After years of intense courtroom battles, the Ripple vs SEC case may finally be approaching its resolution, and sooner than many feared. This week, respected pro-XRP attorney Bill Morgan publicly dismissed fresh speculation that the lawsuit could drag on until late 2026. Instead, he predicts the matter could be resolved as early as August 2025, with a joint settlement and the release of over $125 million in escrow funds already in motion.

This legal clarity is injecting fresh optimism into the XRP community and pushing market sentiment into bullish territory.

Legal Delay Rumors Crushed by Ripple-Aligned Lawyer

In response to swirling rumors of a two-year delay, Morgan called the idea “highly unlikely,” stating that only a denial of the joint settlement motion by Judge Analisa Torres could potentially stretch the timeline.

“There is no serious reason to believe the judge will drag this out to 2026 unless the joint motion is rejected, which is improbable,” Morgan wrote on X.

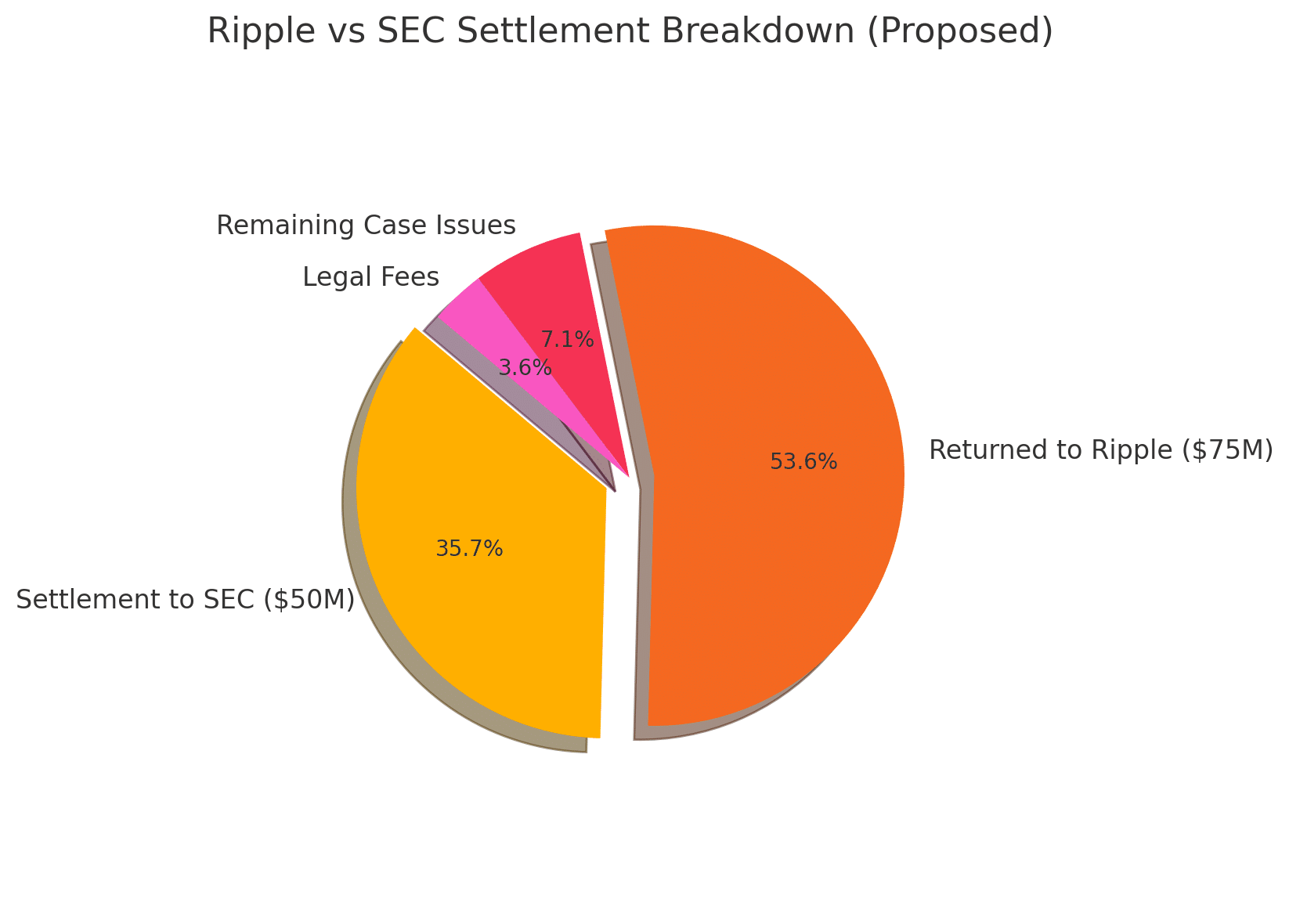

In Ripple vs SEC, both Ripple and the SEC recently submitted a joint motion seeking an “indicative ruling” that would effectively finalize a proposed $50 million civil penalty while returning $75 million of previously frozen XRP to Ripple. Many believe this move is a strategic effort to avoid further appeals and conclude the 4.5-year legal battle.

Judge Torres: A Careful but Efficient Arbiter

While Judge Torres did initially reject an earlier motion for a quick indicative ruling, legal analysts say this should not be viewed as a roadblock. Rather, it indicates the court’s commitment to due process and proper documentation before giving the green light.

If the revised motion addresses all procedural requirements, experts believe the judge could issue a favorable ruling by mid-August, allowing for XRP escrow funds to be distributed and putting the case officially to rest.

XRP Price Primed for Breakout

Investors have responded positively to the developments. XRP’s price is showing steady upward movement as speculation around the case’s conclusion builds. Analysts suggest XRP could soon challenge its $2.5 resistance, with the potential to reach $5–$8 in a post-resolution scenario.

Several technical indicators support this outlook:

RSI and MACD momentum are bullish.

XRP remains well-supported above the 200-day moving average.

Whale accumulation has reportedly increased since the joint motion filing.

A Victory Beyond the Courtroom

This potential victory would not only end Ripple’s prolonged regulatory headache but also set a precedent for future crypto-related legal battles. A fair resolution could:

Provide legal clarity for institutional XRP use.

Encourage other blockchain projects to pursue constructive engagement with regulators.

