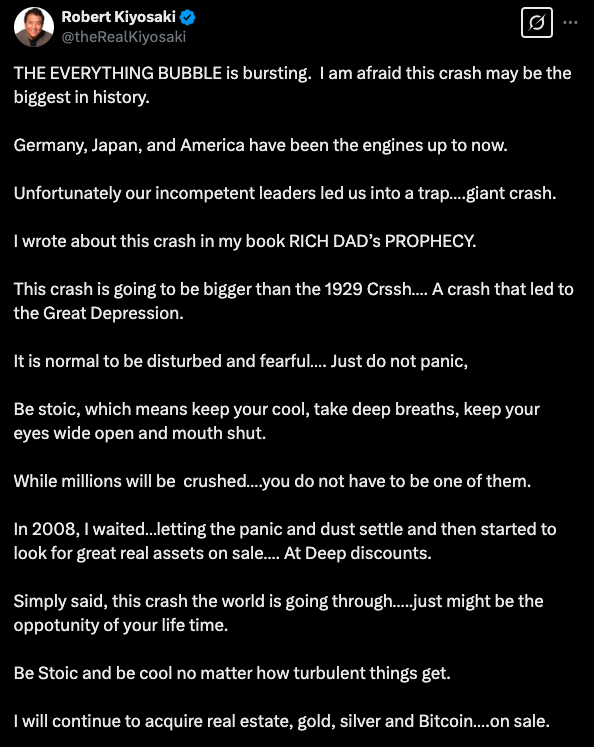

Robert Kiyosaki has blown the whistle again on the global economy. In a post on X, he said the “Everything Bubble is bursting” and we could be on the cusp of the biggest financial crash in history. His bold statement has sent ripples through the investing community worldwide and his track record of challenging conventional wisdom has people listening.

What is the “Everything Bubble”?

Kiyosaki’s “Everything Bubble” ‘refers to the overvaluation across multiple asset classes – stocks, real estate, cryptos, commodities. He believes decades of easy money, aggressive monetary policy and uncontrolled speculation has inflated prices way beyond their intrinsic value.

In his dire warning he compared the coming crash to 1929:

“This crash is going to be bigger than the 1929 Crash… A crash that led to the Great Depression. It’s normal to be disturbed and fearful… Just don’t panic.”

He went on to say traditional economic powerhouses like Germany, Japan and America have been the drivers of this bubble. Once these pillars start to crack, the ripples will crush millions of unsuspecting investors.

Kiyosaki’s Advice for the Chaos

Despite his dire forecast Kiyosaki’s advice is not to panic but to be stoic. He says while the crash will be big, individual investors don’t have to be swept away by fear. His mantra is:

“Be stoic which means keep your cool, take deep breaths, keep your eyes wide open and mouth shut. While millions will be crushed… You don’t have to be one of them.”

In a market where volatility and uncertainty rules, he says be calm and strategic. Kiyosaki is not saying do nothing, he’s saying this is an opportunity to act wisely.

The Roadmap to Wealth Preservation

Kiyosaki’s approach to navigating a crash is to diversify into assets he believes will hold value in the chaos. His strategy is to increase allocation in:

– Real Estate: Historically a safe haven during economic stress.

– Precious Metals: Gold and silver have always been considered stores of value.

– Cryptocurrencies: Specifically Bitcoin which he sees as a digital hedge against the decline of fiat currencies.

He said:

“I will continue to buy real estate, Gold, Silver and Bitcoin… on sale.”

This proactive plan is to hedge against the devaluation of fiat currencies which is something Kiyosaki has been warning about for years. He has been warning about the instability of paper money and the unsustainable nature of current monetary policy.

Global and Macroeconomic Conditions

Kiyosaki’s warning is connected to macroeconomic conditions. Over the past few years, global central banks have been doing QE, pouring a ton of liquidity into the system. While this has given a short-term boost, it has also created asset bubbles across multiple sectors.

– Fed and Global Peers: Fed along with ECB, BOJ and PBOC have reportedly kept interest rates low and have done quantitative easing. Kiyosaki believes when these policies tighten or fail, the impact will be huge.

– Government Debt and Deficits: With debt levels in major economies getting out of control, people are worried about the long term sustainability of these policies. Kiyosaki’s view is when the bubble bursts; the impact will be more severe than any previous downturn.

– Trade and Geopolitical Tensions: With economies like Germany, Japan and US as the engine of growth; any disruption in these markets will have a ripple effect worldwide.

– Shift in Investor Sentiment: As asset prices get to unsustainable levels, a shift in sentiment can trigger rapid sell off and panic and force investors into a downward spiral.

Previous Crashes

Kiyosaki’s warnings are not new. He draws parallels to past events:

– 1929 Crash and Great Depression: Kiyosaki says this is similar to what happened in 1929 but on a larger scale.

– Previous Asset Bubbles: Dot com bubble and housing market crash are examples of how speculation can lead to widespread economic devastation.

These historical analogies are to emphasize that financial bubbles once they burst can have long term and severe consequences.

Critics and Contrarians: A Divided Financial Landscape

Not everyone agrees with Kiyosaki. Some market analysts say while corrections are inevitable the scale of the crash is exaggerated. Critics point to:

– Diversification of Global Economies: Unlike 1929, today’s global economy is more interconnected and diversified so any single market collapse may not be as big.

– Technology and Innovation: Rise of digital assets and growing influence of fintech can provide new avenues for economic resilience.

But Kiyosaki is convinced and tells investors to prepare for the worst while staying calm.

Conclusion: Prepare, Stay Calm and Look for Opportunities

Robert Kiyosaki’s warning that the “Everything Bubble is bursting” should be taken seriously by investors worldwide. His prediction of a big crash that could be bigger than 1929 should be a wake up call to review your investment strategies and protect yourself from financial disaster.

By diversifying your portfolio and focusing on long term wealth preservation through alternative assets like real estate, gold, silver and Bitcoin; you can weather what could be the biggest crash in history.

As the world prepares for a potential crisis; one thing is clear: preparation and calmness are the best defense against chaos. For now the message remains: prepare, stay calm and look for opportunities in the mess.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What does Robert Kiyosaki mean by the “Everything Bubble”

The “Everything Bubble” is the over valuation of multiple asset classes—stocks, real estate, cryptocurrencies and more—driven by excess liquidity and speculation. Kiyosaki believes these prices are unsustainable and will pop.

2. Why does Kiyosaki say this could be the biggest crash in history?

He compares the current economic conditions to the 1929 Crash and says the scale of over valuation and the correction could be enormous and wipe out millions of dollars in wealth.

3. What should investors do?

Kiyosaki says don’t panic but prepare by diversifying into assets that hold value during downturns like real estate, gold, silver and Bitcoin. Stay calm and make smart decisions.

4. How will central banks impact this crash?

Kiyosaki says if the major economies get into trouble the central banks will print money and that will increase liquidity. Investors will then move into safer assets but the initial shock will be severe.

5. Are others disagreeing with this forecast?

Yes while Kiyosaki is dire, some say global diversification and technological innovation will cushion the blow. But Kiyosaki has been warning about fiat instability for years so his perspective is something to consider for risk averse investors.

Glossary

Everything Bubble: The simultaneous over valuation of multiple asset classes due to excess liquidity and speculation.

Fiat Currency: Government money not backed by a physical commodity like the US dollar.

Monetary Easing: When central banks print money by lowering interest rates or quantitative easing.

Wealth Preservation: Investment strategies to protect assets during downturns.

Market Correction: A decline in prices after a big run up in value, seen as a necessary correction in a bull market.