As 2024 draws to a close, the concluding months have seen the cryptocurrency domain shaped by an assorted group of proponents ‘Santas’ and opponents ‘Grinches’. From elected leaders rallying behind digital assets to administrative bodies tightening their supervision, the year witnessed a fluid interplay of encouragement and doubt.

Donald Trump: From Skeptic to Supporter

In a stunning reversal, President-elect Donald Trump has evolved as a prominent proponent of Bitcoin and cryptocurrencies. His proposition to constitute a domestic Bitcoin reserve and his declaration to transform the U.S. into the globe’s “crypto capital” have energized the economy. In an address at Bitcoin 2024 in Nashville, Trump affirmed, “We will be sure the United States pilots the planet in crypto creativity and adoption.”

Nayib Bukele: Sustaining El Salvador’s Crypto Course

El Salvador’s President Nayib Bukele has remained steadfast in his view of Bitcoin as legal tender, weaving the blockchain deeper into the nation’s economic fabric. Despite agreeing to a $1.4 billion loan from the International Monetary Fund requiring dialling back some cryptocurrency initiatives, Bukele’s administration continues purchasing one Bitcoin daily, underscoring their resolute stance.

Hester Peirce: The SEC’s Dissenting Voice

SEC Commissioner Hester Peirce, otherwise known as “Crypto Mom,” has consistently advocated for regulatory clarity and a supportive approach to the crypto sector. She has criticized the SEC’s stringent enforcement actions, arguing they necessitate guidelines that foster innovation while safeguarding investors. Peirce stated, “We must establish clear rules to allow this technology to flourish.”

Brian Armstrong: Coinbase’s Crusader

Coinbase CEO Brian Armstrong has been at the forefront of cryptocurrency advocacy, engaging with policymakers across the U.S., U.K., and Australia. Through the “Stand With Crypto” lobbying coalition, Armstrong has endeavoured to rally assistance for favourable regulations. Confronting legal challenges from the SEC, he has urged crypto firms to rethink ties with law practices employing former SEC litigators, highlighting the need for impartial representation.

Vitalik Buterin: Ethereum’s Visionary

The co-creator of Ethereum, Vitalik Buterin, has pushed the boundaries of blockchain innovation through his proposals. Addressing security and privacy, Buterin explored upgrades to digital wallets on Web3. Looking ahead, he considered defences against potential threats from quantum computing, underscoring the importance of robust protections for cryptographic systems.

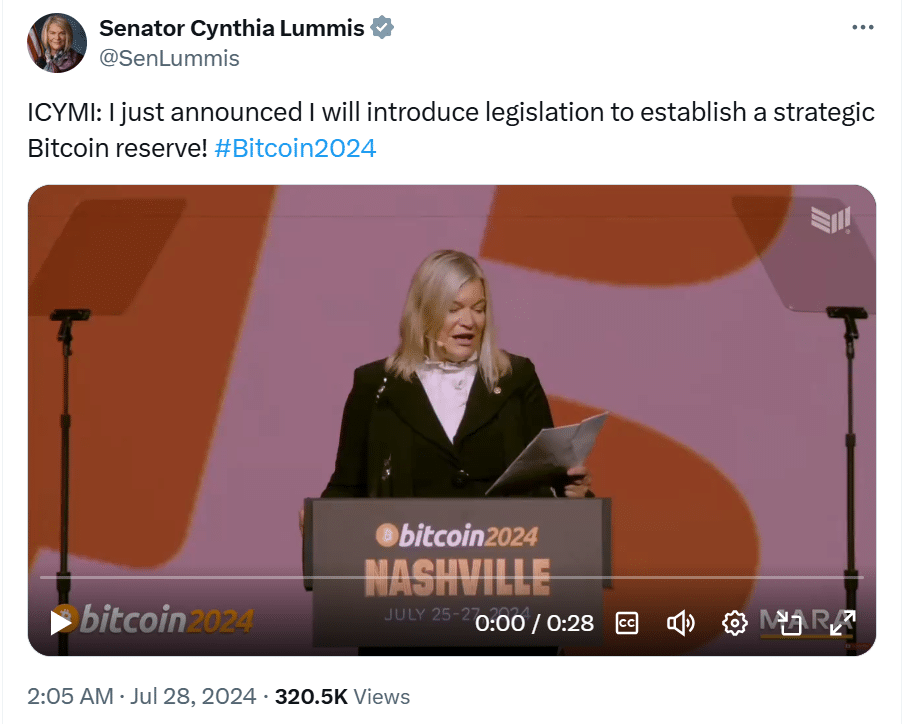

Senator Cynthia Lummis: Bitcoin’s Capitol Hill Champion

Senator Cynthia Lummis has been a vocal proponent of Bitcoin on Capitol Hill. Suggesting a strategic reserve, Lummis asserted the U.S. Treasury could convert some gold into Bitcoin to position America for a future where digital assets play a central economic role. With confidence, she said investing establishes the nation for when cryptocurrencies take centre stage globally.

Michael Saylor: Corporate Crypto Pioneer

Under Michael Saylor’s leadership, MicroStrategy has been pioneering corporate adoption of Bitcoin as its primary treasury reserve asset. With a portfolio exceeding four hundred thirty-nine thousand coins, MicroStrategy’s worth now surpasses brands like Nike and Starbucks. Saylor’s advocacy expands beyond his firm, encouraging other businesses to embrace Bitcoin and stating it remains the most trustworthy store of value for the digital era.

