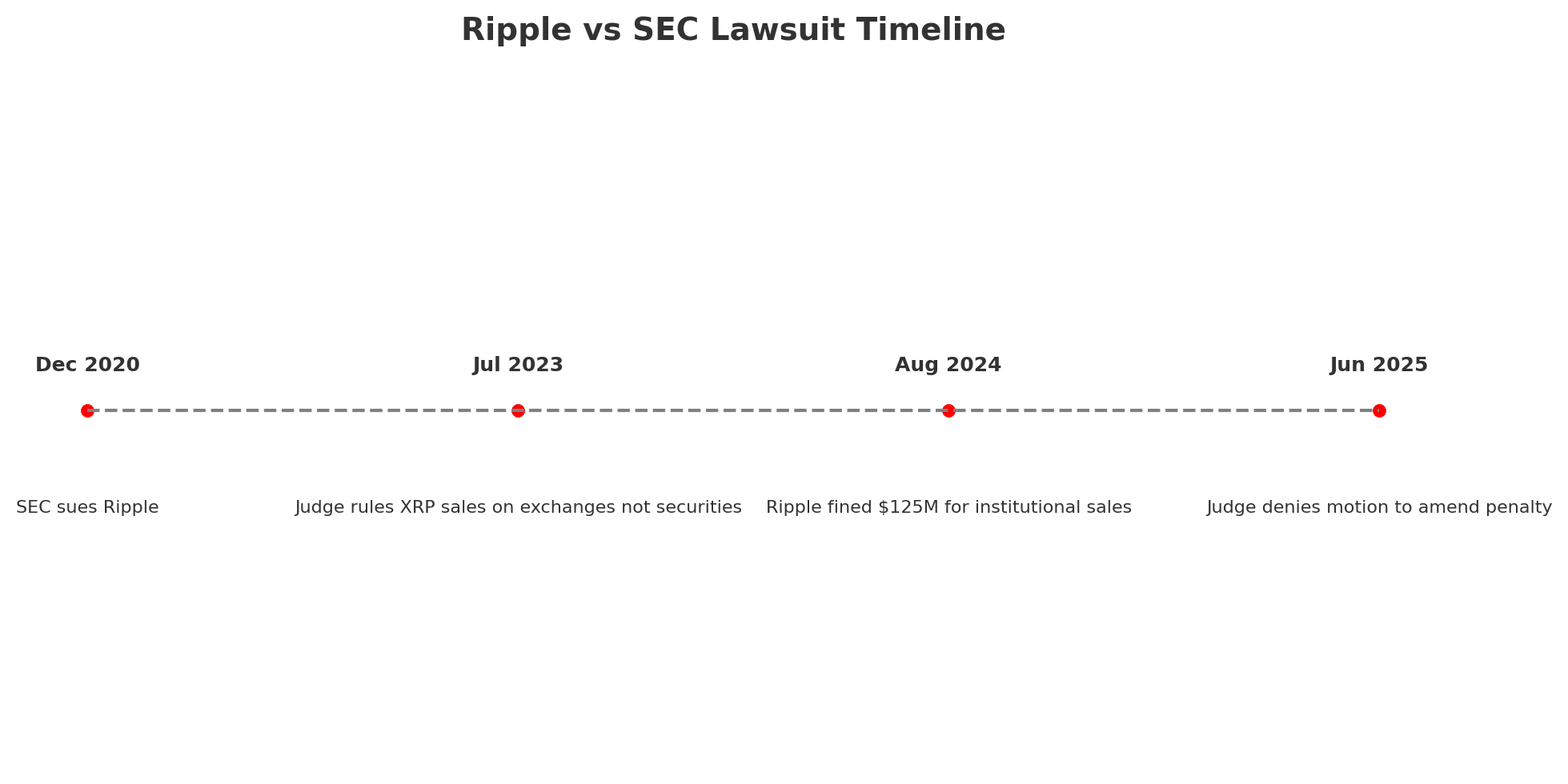

In the latest Ripple vs SEC lawsuit update, a U.S. federal judge has denied a joint motion by Ripple Labs and the Securities and Exchange Commission (SEC) to amend the terms of a previously issued $125 million civil penalty. This decision, issued on June 26, 2025, by Judge Analisa Torres in the Southern District of New York, is a major development in the ongoing legal battle over the classification of XRP.

