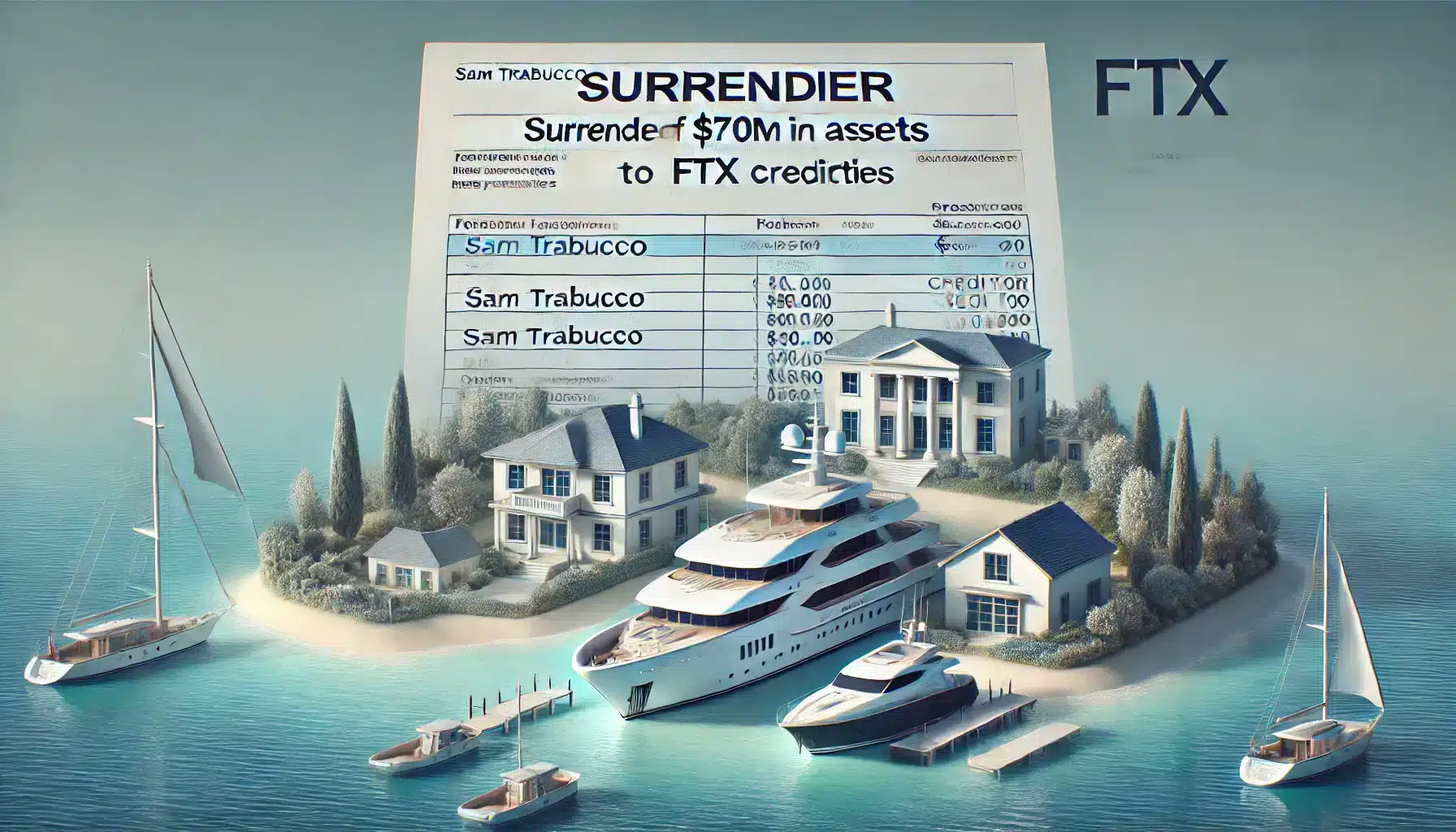

In a new development in his case, Sam Trabucco, co-CEO of Alameda Research, will be giving up about $70M in assets to FTX creditors. Included in the assets he will be giving up are millions of dollars in San Francisco real estate and a yacht. Filed November 3rd, this recent agreement adds to the financial and legal fallout from the FTX collapse in December 2022.

Details of Asset Forfeiture

Trabucco will have to give up 2 San Francisco apartments worth $8.7M and a 53 foot yacht he bought in March 2022 for $2.5M. He also will give up his claims against FTX creditors for about $70M. This will be part of the repayment to FTX creditors who lost so much due to the collapse.

The filing also notes that Sam Trabucco received almost $40M in “potentially avoidable transfers” while at Alameda Research and that those transfers may be assets that could be clawed back under bankruptcy law if they flowed from the FTX estate.

Trabucco’s Role at Alameda Research

Sam Trabucco was co-CEO of Alameda Research and very close to Sam Bankman-Fried. He left Alameda in August 2022, just a few months before FTX and Alameda filed for bankruptcy.

While Trabucco never really admitted to any misconduct or criminal activity going on in the firm, his X tweets seemed to imply that Alameda was very aggressive in its trading and had a high-risk appetite. He stopped short of saying Alameda or FTX was mismanaging funds, which is the focus of the current investigations.

Alameda Research was a hedge fund run by Bankman-Fried that did crypto trading and arbitrage. The association between Alameda and FTX created a complex web of cross-financing problems between the two companies.

Prosecutors have said that these ties were a key factor in the FTX collapse with funds being misused across companies in ways that destabilized the financials and customer assets.

Legal Ramifications in the FTX Collapse

Trabucco giving up assets is part of the larger effort by FTX’s bankruptcy trustees to get money back for creditors. This asset forfeiture is in line with other asset forfeitures against former FTX and Alameda executives involved in the collapse of FTX.

The bankruptcy is one of the biggest in recent financial history and has been focused on identifying and recovering assets from top executives and restoring value to FTX’s many creditors.

Personal gains of other personas involved in the operation are also part of the investigation. Most of the top officials, including Trabucco, made a killing with high salaries, asset transfers or other FTX-related financial gains. Bankman-Fried himself faces multiple charges related to fraud, financial misrepresentation and mismanagement of FTX and Alameda assets.

Conclusion

Sam Trabucco giving up multi-million dollar assets is another chapter in the FTX bankruptcy and asset recovery process. Forfeiture court approval of properties, financial claims, and luxury yachts is the extent of the financial penalties against former FTX and Alameda executives.

While Trabucco’s assets are now for creditor recovery, the bankruptcy hearings are ongoing to get compensation for those affected by the FTX collapse. This is a landmark case that has exposed the regulatory gaps and governance issues in the crypto space and will perhaps change the whole compliance landscape in digital finance.

TheBITJournal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.