Robert Kiyosaki, renowned author of “Rich Dad Poor Dad,” has spotlighted Bitcoin as “the biggest opportunity in history.” He warns that the “fear of making mistakes” (FOMM) may deter many from seizing this unprecedented chance. Kiyosaki predicts that Bitcoin could surpass $200,000 by the end of 2025, urging individuals to overcome their apprehensions and consider investing in this digital asset.

Understanding FOMM and Its Impact on Investment Decisions

Kiyosaki introduces the concept of FOMM, contrasting it with the more familiar FOMO (fear of missing out). While FOMO drives individuals to invest hastily to avoid missing potential gains, FOMM paralyzes them, preventing action due to the dread of making errors. He asserts that this fear, often instilled by traditional education systems, is a significant barrier to wealth accumulation, especially in emerging opportunities like Bitcoin.

Bitcoin’s Projected Trajectory: Insights from Kiyosaki and Other Experts

Kiyosaki’s optimism about Bitcoin’s future is unwavering. He forecasts that Bitcoin could reach between $175,000 and $350,000 by the end of 2025. This bullish sentiment is echoed by other financial experts:

Anthony Scaramucci, manager of a top-performing crypto ETF, predicts Bitcoin will reach $200,000 in 2025, attributing this growth to increased institutional adoption and favorable financial policies.

Martin Leinweber from MarketVector Indexes suggests that Bitcoin could hit a cycle top of $150,000 in 2025 if historical trends persist, noting that price rallies often coincide with U.S. presidential elections and Bitcoin halvings.

The Psychological Barriers to Investing in Bitcoin

Bitcoin’s volatility often deters potential investors, as price fluctuations can evoke fear and uncertainty. Kiyosaki emphasizes that such apprehension is a learned behavior, advocating for a paradigm shift where mistakes are viewed as learning opportunities rather than deterrents. He encourages individuals to educate themselves and make informed decisions, highlighting that overcoming FOMM is crucial to capitalizing on Bitcoin’s potential.

Current Bitcoin Market Overview

As of March 24, 2025, Bitcoin is trading at approximately $87,415.31, reflecting a 3.65% increase in the past 24 hours. This upward trend aligns with the optimistic projections of financial experts and underscores the growing interest in Bitcoin as a viable investment.

