After nearly five years of legal tension and market uncertainty, the Ripple vs. SEC case, arguably the most important regulatory battle in crypto history, is finally approaching its conclusion. On June 16, 2025, Ripple Labs and the U.S. Securities and Exchange Commission filed a joint motion to pause appeals, signaling a major breakthrough in their efforts to settle the long-standing dispute over the classification and sale of XRP.

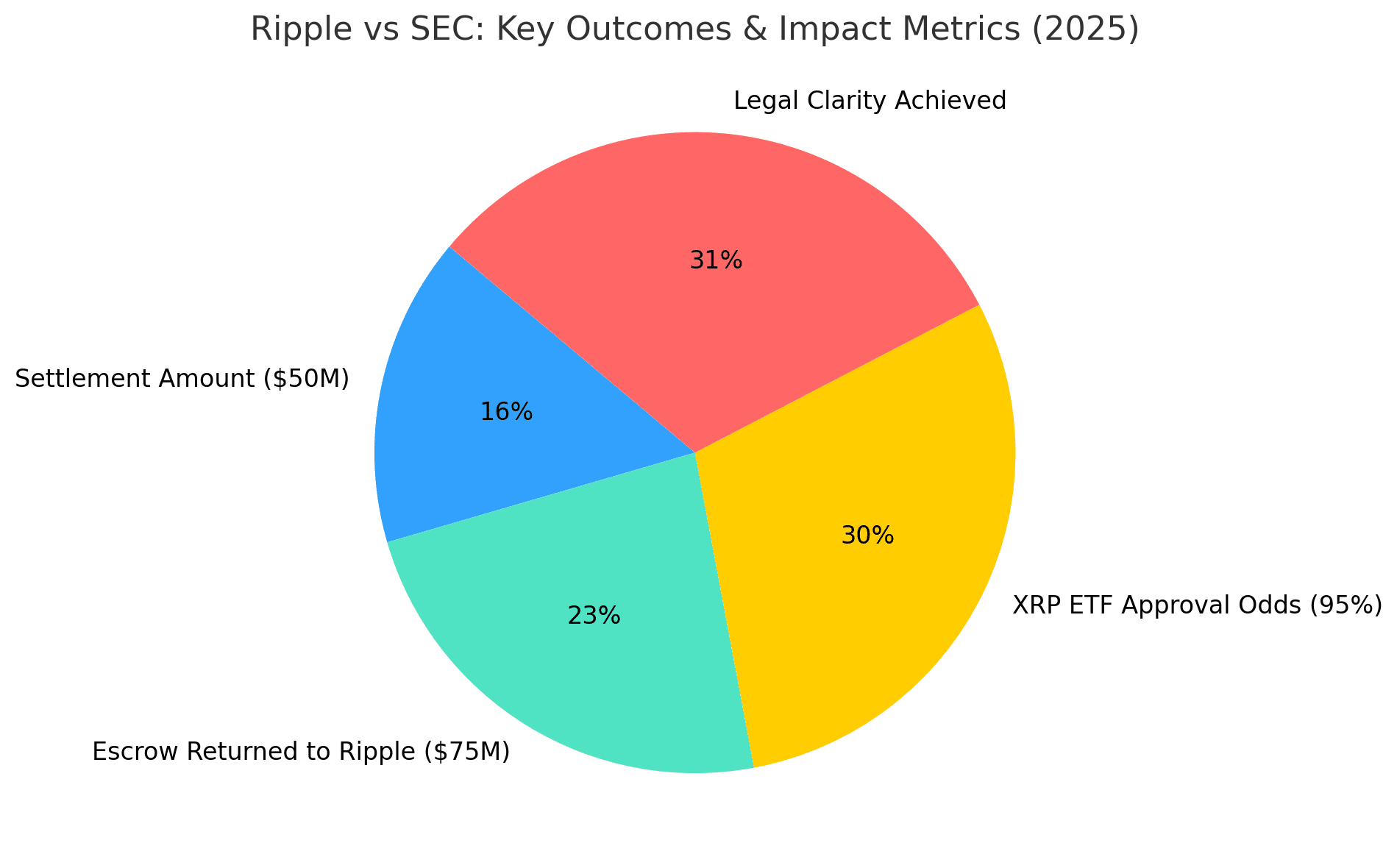

At the center of this next phase is a proposed $50 million settlement and a request to lift the existing injunction that has constrained XRP’s market expansion since 2020. If approved, this could mark the beginning of a new era for Ripple and possibly for U.S. crypto regulation at large.

