In recent weeks, Ripple’s XRP has experienced notable volatility, with its price dynamics capturing the attention of investors and analysts alike. As of February 25, 2025, XRP is trading at approximately $2.17, reflecting a slight decrease of 0.13% from the previous close. This fluctuation raises pertinent questions about the cryptocurrency’s immediate trajectory and the potential for bearish trends to push XRP toward the $2.10 mark.

Ripple XRP Price Performance: Recent Trends

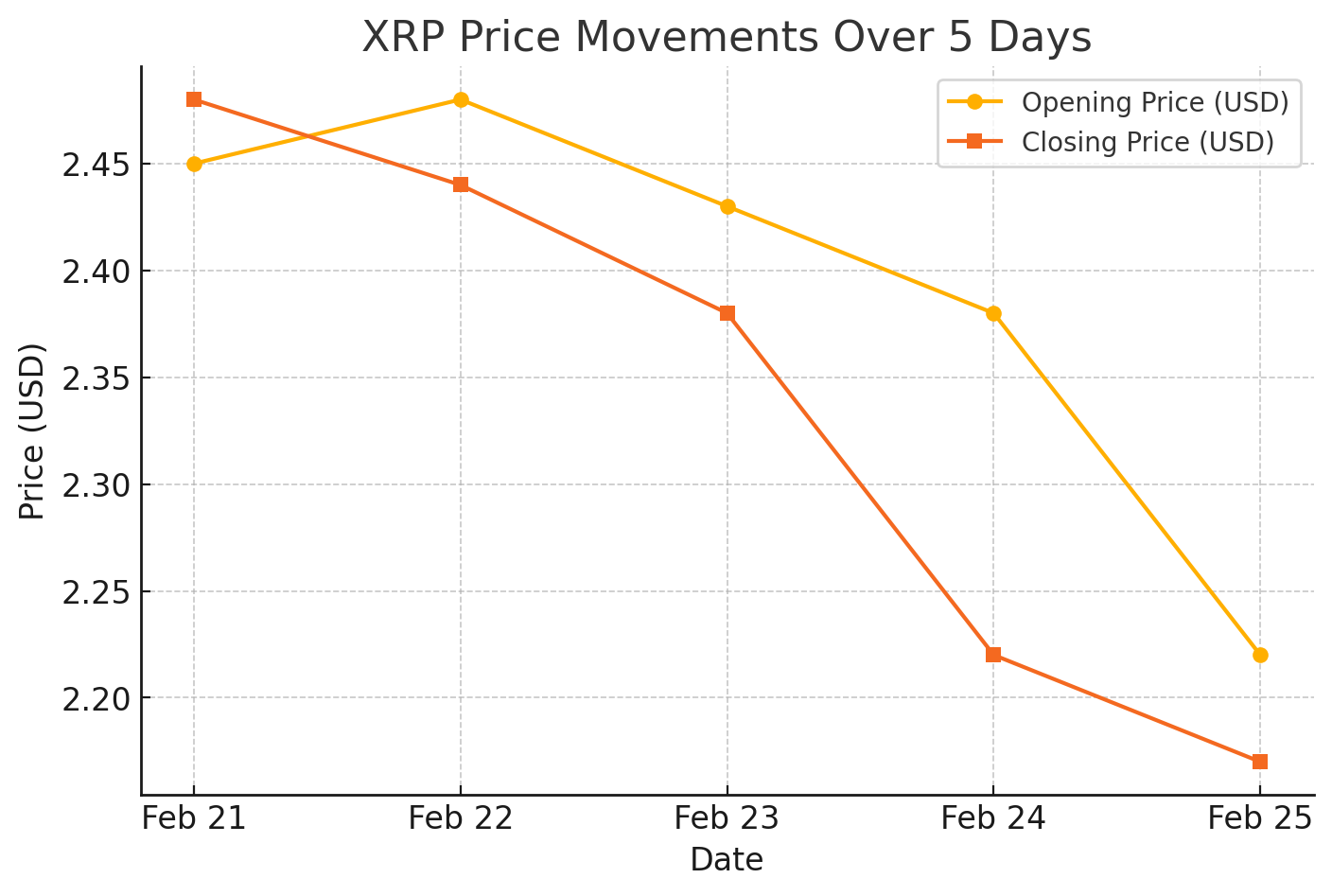

To better understand XRP’s trajectory, let’s examine its recent price movements:

| Date | Opening Price (USD) | Highest Price (USD) | Lowest Price (USD) | Closing Price (USD) | Price Change (%) |