This Ripple vs SEC lawsuit update underscores the court’s unwillingness to revisit final rulings without meeting strict legal standards. Ripple and the SEC sought to lower the fine to $50 million and dissolve the injunction that restricted Ripple’s sale of XRP to institutional investors. Judge Torres, however, ruled that neither party demonstrated the “exceptional circumstances” required to amend a final judgment under Rule 60(b) of the Federal Rules of Civil Procedure.

Legal Background: Ripple vs SEC

The Ripple vs SEC lawsuit update cannot be understood without revisiting the origins of the case. In December 2020, the SEC sued Ripple Labs, alleging that the company raised over $1.3 billion through the sale of XRP in unregistered securities offerings. While the court later ruled in July 2023 that XRP sales on public exchanges did not qualify as securities transactions, it determined that Ripple’s direct sales to institutional investors did.

This led to the court’s August 2024 judgment ordering Ripple to pay a $125 million penalty and comply with an injunction to halt unregistered institutional sales. The Ripple vs SEC lawsuit update now confirms that this penalty remains firmly in place, at least for now.

Implications for Ripple and the Crypto Industry

This Ripple vs SEC lawsuit update is more than a legal technicality; it has wide-ranging implications for Ripple and the broader crypto industry. By denying the proposed amendment, the court reinforced the idea that regulatory clarity and finality are critical. Both parties’ unusual alliance in this motion suggests a mutual interest in closing the case, but the court has made clear that final rulings are not negotiable simply because both sides agree.

Legal experts suggest Ripple may now pursue a revised motion under Rule 60(b) or proceed with an appeal. The SEC’s silence, meanwhile, has led to speculation about future enforcement efforts under Chair Gary Gensler’s aggressive regulatory approach.

Market Reaction

Despite the denial of the motion, XRP’s price remained relatively stable, reflecting market anticipation of continued legal proceedings. The Ripple vs SEC lawsuit update hasn’t triggered major volatility yet, but future moves—such as an appeal—could impact sentiment.

Final Thoughts

This Ripple vs SEC lawsuit update solidifies Judge Torres’ commitment to legal precedent and sends a clear message: final rulings are not easily reversed. The denial of the joint motion marks yet another critical chapter in the years-long courtroom saga between Ripple and the SEC, with the eyes of the crypto world watching closely.

FAQs on the Ripple vs SEC Lawsuit Update

Q1: What is the Ripple vs SEC lawsuit about?

The SEC sued Ripple in 2020 for allegedly selling XRP as an unregistered security. The case has focused on whether XRP qualifies as a security under U.S. law.

Q2: Why did the judge deny the request to amend the penalty?

Judge Torres ruled that the request failed to meet the legal standard for altering a final judgment, which requires “exceptional circumstances.”

Q3: How much was the original penalty?

Ripple was ordered to pay a $125 million civil penalty related to its XRP sales to institutional investors.

Q4: What was Ripple trying to do in this latest motion?

Ripple and the SEC jointly sought to reduce the penalty to $50 million and dissolve the injunction. The court denied that request.

Q5: What happens next in the Ripple vs SEC lawsuit?

Ripple may file a new motion under the correct legal rule or pursue an appeal. No next steps have been officially announced.

Glossary of Key Terms

Ripple Labs: A blockchain company that developed the XRP Ledger and promotes the use of XRP for cross-border payments.

SEC (Securities and Exchange Commission): The U.S. government agency responsible for regulating securities markets.

XRP: A cryptocurrency created by Ripple Labs, used for fast and low-cost international payments.

Injunction: A court order that restricts or requires specific actions—in this case, barring Ripple from certain XRP sales.

Rule 60(b): A rule in the Federal Rules of Civil Procedure that allows a court to relieve a party from a final judgment under special conditions.