The U.S. Securities and Exchange Commission (SEC) has dismissed two charges against Ripple Labs’ CEO, Brad Garlinghouse, and Executive Chairman, Chris Larsen. This move signifies a pivotal moment in the prolonged legal battle between the SEC and Ripple, potentially reshaping the regulatory landscape for cryptocurrencies.

SEC Withdraws Allegations Against Ripple Executives

On October 19, 2023, the SEC filed a motion to dismiss two claims against Garlinghouse and Larsen. The agency had previously accused the executives of aiding and abetting Ripple’s unregistered sales of XRP tokens, alleging these transactions amounted to over $1.3 billion in unregistered securities offerings. This dismissal follows a series of legal setbacks for the SEC, including a July 2023 ruling by U.S. District Judge Analisa Torres, which determined that XRP sales on public exchanges did not constitute securities transactions.

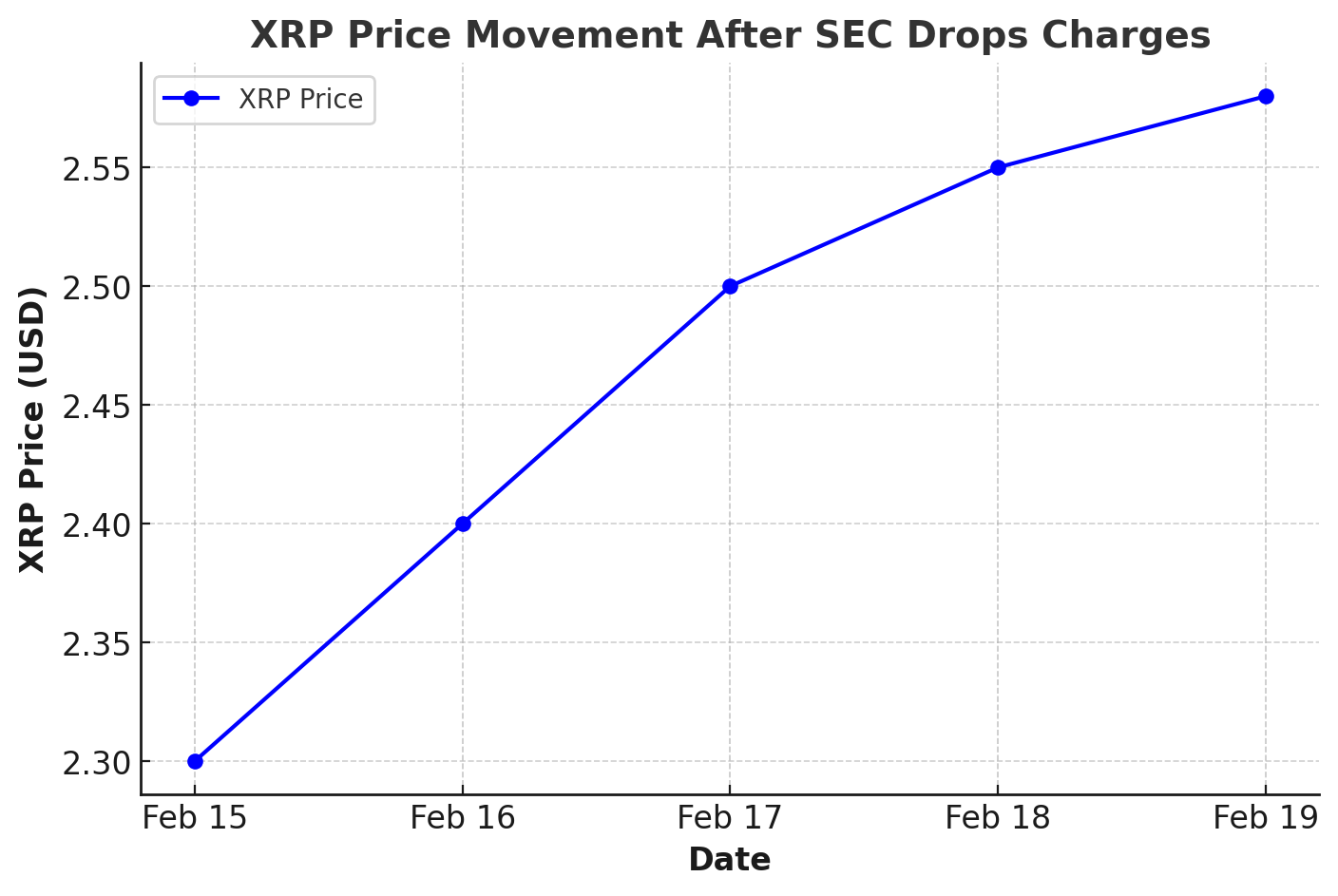

Market Reaction and XRP Price Dynamics

The lawsuit’s resolution has had a notable impact on XRP’s market performance. Following the news of the SEC dropping charges against Ripple’s executives, XRP experienced a price surge, reflecting renewed investor confidence. As of February 19, 2025, XRP is trading at $2.58, with an intraday high of $2.63 and a low of $2.47. This upward trajectory indicates positive market sentiment surrounding Ripple’s recent legal victories.

Implications for the Cryptocurrency Industry

The conclusion of the SEC’s lawsuit against Ripple is poised to have far-reaching implications for the broader cryptocurrency landscape. This case has been closely monitored as a potential precedent for how digital assets are classified and regulated in the United States. Ripple’s favorable outcome may embolden other cryptocurrency projects to challenge regulatory actions and seek clearer guidelines regarding the classification of digital assets.

Statements from Industry Experts

Former SEC officials have weighed in on the development, suggesting that the dismissal of charges signifies a shift in the regulatory approach toward cryptocurrencies. One former official noted,

“The SEC’s decision to drop the case against Ripple’s executives indicates a potential reevaluation of how digital assets are regulated, possibly moving towards more nuanced and supportive frameworks.”

Conclusion

The SEC’s decision to drop its lawsuit against Ripple’s top executives marks a pivotal moment in cryptocurrency and regulatory oversight. This outcome not only reinforces Ripple’s standing in the crypto industry but also sets a precedent that may influence future regulatory actions and the broader acceptance of digital assets in mainstream finance.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What were the initial allegations against Ripple by the SEC?

The SEC alleged that Ripple Labs and its executives conducted an unregistered securities offering by selling XRP tokens, raising over $1.3 billion.

What was the outcome of the court’s ruling in July 2023?

The court ruled that Ripple’s institutional sales of XRP violated securities laws, but its sales to retail investors did not constitute securities transactions.

How did the market react to the SEC dropping charges against Ripple’s executives?

Following the dismissal of charges, XRP’s price experienced an upward trend, reflecting increased investor confidence.

What are the broader implications of this legal development for the crypto industry?

This case sets a precedent that may influence how digital assets are regulated in the future, potentially leading to clearer guidelines and a more favorable environment for cryptocurrency projects.

Glossary of Key Terms

XRP: The native cryptocurrency of the Ripple network, used for facilitating transactions on the Ripple payment protocol.

Securities and Exchange Commission (SEC): A U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry.

Unregistered Securities Offering: The sale of investment contracts or securities without registering them with the relevant regulatory body, in this case, the SEC.

Programmatic Sales: Automated sales of assets, often executed through algorithms on digital platforms, targeting a broad base of retail investors.

Institutional Sales: Sales of assets directed towards institutional investors, such as hedge funds or financial institutions, typically involving larger amounts and different regulatory considerations.