Renowned author of Rich Dad Poor Dad, Robert Kiyosaki, has long warned of an impending financial collapse. Though initially dismissed, his predictions now seem eerily accurate. With Bitcoin and traditional markets experiencing sharp declines, investors are left wondering: What comes next?

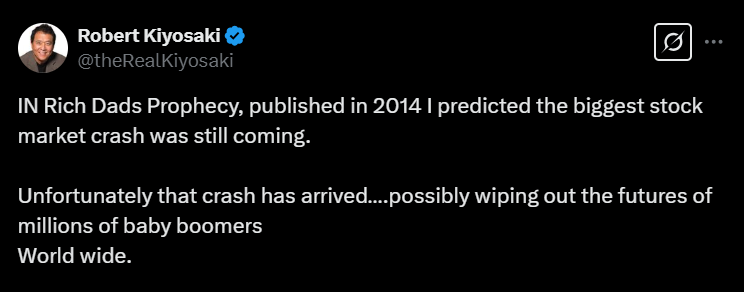

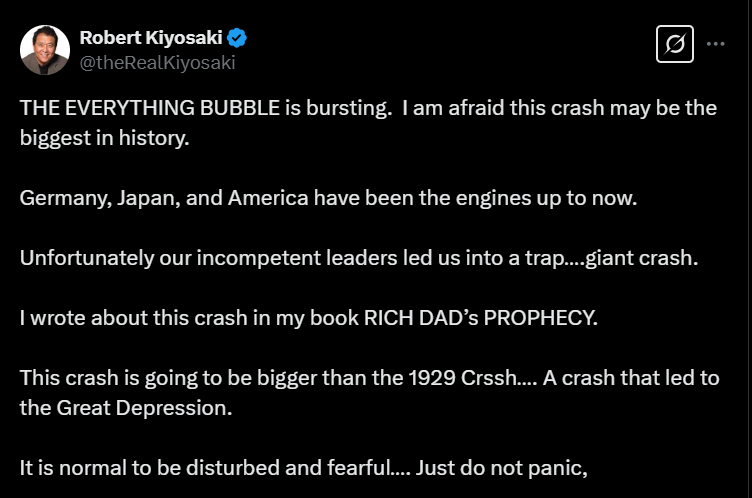

Kiyosaki has consistently voiced concerns over excessive U.S. debt and reckless monetary policies, warning of a historic crash. As early as 2014, he predicted:

“Real estate, stocks, bonds, gold, silver, and Bitcoin will all crash.”

Fast forward to today, and global financial markets are seeing significant downturns. The Nasdaq has suffered its worst drop since 2022, erasing $1.7 trillion in value. Meanwhile, the crypto sector has taken a hit—Bitcoin briefly plummeted to $76,000, Ethereum fell below $1,800, and within 24 hours, the market lost over $940 million in value.

What’s Driving the Crisis?

With Donald Trump’s second presidential term underway, volatility in the crypto market has intensified. While some analysts initially attributed the downturn to geopolitical tensions, the true causes are more complex.

Financial analysis firm The Kobeissi Letter points to a shift in investor sentiment as a primary driver. In just a few months, market conditions have flipped from greed to extreme fear. Simultaneously, increased short positions by crypto whales, fund outflows, and uncertainty surrounding Bitcoin reserves have exacerbated the situation.

Kiyosaki’s Advice: Invest in “Real Assets”

Despite the chaos, Kiyosaki and other financial experts see this as a potential buying opportunity. Institutions like MicroStrategy are treating the dip as a strategic entry point.

However, Kiyosaki remains critical of ETFs, calling them “fake.” He advises investors to steer clear of these assets, emphasizing:

“How do you succeed against this corrupt and criminal monetary system? Own real gold, silver, and Bitcoin. But never ETFs—because they are as fake as the U.S. dollar and bonds.”

As markets navigate this turmoil, experts believe the downturn may be temporary. With improved Bitcoin reserve clarity and regulatory developments, a recovery could be on the horizon. Kiyosaki urges investors to diversify, avoid leverage, and adopt solid trading strategies to weather the storm.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!