|---|---|---|---|---|---|

| Feb 21, 2025 | 2.45 | 2.50 | 2.40 | 2.48 | -0.40 |

| Feb 22, 2025 | 2.48 | 2.53 | 2.41 | 2.44 | -1.61 |

| Feb 23, 2025 | 2.43 | 2.47 | 2.35 | 2.38 | -2.46 |

| Feb 24, 2025 | 2.38 | 2.41 | 2.16 | 2.22 | -6.72 |

| Feb 25, 2025 | 2.22 | 2.30 | 2.10 | 2.17 | -2.25 |

Technical Analysis: Deciphering XRP’s Price Movements

A critical examination of XRP’s recent performance reveals a breakdown from an ascending triangle pattern, a development that often signals a shift from bullish to bearish momentum. This pattern breach, coupled with the violation of the crucial $2.50 support level, suggests a possible continuation of the downward trend. Technical indicators, such as the Average Directional Index (ADX) positioned at 20, denote a weak trend strength, further corroborating the bearish outlook.

The immediate support level to monitor is $2.10. Should Ripple XRP close a four-hour candle below the $2.50 threshold, the probability of descending to this support intensifies. Conversely, reclaiming and sustaining positions above $2.50 could invalidate the bearish scenario, paving the way for potential recovery.

Market Sentiment and On-Chain Metrics

Despite the prevailing bearish technical indicators, on-chain data presents a nuanced perspective. Recent analyses indicate a net outflow of over $13.65 million worth of XRP tokens within the past 24 hours, implying accumulation by long-term holders. This trend often precedes upward price movements, as reduced supply on exchanges can create upward pressure.

However, the surge in trading volume—escalating by 70% over the same period—introduces ambiguity. While heightened activity reflects increased market participation, it does not inherently signify bullish momentum; it could equally represent intensified selling pressure.

Liquidation Levels and Trader Positions

An analysis of trader behavior reveals over-leveraged positions at critical price points. Significant liquidation levels are identified at $2.40 on the downside and $2.55 on the upside. A decline below $2.40 could trigger liquidations exceeding $35.50 million in long positions, potentially accelerating the downward momentum. Conversely, a surge above $2.55 may result in the liquidation of over $40 million in short positions, which could catalyze a bullish reversal.

Broader Market Influences

Ripple XRP’s price dynamics do not exist in isolation; they are influenced by a confluence of broader market factors. The cryptocurrency market, in general, has been navigating a period of uncertainty, with major assets like Bitcoin and Ethereum also experiencing fluctuations. Macroeconomic elements, including regulatory developments and investor sentiment, play pivotal roles in shaping market trajectories.

Notably, recent discussions surrounding the potential approval of XRP-focused exchange-traded funds (ETFs) have injected both optimism and caution into the market. While such financial instruments could enhance institutional adoption and liquidity, the regulatory landscape remains a critical determinant of their realization.

Conclusion: The Path Forward

In summary, Ripple XRP stands at a critical juncture, with technical indicators leaning bearish while on-chain metrics suggest potential accumulation. Traders and investors should vigilantly monitor the $2.50 support level and the $2.10 threshold, as movements beyond these points could delineate the short-term direction of XRP’s price.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. Will Ripple XRP drop to $2.10 soon?

While the technical indicators suggest a bearish outlook, on-chain data shows accumulation by long-term holders. If XRP falls below $2.50, a drop to $2.10 becomes more likely.

2. What is the key support level for XRP?

Currently, the key support level is $2.10. It may see further declines if XRP fails to hold above this level.

3. How does trading volume impact XRP’s price?

A surge in trading volume indicates increased market activity, but it does not always signal bullish momentum. High volumes can also indicate selling pressure.

4. Can XRP recover above $2.50?

If XRP reclaims and sustains levels above $2.50, it could invalidate the bearish trend and push toward higher resistance levels.

5. What role do liquidation levels play in Ripple XRP’s price movements?

Large liquidations at key price levels can trigger rapid price movements. A break below $2.40 may liquidate long positions, while a surge above $2.55 could liquidate shorts, leading to a reversal.

Glossary of Key Terms

Support Level – A price point where buying pressure is expected to be strong enough to prevent further decline.

Resistance Level – A price point where selling pressure is expected to prevent further upward movement.

Liquidation – The forced closing of a leveraged position when losses exceed margin requirements.

On-Chain Data – Blockchain-based data such as transaction volumes, wallet activity, and token movements.

Trading Volume – The total number of assets traded within a specific period, indicating market activity.

Sources

Disclaimer

This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry risks, and readers should conduct their own research or consult with a financial advisor before making any investment decisions.