As per the source, the U.S. Securities and Exchange Commission (SEC) has recently paused its lawsuits against major crypto exchanges Binance and Coinbase. This development has ignited speculation about the potential for a favorable resolution in the SEC’s ongoing case against Ripple Labs, the company behind XRP.

SEC’s Strategic Pause: A New Direction?

The SEC’s decision to halt its legal actions against Binance and Coinbase marks a notable change in its approach to cryptocurrency regulation. This move suggests a possible reassessment of the agency’s stance on digital assets under the leadership of Acting Chair Mark Uyeda. In November, Uyeda criticized the SEC’s aggressive enforcement tactics, stating,

“The Commission’s war on crypto must end, including crypto enforcement actions solely based on a failure to register with no allegation of fraud or harm.”

Ripple’s Legal Battle: A Turning Point?

The SEC’s lawsuit against Ripple, initiated in December 2020, alleges that the company conducted an unregistered securities offering by selling XRP tokens. However, recent developments indicate a potential shift. The SEC has withdrawn its appeal in a related case involving the Blockchain Association and the Crypto Freedom Alliance of Texas, which challenged the SEC’s expansion of its dealer rule. This withdrawal has fueled optimism within the XRP community about a possible favorable outcome for Ripple.

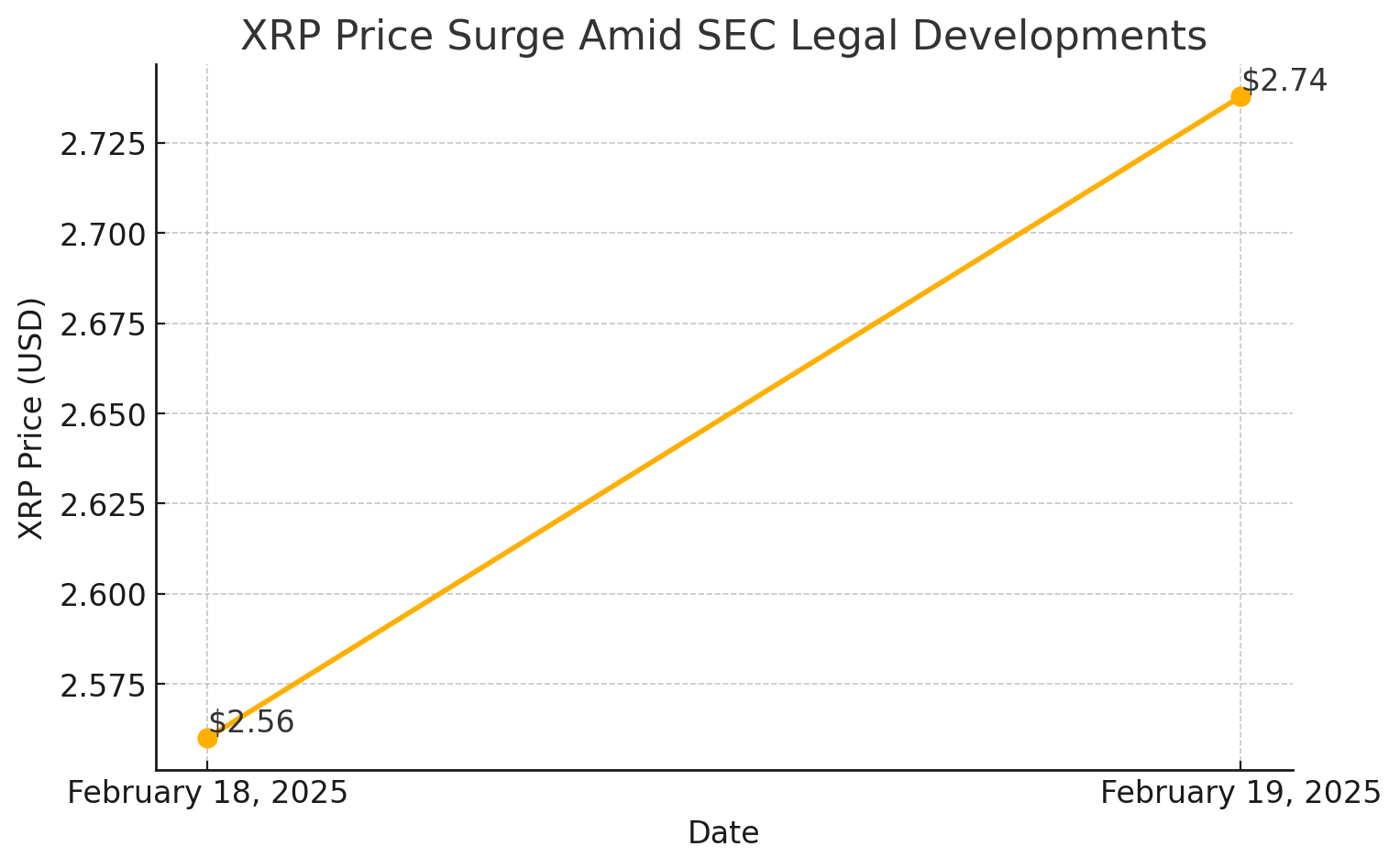

Market Response: XRP’s Price Surge

Amid these legal developments, XRP has experienced a notable price increase. On February 19, XRP rallied 6.9%, reversing a previous 3.75% loss and closing at $2.7379. This surge is attributed to speculation about the SEC potentially withdrawing its appeal in the Ripple case and progress on XRP-spot ETFs.

Expert Insights: Industry Perspectives

Former SEC enforcement chief John Reed Stark has suggested that the agency might drop its appeal in the Ripple lawsuit, signaling a broader retreat from aggressive crypto enforcement. Stark pointed to softened legal battles against major exchanges and internal shifts within the SEC as indicators of this potential change.

Price Analysis: XRP’s Trajectory

The recent legal and regulatory developments have had a significant impact on XRP’s market performance.

| Date | Event | XRP Price Change |

