The U.S. Securities and Exchange Commission (SEC) has officially acknowledged Grayscale Investments’ application for a spot XRP exchange-traded fund (ETF). This pivotal development initiates a 240-day review period, during which the SEC will deliberate on the approval of the proposed ETF. The acknowledgment has ignited optimism within the crypto community, as it suggests a potential shift toward regulatory acceptance of digital assets beyond Bitcoin and Ethereum.

Grayscale’s Ambitious Move into XRP ETFs

Grayscale’s filing aims to introduce the first-ever spot XRP ETF, providing investors with direct exposure to XRP through a regulated investment vehicle. The proposed ETF would track XRP’s market performance, offering a familiar platform for traditional investors to engage with the cryptocurrency market without the complexities of direct token ownership. This initiative reflects Grayscale’s commitment to expanding its digital asset offerings and catering to the growing demand for diversified crypto investment products.

The SEC’s acknowledgment of the application is a procedural yet crucial step, signaling the commencement of a comprehensive review process. Historically, the SEC has exercised caution regarding cryptocurrency ETFs, primarily limiting approvals to Bitcoin and Ethereum. However, this recent development indicates a potential broadening of the regulatory perspective to include other significant digital assets like XRP.

Market Response and Investor Sentiment

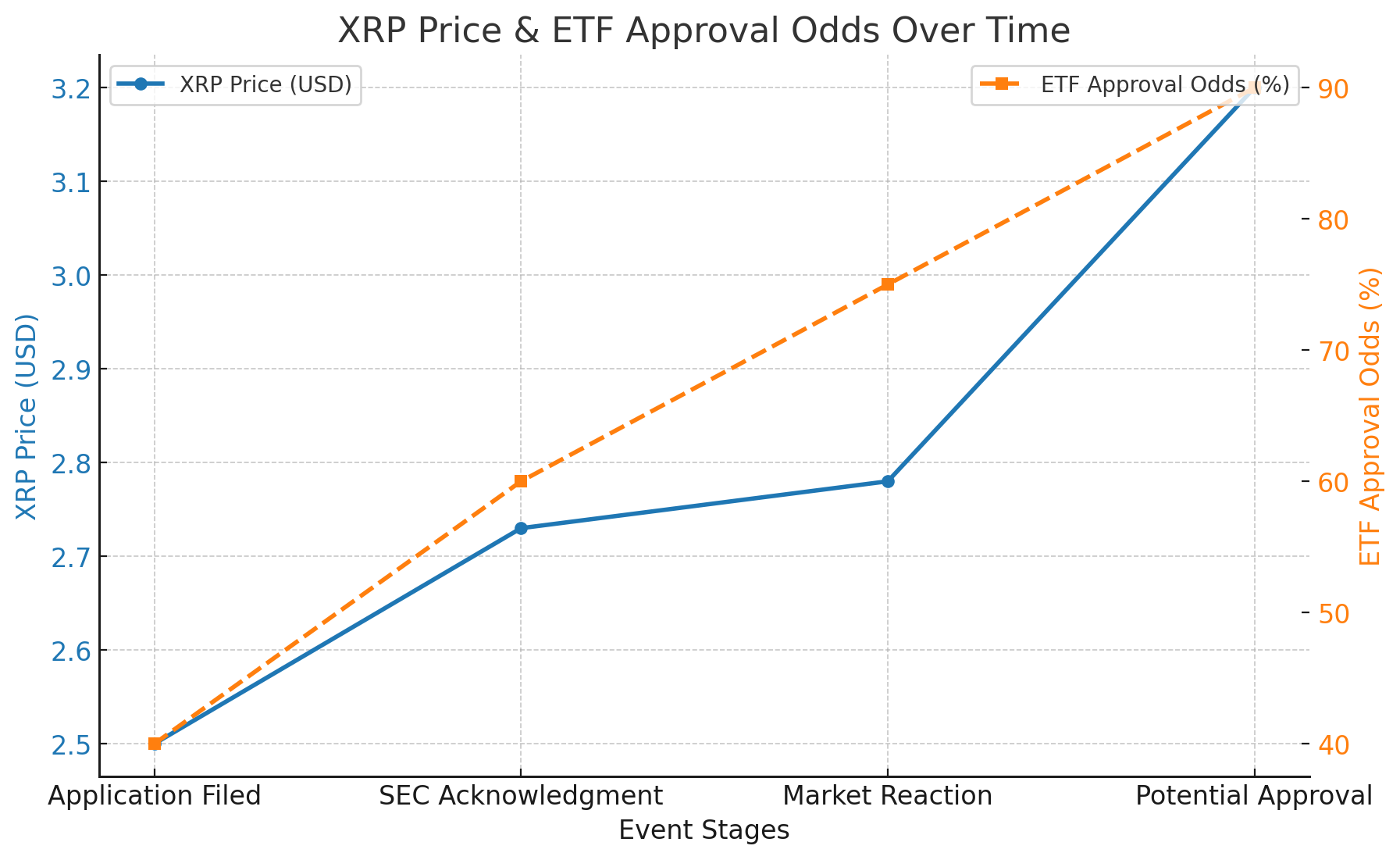

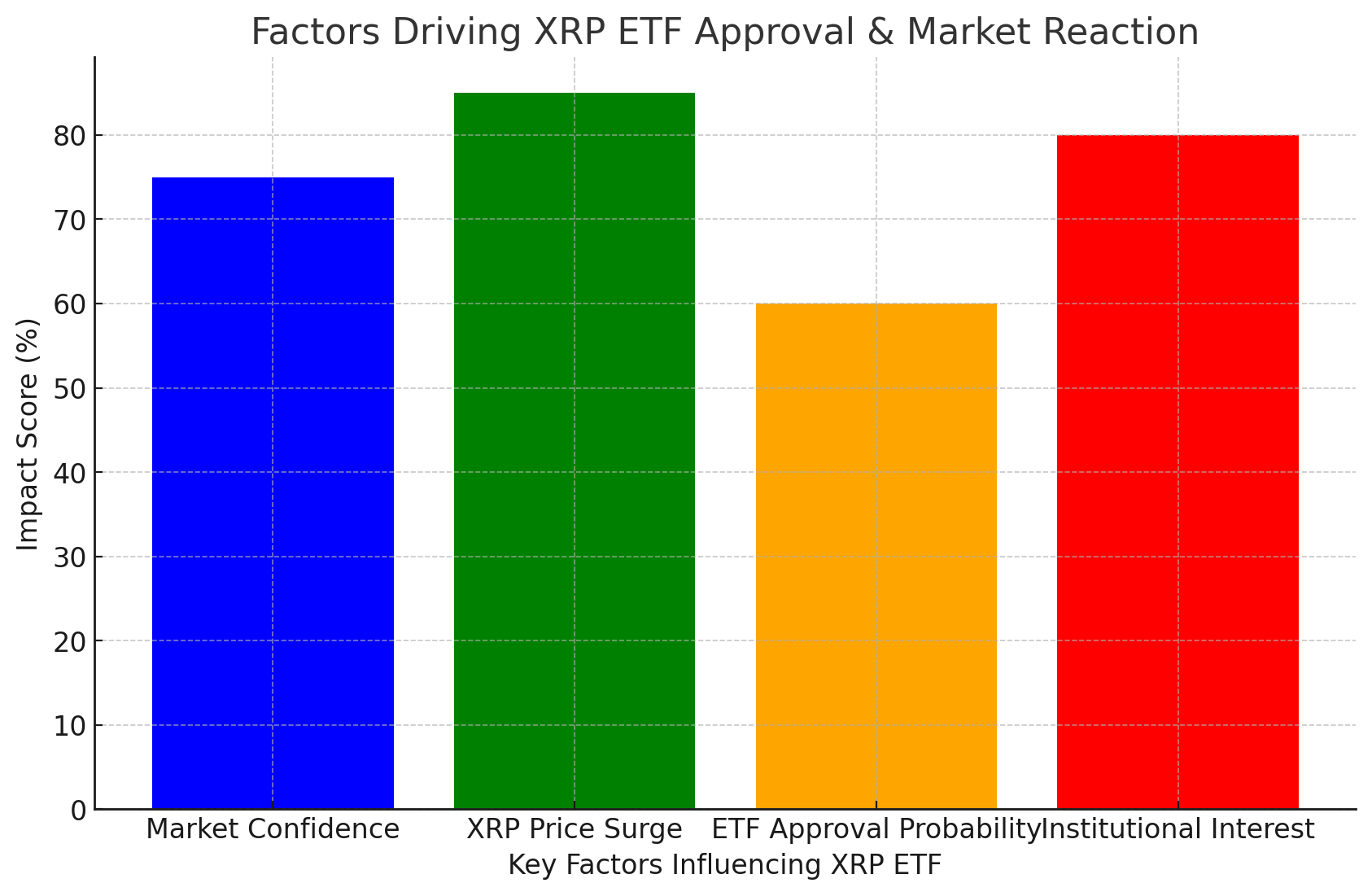

The SEC’s formal recognition of the XRP ETF application has had a palpable impact on the market. XRP’s price experienced a notable surge, climbing over 9% to trade just under $2.73 following the announcement. This upward momentum underscores growing investor confidence in the potential approval of XRP ETFs and the broader acceptance of altcoins in regulated financial products. The market capitalization of XRP has also seen a substantial increase, reflecting heightened interest and positive sentiment among investors.