The $50 Million Deal That Could End It All

According to filings reviewed from multiple sources, including Coinpedia and CryptoSlate, Ripple and the SEC are working under a mutually agreed-upon timeline, with a court update due by August 15, 2025. The two sides have asked the court to approve a motion under Rule 60(b), which allows reconsideration of prior judgments due to “exceptional circumstances.” The move would effectively halt appeals and trigger a new phase of finalization.

As part of the deal, Ripple is expected to pay a reduced penalty of $50 million, down from the original $125 million. The remaining $75 million held in escrow would be returned to Ripple, and the ongoing injunction against XRP’s institutional sales would be lifted.

This resolution is widely seen as a win for Ripple, especially after the 2023 partial summary judgment where the court ruled that programmatic sales of XRP did not constitute securities offerings, a precedent that shook the SEC’s enforcement approach.

Ripple Legal Precedent and Market Impact

The resolution of the Ripple vs. SEC case would have far-reaching consequences beyond XRP. It would set a modern legal precedent regarding the classification of digital assets and clarify how blockchain-based tokens can be issued, traded, and integrated into mainstream financial systems.

Crypto legal experts believe this will reshape how the SEC approaches enforcement. Already, signs are emerging that regulatory posture is shifting, with fewer aggressive lawsuits and more focus on negotiated outcomes. In fact, under the evolving leadership of the SEC’s Crypto Task Force, many believe that the era of regulatory ambiguity may finally be closing.

XRP Price and ETF Odds Soar

Unsurprisingly, the Ripple news has sent XRP price surging, with a renewed sense of optimism across the market. Bloomberg ETF analysts James Seyffart and Eric Balchunas now peg the odds of an XRP spot ETF approval at 95%, citing increasing regulatory clarity as a key catalyst.

If the settlement is finalized and the injunction lifted, XRP would regain its path toward institutional adoption, clearing the way for U.S.-based spot ETFs to list XRP on platforms such as Nasdaq and NYSE.

An approved XRP ETF would represent a milestone for altcoins in the ETF race, following closely behind Bitcoin and Ethereum. It would also offer investors exposure to XRP without the complexity of managing wallets, keys, and custodianship, opening the floodgates for billions in new capital.

What Happens Next?

A final ruling or dismissal of appeals is expected by mid-August 2025, though both parties may expedite the process if the court grants their joint motion. Market watchers will be closely monitoring:

SEC comments on the remand and final penalties

Ripple’s roadmap post-injunction, including global partnerships and XRP Ledger expansion

XRP ETF filings, which are expected to follow immediately after legal clarity is restored

Conclusion: The End of Crypto’s Most Critical Legal Battle

The Ripple vs. SEC lawsuit has long been considered a bellwether for crypto regulation in the United States. With a favorable outcome likely, Ripple stands to regain its full operational flexibility, while XRP may reclaim its position among the top assets in global crypto rankings.

More importantly, this moment could redefine the relationship between blockchain innovators and U.S. regulators, transforming what was once a legal blockade into a gateway for wider crypto adoption and investment access.

FAQs

1. What is the current status of the Ripple vs. SEC case?

Ripple and the SEC have filed a joint motion to pause appeals and are working toward a $50 million settlement, with a final court update expected by August 15, 2025.

2. Why is this case significant for the crypto industry?

It sets a legal precedent on whether XRP and similar digital assets are securities, potentially shaping future crypto regulation in the U.S.

3. Will the Ripple vs. SEC case affect XRP ETF approval?

Yes. Legal clarity improves the odds of an XRP ETF being approved, with Bloomberg analysts estimating a 95% chance as of June 2025.

Glossary of Key Terms

Ripple: A blockchain-based company that facilitates fast cross-border payments using its digital asset, XRP.

XRP: The native token of the XRP Ledger, used for payments and liquidity in Ripple’s ecosystem.

SEC (Securities and Exchange Commission): The U.S. regulatory body overseeing securities laws and enforcement actions.

Rule 60(b): A legal rule that allows a party to request reconsideration of a final judgment under special circumstances.

XRP ETF: An exchange-traded fund offering investors exposure to XRP without holding the actual asset.