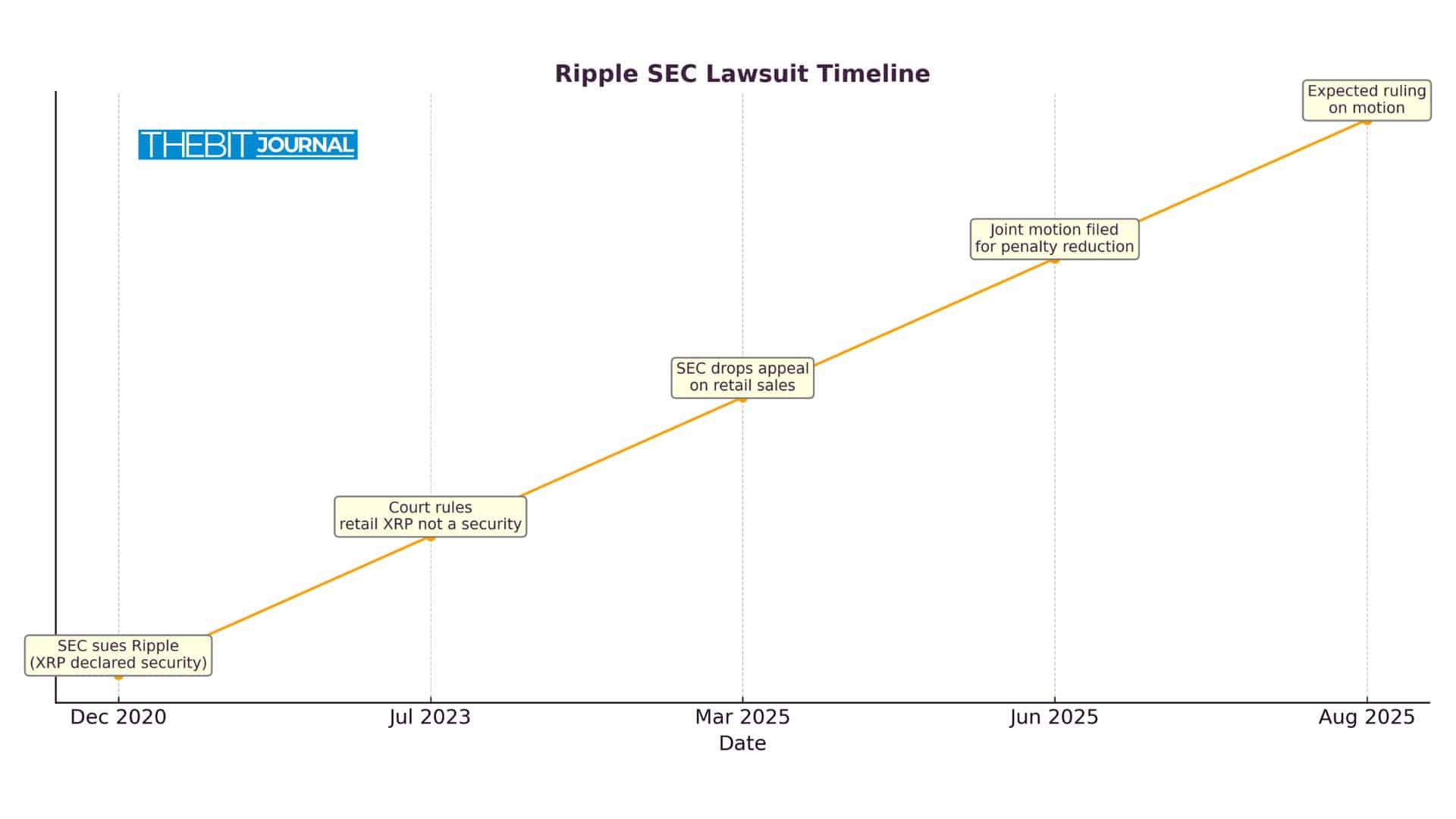

Timeline of the Ripple SEC Lawsuit

The Ripple SEC Lawsuit began in December 2020, when the SEC essentially charged Ripple Labs with selling XRP as an unregistered security. Key developments have happened since then:

- July 2023: The U.S. government found that sales of XRP on a retail level were not found by the court to violate the securities laws. The institutional sales were found by the court to have violated securities laws.