Industry analysts suggest that the approval of a spot XRP ETF could lead to significant capital inflows from institutional investors, further stabilizing the market and enhancing liquidity. Such a development would not only validate XRP as a legitimate investment asset but also pave the way for the introduction of ETFs for other altcoins, thereby diversifying investment opportunities within the cryptocurrency space.

Regulatory Landscape and Future Implications

The SEC’s decision to acknowledge the XRP ETF application comes amidst a dynamic regulatory environment. The recent election of President Donald Trump has introduced a more crypto-friendly administration, with expectations of regulatory reforms that could favor the cryptocurrency industry. Notably, the anticipated resignation of SEC Chair Gary Gensler and the potential appointment of a pro-crypto successor have fueled optimism regarding the approval of cryptocurrency ETFs. Industry stakeholders are hopeful that these changes will lead to a more accommodating regulatory framework, fostering innovation and growth within the digital asset sector.

However, challenges persist. The SEC’s thorough review process aims to ensure investor protection and market integrity, which means that approval is not guaranteed.

Conclusion

The SEC’s acknowledgment of Grayscale’s spot XRP ETF application marks a pivotal moment in the evolution of cryptocurrency investments. While the path to approval involves navigating regulatory and legal complexities, the potential introduction of an XRP ETF could provide investors with diversified exposure to the burgeoning digital asset landscape. As the review process unfolds, the crypto community and investors alike will be closely monitoring developments that could reshape the future of digital asset investments.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

Frequently Asked Questions (FAQs)

What does the SEC’s acknowledgment of Grayscale’s XRP ETF application signify?

The acknowledgment indicates that the SEC has officially begun reviewing Grayscale’s proposal for a spot XRP ETF, initiating a 240-day period to approve or deny the application.