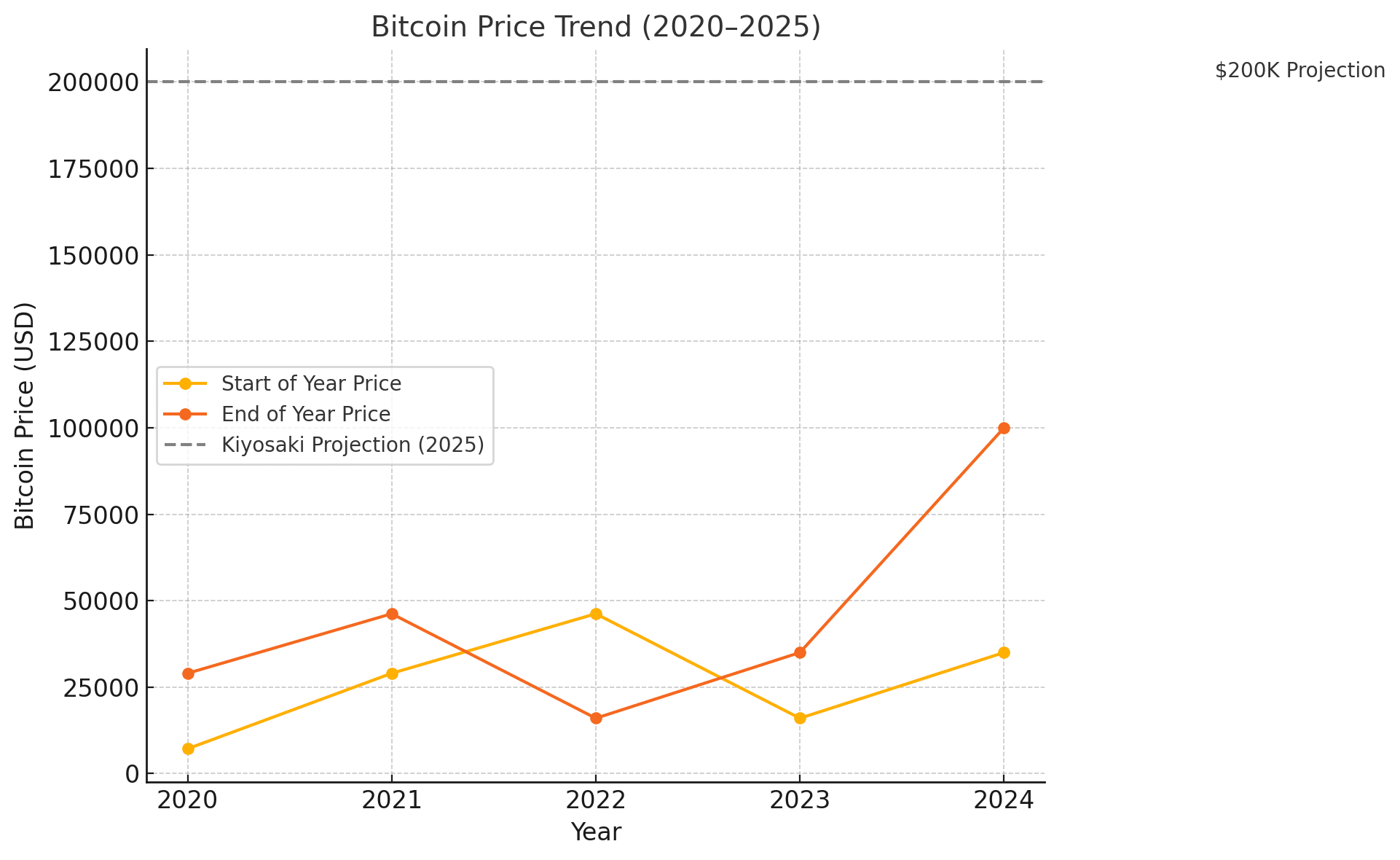

Bitcoin Price History

Understanding Bitcoin’s historical price movements provides context for its potential future trajectory. Below is a summary of Bitcoin’s price history:

| Year | Price at Start of Year | Price at End of Year | Annual Return |

|---|---|---|---|

| 2020 | $7,161 | $28,993 | +303% |

| 2021 | $28,993 | $46,211 | +59% |

| 2022 | $46,211 | $16,000 | -65% |

| 2023 | $16,000 | $35,000 | +119% |

| 2024 | $35,000 | $100,000 | +186% |

| 2025 | $100,000 | TBD | TBD |

Data sourced from Investopedia and Bankrate.

Educational Resources and Influential Voices in the Bitcoin Space

For those seeking to navigate the complexities of Bitcoin investment, Kiyosaki recommends turning to knowledgeable figures in the crypto space. He highlights individuals like Michael Saylor, Samson Mow, and Max Keiser as valuable sources of insight. Additionally, he underscores the accessibility of financial education through platforms like YouTube, enabling individuals to make informed decisions independently of traditional financial institutions.

Conclusion

Robert Kiyosaki’s advocacy for Bitcoin serves as a clarion call for individuals to confront their fears and embrace the opportunities presented by this digital asset. By overcoming the fear of making mistakes and engaging with educational resources, investors can position themselves to potentially benefit from what Kiyosaki deems the most significant wealth creation opportunity in history.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What is FOMM, and how does it affect investment decisions?

FOMM stands for “fear of making mistakes.” It refers to the hesitation or paralysis individuals experience when they avoid investments due to the fear of errors or losses. This mindset can prevent individuals from seizing lucrative opportunities, such as investing in Bitcoin.

Why does Robert Kiyosaki believe Bitcoin is a significant opportunity?

Kiyosaki views Bitcoin as a hedge against inflation and government overreach. He believes its decentralized nature and limited supply position it as a valuable asset in the evolving financial landscape.

Are there other experts who share Kiyosaki’s optimism about Bitcoin?

Yes, several financial experts, including Anthony Scaramucci and Martin Leinweber, have projected substantial increases in Bitcoin’s price in the coming years, citing factors like institutional adoption and historical price trends.

How can I educate myself about Bitcoin investments?

Educational resources are widely available on platforms like YouTube. Influential figures in the crypto space, such as Michael Saylor, Samson Mow, and Max Keiser, offer valuable insights into Bitcoin investment strategies.

What are the risks associated with investing in Bitcoin?

Bitcoin is known for its volatility, with prices subject to significant fluctuations. Potential investors should be prepared for this volatility and consider their risk tolerance. It’s advisable to conduct thorough research and consult with financial advisors before investing.

Glossary of Key Terms

Bitcoin: A decentralized digital currency without a central bank or single administrator, which can be sent from user to user on the peer-to-peer Bitcoin network without the need for intermediaries.

FOMM (Fear of Making Mistakes): A psychological barrier where individuals avoid taking action due to the fear of making errors, often leading to missed opportunities.

FOMO (Fear of Missing Out): Anxiety that an exciting or interesting event may currently be happening elsewhere, often aroused by posts seen on social media. In investing, it refers to the fear of missing a potentially profitable opportunity.

Hedge: An investment made to reduce the risk of adverse price movements in an asset, often involving taking an offsetting position in a related security.

Volatility: A statistical measure of the dispersion of returns for a given security or market index, often measured by the standard deviation or variance between returns. In the context of Bitcoin, it refers to the frequency and magnitude of price movements.