- March 2025: The SEC withdraws its appeal concerning the issue of the court’s retail ruling;

- June 2025: Ripple and the SEC filed a joint motion concerning penalties and restrictions on future sales of XRP;

- August 15, 2025: Date for a final status update and possible ruling.

The focus of the lawsuit has now turned toward establishing penalty payments and lifting the injunction that prohibits Ripple from selling XRP on a wholesale basis.

Why the Delay? Insights from Legal Experts

Several crypto law analysts, including former SEC officials, have weighed in. According to attorney Bill Morgan, the current delay is not unusual. He explained that the holdup stems from Ripple’s motion to reduce its $125 million penalty and lift the injunction on institutional XRP sales. These motions must be reviewed and signed by the judge before final closure.

“According to prominent legal expert Bill Morgan, Ripple is the source of the holdup because it wants the injunction dissolved.”

In a separate interview, Morgan added:

“The market is quiet now, but the next court ruling could trigger real movement for XRP. Investors know this case is about more than just Ripple—it’s about how far the SEC can reach into crypto.”

These statements reflect a shared view across legal circles: this is not a delay in dispute but a final procedural phase before the court wraps up.

The Bigger Picture for Crypto Regulation

In the United States, the Ripple SEC Lawsuit has become an essential resource for crypto regulation. It has already set precedents for an understanding that all token sales do not fall under the definition of securities law.

If Ripple were to succeed in having the injunction on institutional sales lifted, this could lead to greater flexibility for token-related businesses.

From the viewpoint of regulatory practitioners, many experts also feel this case might have a bearing on courts’ treatment of future token offerings. As digital assets gain the public’s interest, having clear legal demarcations will ensure that companies and investors make appropriately informed decisions.

What Comes Next?

The judge is expected to respond to the joint motion before or on August 15. If approved:

- The penalty may be reduced.

- Institutional XRP sales may resume.

- The case will likely conclude without further appeals.

If the judge disagrees with the proposed terms, either party could file another motion or appeal. However, most observers agree that both sides want closure.

Conclusion

The Ripple SEC Lawsuit is nearing the end of the curtain. After a spate of trials, counter-appeals, and minor judgments, the only thing remaining is the court’s acceptance of the terms of the settlement.

That will resolve the question of XRP’s legal status within the U.S., and from then on, Ripple will be able to go about its institutional business free of any legal encumbrances.

Investors, developers, and regulators are watching closely. The outcome will not only have implications for Ripple; it may determine how crypto firms can work under U.S. law for years afterward.

Summary

The Ripple SEC Lawsuit is nearing its final phase as both parties await a judge’s decision on penalties and future XRP sales. With significant legal points already resolved, the case now depends on court approval of a joint motion. Experts believe a ruling could arrive soon, shaping Ripple’s next steps and influencing how crypto firms handle regulation in the U.S. Investors are watching closely for what comes next.

FAQs

Q1: What is really at stake in the Ripple SEC lawsuit?

The primary issue at stake in the lawsuit is whether Ripple’s sale of XRP constitutes an offering of securities under applicable U.S. law.

Q2: Is XRP a security?

A court ruled in 2023 that XRP sold to retail buyers is not a security. Institutional sales were found to violate securities law.

Q3: What is the next step in the lawsuit?

The judge is reviewing a joint motion from Ripple and the SEC, which includes penalty adjustments and removal of sale restrictions.

Q4: When is the expected end of the case?

The next update from the courts is due on or before August 15, 2025, but a decision could come much sooner.

Glossary of Key Terms

XRP: The monetary unit of Ripple for cross-border payments.

SEC: U.S. Securities and Exchange Commission-an agency under the Federal Government for regulating securities.

Institutional Sales: The sale of tokens to large-scale investors or organizations as opposed to the general public.

Injunction: Prohibitory Order Restricting Certain Actions, in this case, Ripple selling to institutions.

Appeal: A Power Given by Law to Seek Further Review in the Judgement by the Higher Courts.