|---|---|---|

| February 19, 2025 | SEC withdraws appeal in related case; speculation about Ripple case grows | +6.9% |

| February 18, 2025 | Market uncertainty; no major legal updates | -3.75% |

Analysts suggest that if the SEC withdraws its appeal in the Ripple case, XRP could break past its all-time high of $3.5505. Conversely, continued legal challenges could exert downward pressure on the token’s value.

FAQs

What is the current status of the SEC’s lawsuit against Ripple?

The SEC has paused its lawsuits against Binance and Coinbase, leading to speculation that it may also withdraw its case against Ripple. However, as of now, the lawsuit remains active.

How have recent SEC actions impacted XRP’s price?

Recent SEC actions, including the withdrawal of an appeal in a related case, have increased investors’ optimism, resulting in a 6.9% surge in XRP’s price on February 19, 2025.

What are the potential outcomes for Ripple in its legal battle with the SEC?

Potential outcomes include the SEC withdrawing its lawsuit, a court ruling in favor of Ripple, or a settlement between the two parties. Each scenario would have different implications for Ripple and the broader cryptocurrency market.

How might a resolution in the Ripple case affect the broader crypto market?

A favorable resolution for Ripple could set a legal precedent, potentially leading to more regulatory clarity and a positive impact on the broader cryptocurrency market.

What should XRP investors consider in light of these developments?

Investors should stay informed about ongoing legal proceedings, understand the potential risks involved, and consider diversifying their portfolios to mitigate potential adverse effects.

Glossary

XRP: The native cryptocurrency of the Ripple network, used for facilitating transactions.

SEC (Securities and Exchange Commission): The U.S. federal agency responsible for enforcing securities laws and regulating the securities industry.

ETF (Exchange-Traded Fund): An investment fund traded on stock exchanges, holding assets such as stocks, commodities, or cryptocurrencies.

Appeal: A legal process in which a case is brought before a higher court for review of a lower court’s decision.

Programmatic Sales: Automated sales of assets, often executed through algorithms on trading platforms.