Strengthen global confidence in the U.S. crypto legal system.

Circle Graph: Case Timeline and Outcome Breakdown

Final Thoughts

The end of the Ripple vs SEC legal battle now seems within reach. With both sides pushing for a joint resolution and legal experts like Bill Morgan ruling out major delays, XRP holders are watching closely. A favorable ruling by August could open the door to a price breakout, wider adoption, and long-awaited regulatory clarity.

Summary

The Ripple vs SEC lawsuit may finally be reaching its conclusion as top lawyer Bill Morgan dismisses speculation of a delay until 2026. A joint motion proposing a $50 million penalty and release of $75 million to Ripple has been filed. Experts anticipate a final ruling by August 2025. This momentum has lifted XRP’s price, with bullish breakout signals emerging. A swift resolution would mark a major win for Ripple and set a strong legal precedent for the crypto industry.

FAQs

What is the current status of the Ripple vs SEC case?

The case is close to a settlement. Both parties have submitted a joint motion proposing a $50 million civil penalty and $75 million returned to Ripple.

When is the case expected to be resolved?

Experts anticipate a final ruling by August 2025, assuming the judge approves the indicative ruling.

How has the XRP price reacted?

XRP has shown bullish momentum, with analysts predicting a breakout if the legal resolution is confirmed.

Glossary

Indicative Ruling: A preliminary decision by a judge that signals approval or denial of a proposed action.

Escrow: Funds held by a third party to ensure obligations are fulfilled in a legal or financial transaction.

Civil Penalty: A financial fine imposed by regulatory bodies as punishment for legal violations.

Whale Accumulation: Large-scale buying activity by major investors or institutions.

Sources and References

The price predictions and financial analysis presented on this website are for informational purposes only and do not constitute financial, investment, or trading advice. While we strive to provide accurate and up-to-date information, the volatile nature of cryptocurrency markets means that prices can fluctuate significantly and unpredictably.

You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The Bit Journal does not guarantee the accuracy, completeness, or reliability of any information provided in the price predictions, and we will not be held liable for any losses incurred as a result of relying on this information.

Investing in cryptocurrencies carries risks, including the risk of significant losses. Always invest responsibly and within your means.

For advertising inquiries, please email . [email protected] or Telegram