The ongoing legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has been a focal point in the cryptocurrency industry, with significant implications for XRP’s future and the broader crypto market, including the potential emergence of XRP-focused exchange-traded funds (ETFs).

The Ripple vs. SEC Lawsuit

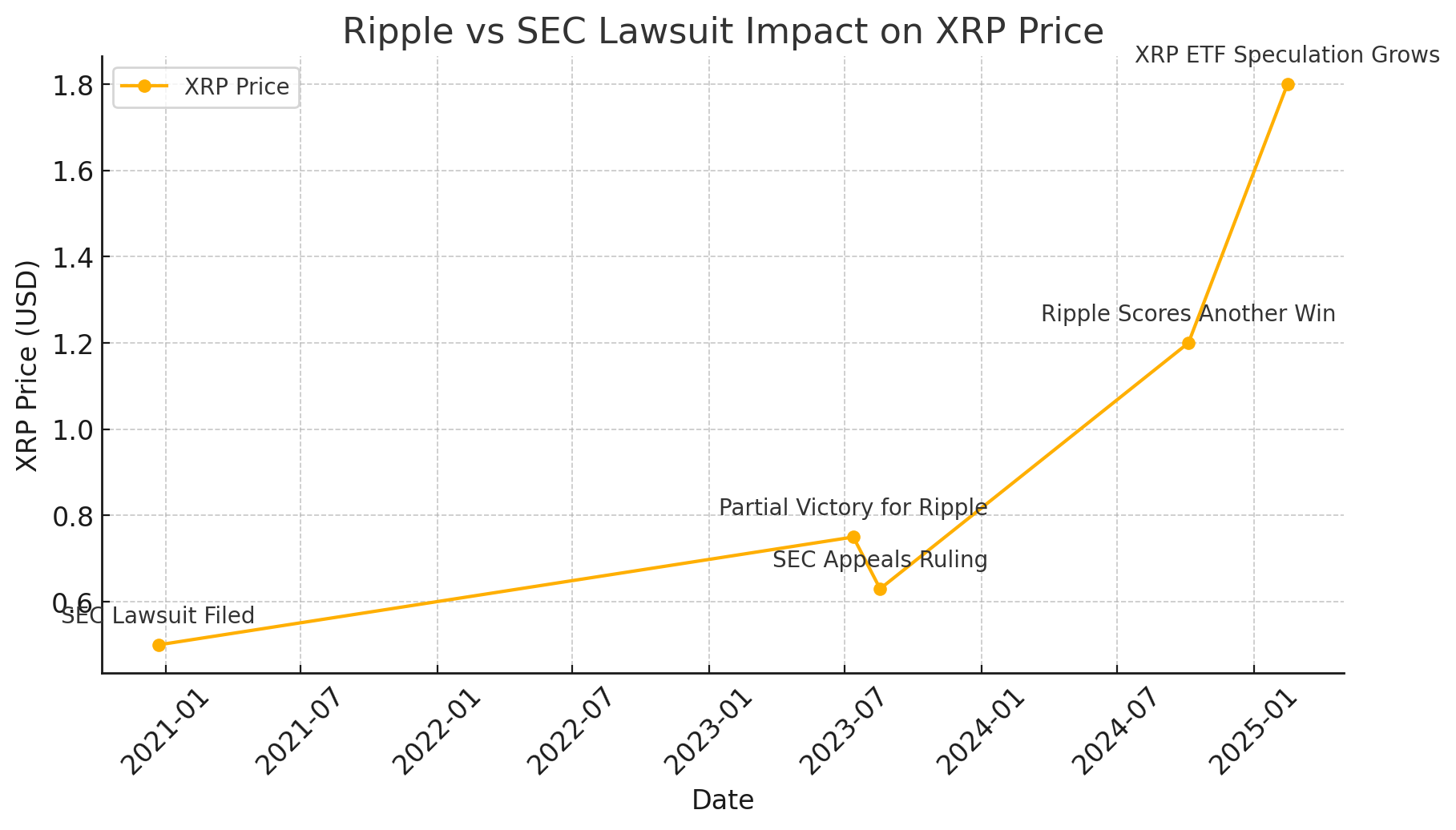

In December 2020, the SEC filed a lawsuit against Ripple Labs, alleging that the company’s sale of XRP constituted an unregistered securities offering. Ripple countered, asserting that XRP is a currency and not a security, thereby falling outside the SEC’s jurisdiction. This legal tussle has been pivotal in determining how cryptocurrencies are classified and regulated in the United States.