The SEC: Regulatory Rigor Under Gensler

Under Chair Gary Gensler, the SEC has intensified oversight of the crypto sector. Lawsuits and enforcement actions launched significant uncertainty, initiating rigor that critics argue stifled burgeoning innovation. Set to end in early 2025, Gensler’s term emphasized a demanding approach. Gemini co-founder Tyler Winklevoss commented the damage from Gensler and the SEC may not be undone for the crypto industry.

Britain’s FCA: A Restrictive Stance

The Financial Conduct Authority of the United Kingdom has implemented stringent policies. Concerns emerged that innovation faces impediments, and crypto companies could relocate where they are better accommodated. Actions against unauthorized platforms seemed part of a wider crackdown that may hinder growth, according to observations of the regulator’s impact.

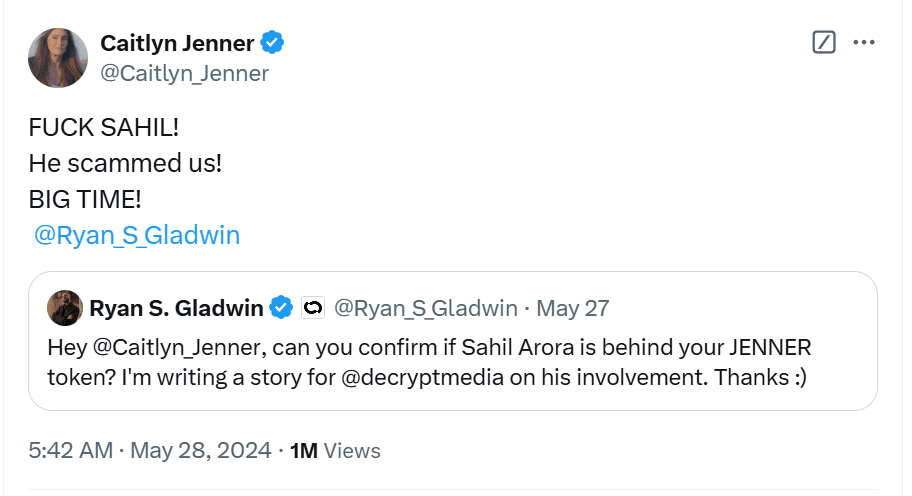

Sahil Arora: The Memecoin Manipulator

Sahil Arora gained notoriety for orchestrating memecoin cons involving celebrity endorsements, only to abandon the ventures before their downfall. Partnerships with figures like Caitlyn Jenner and Iggy Azalea have elicited condemnation and legal scrutiny, highlighting the risks associated with speculative crypto investments. These complex deceptions cultivated trust before deceiving victims into sham crypto investments, a prevalent form of crypto fraud costing victims worldwide over $75 billion and underscoring the need for prudent vigilance.

Operation Chokepoint 2.0: Allegations of Banking Isolation

Operation Chokepoint 2.0: Allegations of Financial Isolation

The Biden administration faced accusations of attempting to isolate crypto from traditional banking through an initiative dubbed “Operation Chokepoint 2.0”, which industry leaders, including Coinbase CEO Armstrong, condemned as unethical and unconstitutional, worrying that such moves could threaten access to essential financial services.

Dark Angels Ransomware Group: Cybercriminals Exploiting Crypto

The prolific Dark Angels ransomware group has emerged as a significant cybersecurity threat following record-setting attacks, such as the $75 million Bitcoin ransom they extracted in July, exemplifying ongoing challenges regarding digital currency exploitation for illicit gains within the crypto ecosystem.

Pig Butchering Scams: A Global Epidemic

“Pig butchering” frauds have proliferated worldwide, deceiving victims into bogus cryptocurrency investments after cultivating online relationships of trust, with losses exceeding $75 billion – highlighting an urgent need for heightened vigilance, regulatory oversight and consumer education to curb such widespread deception.

State-Sponsored Cybercrime: The Lazarus Group’s Resurgence

State-linked cybercrime rose sharply as the Lazarus Group, tied to North Korea, laundered over $1 million in Bitcoin in January after a period of dormancy, having already stolen an estimated $3 billion in cryptocurrencies since 2017 – representing a persistent security threat to digital assets.

Conclusion: A Year of Dichotomy in Crypto

The cryptocurrency landscape of 2024 exhibited paradoxical qualities, with both champions driving adoption forward and adversaries introducing formidable barriers, as the industry anticipated potentially increased institutional uptake and a less adversarial U.S. administration, though interplaying challenges continually emerged.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Who are the “Santas” and “Grinches”?

The “Santas” were those who trumpeted innovation and saw the potential for progress, while the “Grinches” dragged their heels and caused delays through needless regulations, shady schemes, or digital dangers, which bred distrust.

2. How were they selected?

Their places were picked due to actions in 2024 that were powerfully positive or problematically negative for the crypto community’s aims.

3. How did this dynamic affect crypto in 2024?

Advocates strove for growth and mass adoption with vigour and vision, whereas antagonists left the industry unstable and unsure through uncertainty and doubts during that pivotal year which would shape crypto’s course.