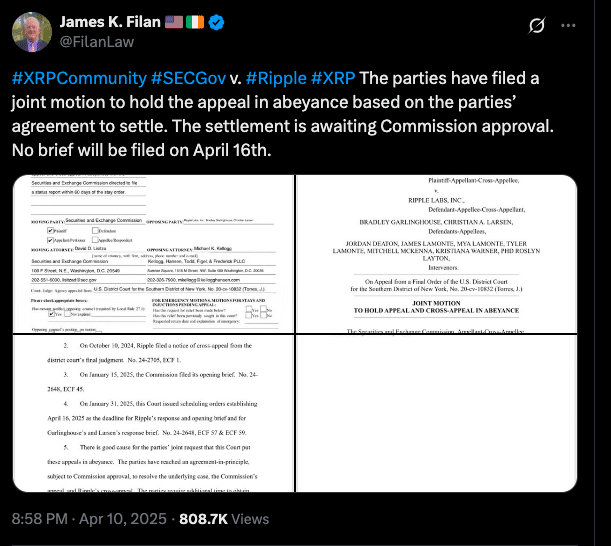

The long running legal battle between ‘Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has seen a new turn. On April 10, 2025’ both parties filed a joint motion to pause their appeals, citing an “agreement in principle” to settle all outstanding issues.

According to the court filing, Ripple and the SEC are asking to hold the appeals “in abeyance” to allow time to finalize the settlement terms. The SEC commissioners still need to approve those terms. The motion explicitly states that the stay applies to both the SEC’s appeal of the district court’s prior judgment and Ripple’s cross-appeal, which also includes claims against co-founders Brad Garlinghouse and Chris Larsen.

“This joint motion is a rare moment of agreement between regulators and innovators in crypto,” said James K. Filan, a defense lawyer following the case. “If approved it will bring long overdue clarity to digital assets like XRP.”

The End of an Era?

Based on available ‘data, the SEC sued Ripple Labs in December 2020 ‘alleging the company conducted an unregistered securities offering by selling XRP. ‘Ripple has always maintained that XRP is a digital ‘currency, not a security and therefore outside the SEC’s jurisdiction. The case has been a test for how ‘US regulators treat cryptocurrencies and has fueled broader debates around ‘jurisdiction and enforcement.

In a post on X (formerly Twitter), James Filan published the court filing that ‘confirmed both sides had “agreed to settle” and would not be filing briefs on April 16 as previously scheduled. The settlement framework reportedly covers penalties, legal obligations and executive liability but the details are still under wraps pending approval.

Ripple Won Part of the Case in 2023

The motion follows Ripple’s win in 2023 when U.S. District Judge Analisa Torres ruled that XRP sales on public exchanges did not constitute investment contracts, a big win for Ripple that upended regulatory assumptions. However the court also found that Ripple’s institutional sales of XRP violated securities laws leaving room for the SEC’s appeal.

In March 2025, Ripple announced that the SEC had agreed to dismiss its appeal if Ripple dropped its cross-appeal. Stuart Alderoty, Ripple’s Chief Legal Officer, later confirmed that both sides had agreed to this condition and the penalty.

“We’re happy to put this behind us with a $50 million penalty — a third of what was asked for,” Alderoty said in a March 25 press release. “This sets a good precedent for the entire digital asset space.”

The original $125 million penalty was reduced by 60% as regulators seem to be more open to negotiated outcomes in crypto cases.

Industry Implications and Regulatory Signals

Just days ago the SEC filed a similar request in the Gemini case, asking for a temporary pause to finalize a settlement over the Gemini Earn program. The SEC is willing to negotiate rather than litigate, which could be a sign of a shift in their approach to digital assets.

“If this trend continues we might be looking at the beginning of a more cooperative regulatory era,” said Philip Moustakis, former SEC enforcement attorney and current counsel at Seward & Kissel LLP. “Settlements like Ripple’s could be the foundation of future crypto governance.”

Ripple’s legal team also hinted that the end of the litigation could clear the way for an XRP ETF, something that industry analysts say won’t face the same resistance that Bitcoin and Ethereum products did a few years ago.

What’s Next?

The joint motion is a big deal but not final until the SEC commissioners and the court approve. If the deal holds, it will not only end one of the most important crypto cases in history but also set a regulatory precedent for future disputes.

“This was never just about Ripple,” said digital asset lawyer Hailey Lennon. “It was about how the entire crypto space defines itself under outdated laws. Settling this case could give regulators and lawmakers a roadmap.”

Investors are optimistic. XRP briefly jumped to $2.01 after the filing, reflecting renewed confidence in the token’s legal clarity and potential reentry into US financial products.

Conclusion: Wrap-Up

Ripple and the SEC’s motion to pause their appeals is a big moment in a multi-year saga that has shaped how the world views crypto and investors. With both sides seemingly in agreement on a settlement the case may end without further drama but its long term impact on crypto legislation, SEC enforcement and digital asset innovation is just beginning.

The final approval from the SEC commissioners and the court will determine if this chapter is closed but for now the markets and the industry are preparing for a post-Ripple-case era.

FAQs

What is the Ripple v. SEC case about?

The SEC sued Ripple Labs in December 2020, saying XRP was sold as an unregistered security. Ripple says XRP is a currency, not a security, so it’s exempt from that.

What did the court previously rule?

In July 2023, the court said XRP sales on exchanges weren’t securities, but institutional sales were. Both sides appealed.

Why are Ripple and the SEC pausing their appeals?

They’ve reached an “agreement in principle” to settle. The motion to pause appeals allows them time to finalize the deal, which still needs SEC commissioner approval.

What is the proposed settlement amount?

Ripple will pay $50 million, down from the originally proposed $125 million, according to Ripple’s lawyers.

Will this impact future crypto regulation?

Yes. The Ripple case has set legal precedents and shaped enforcement strategy. A settlement could mean more negotiated outcomes and clearer guidelines for the crypto industry.

Glossary

XRP – A digital token used by Ripple ‘Labs to facilitate fast, low-cost cross-border payments.

SEC (Securities and Exchange Commission) – The ‘U.S. government agency that enforces securities laws and regulates the securities markets.

Appeal – A legal process where a party asks a higher court ‘to review and change a lower court’s decision.

Abeyance – A’ temporary halt to legal proceedings, often used while waiting for resolution or further action.

Settlement – A legal agreement ‘that resolves a dispute without a court judgment.

Institutional Sales – Direct sales of tokens to entities or investment firms, usually under different legal ‘scrutiny than public exchange sales.