Recent Developments in the Case

As of early 2025, several key developments have shaped the trajectory of this lawsuit:

Partial Court Ruling: In July 2023, a federal judge ruled that XRP is not inherently a security, marking a partial victory for Ripple. However, the court also noted that XRP could be considered a security under certain circumstances, particularly concerning institutional sales.

SEC’s Appeal: The SEC filed an appeal against the ruling, prolonging the legal proceedings. The outcome of this appeal is anticipated to have far-reaching consequences for XRP and other cryptocurrencies facing similar regulatory scrutiny.

Impact on XRP’s Market Dynamics

The lawsuit has had a profound impact on XRP’s market performance and adoption:

Exchange Delistings and Relistings: Following the SEC’s initial lawsuit, several U.S.-based cryptocurrency exchanges delisted XRP to avoid potential regulatory repercussions. However, as the case progressed and Ripple secured partial victories, some exchanges have reconsidered their positions, with discussions about relisting XRP gaining momentum.

Price Volatility: XRP’s price has experienced significant fluctuations in response to legal developments. For instance, positive news regarding the lawsuit has historically led to substantial price increases for XRP. In late 2024, XRP’s price surged by 200% following favorable developments.

Prospects for XRP-Focused ETFs

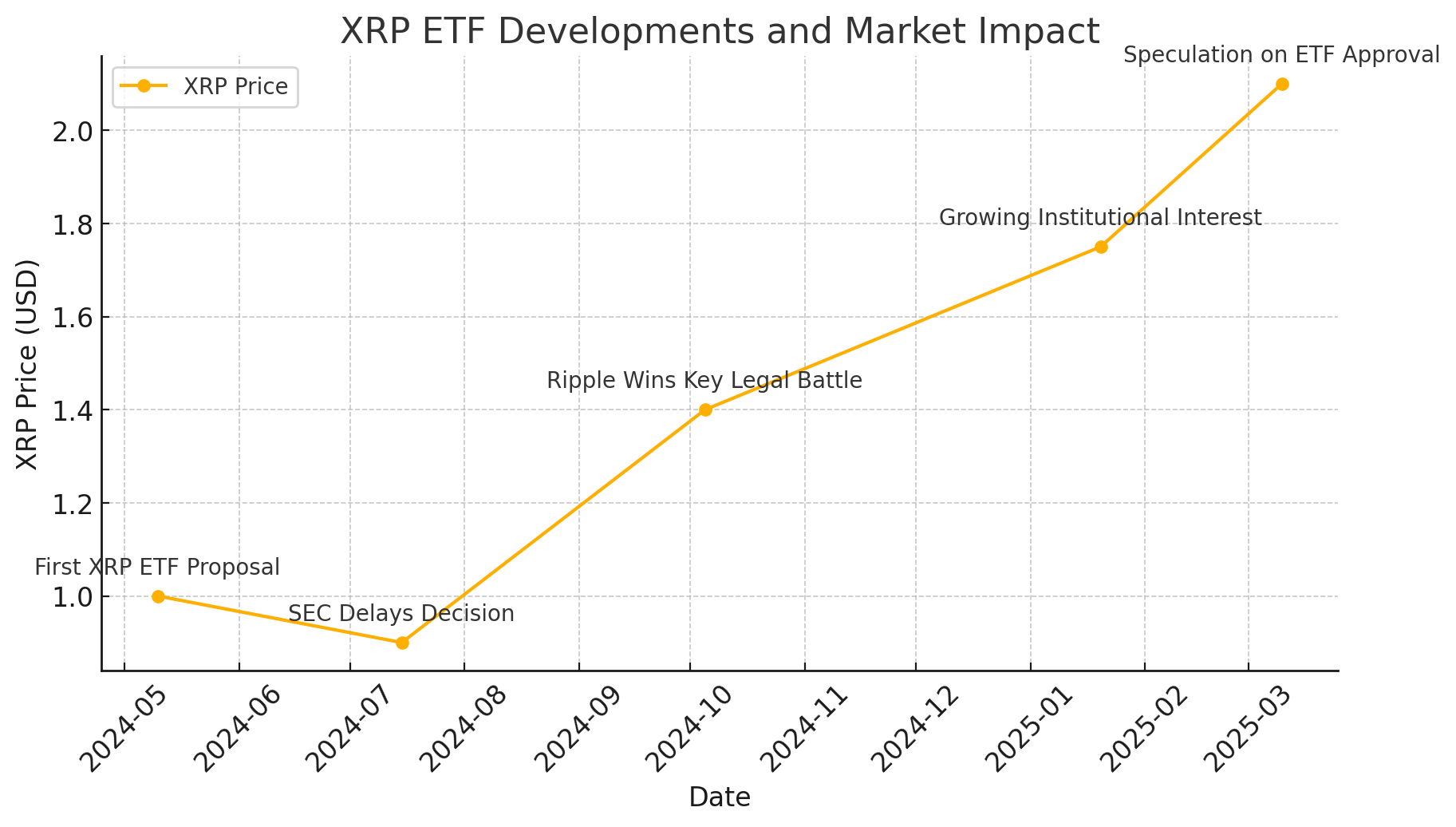

The approval of ETFs centered around XRP has been a topic of considerable interest:

Regulatory Hurdles: The primary obstacle to the launch of an XRP ETF lies in regulatory uncertainty, particularly due to the ongoing legal battle between Ripple and the SEC.

Market Sentiment: Despite regulatory challenges, the cryptocurrency market has shown optimism regarding the potential approval of XRP ETFs. Notably, firms like Bitwise have filed for an XRP exchange-traded fund (ETF), indicating confidence in the asset’s future.

Broader Implications for the Crypto Industry

The Ripple vs. SEC lawsuit is emblematic of the broader regulatory challenges facing the cryptocurrency industry:

Regulatory Clarity: A definitive ruling in this case could set a precedent for how cryptocurrencies are classified and regulated in the U.S., providing much-needed clarity for investors and companies alike.