How might the approval of an XRP ETF impact the cryptocurrency market?

Approval could enhance XRP’s legitimacy, attract institutional investors, and potentially lead to increased liquidity and market capitalization for XRP and other altcoins.

What are the potential challenges facing the approval of the XRP ETF?

Challenges include the SEC’s rigorous review process and ongoing legal disputes between Ripple Labs and the SEC regarding XRP’s classification as a security.

How has the market reacted to the SEC’s acknowledgment of the XRP ETF application?

Following the acknowledgment, XRP’s price surged over 9%, reflecting increased investor confidence and positive market sentiment.

What changes in the regulatory environment could influence the approval of cryptocurrency ETFs?

The recent election of a crypto-friendly administration and anticipated leadership changes within the SEC may lead to a more accommodating regulatory framework for cryptocurrency ETFs.

Glossary of Key Terms

Exchange-Traded Fund (ETF): An investment fund traded on stock exchanges, holding assets such as stocks, commodities, or cryptocurrencies.

Spot ETF: An ETF that holds the actual underlying asset, such as a cryptocurrency, rather than derivatives or futures contracts.

Acknowledgment: The SEC’s formal acceptance to review a submitted application, marking the beginning of the evaluation process.

Ripple Labs: The company that developed XRP and the XRP Ledger, focusing on payment solutions and financial technology.

Altcoin: Any cryptocurrency other than Bitcoin; short for “alternative coin.”

Sources

Grayscale’s Spot XRP ETF Takes a Big Step Toward Approval

Trump victory tipped to break logjam of exotic US crypto ETF filings

![Reviewing the 5 Best New Meme Coins to Join This Week [As Recommended by Savvy Investors] 41 Reviewing the 5 Best New Meme Coins to Join This Week [As Recommended by Savvy Investors]](https://thebitjournal.b-cdn.net/wp-content/uploads/2024/12/best-meme-coins-420x280.png)