Institutional Adoption: Clear regulatory guidelines could pave the way for increased institutional investment in cryptocurrencies, as traditional financial entities often seek regulatory certainty before engaging with new asset classes.

Conclusion

The outcome of the Ripple vs. SEC lawsuit is poised to have significant ramifications for XRP and the broader cryptocurrency market. A favorable resolution for Ripple could lead to the re-listing of XRP on major exchanges, increased institutional adoption, and the potential approval of XRP-focused ETFs. Conversely, an unfavorable outcome could prompt a reevaluation of regulatory strategies within the crypto industry. Stakeholders are keenly awaiting the final verdict, which will undoubtedly influence the future trajectory of digital assets.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is the Ripple vs. SEC lawsuit about?

The SEC alleges that Ripple Labs conducted an unregistered securities offering by selling XRP. Ripple contends that XRP is a currency, not a security, and thus not subject to SEC regulation.

How has the lawsuit affected XRP’s price?

The lawsuit has introduced significant volatility to XRP’s price, with notable surges following positive legal developments and declines amid unfavorable news.

What are the chances of an XRP ETF being approved?

While regulatory uncertainty persists due to the ongoing lawsuit, filings by firms like Bitwise indicate optimism about the potential approval of an XRP-focused ETF.

How might the lawsuit’s outcome impact the broader crypto market?

A clear ruling could set a regulatory precedent, influencing how other cryptocurrencies are classified and potentially affecting institutional investment and market dynamics.

Glossary of Key Terms

Cryptocurrency: A digital or virtual form of currency that uses cryptography for security and operates independently of a central authority.

Exchange-Traded Fund (ETF): An investment fund traded on stock exchanges, holding assets like stocks, commodities, or cryptocurrencies.

Securities and Exchange Commission (SEC): A U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry.

Security: A financial instrument representing ownership in a company or a debt owed by a company or government, such as stocks or bonds.

XRP: The native cryptocurrency of the Ripple network, designed to facilitate fast and cost-effective cross-border payments.